How To Get A Small Business Start Up Loan – If you are an individual interested in starting a new company in Singapore, or if you are currently running a registered start-up in Singapore, you may be interested in knowing which grants you can access. This article will cover 7 of them:

Startup SG was launched in 2017 as a platform for entrepreneurs to access local support schemes. One of the six pillars of Startup SG, Startup SG Founders is the most important for first-time entrepreneurs. Assistance under Startup SG is provided by Enterprise Singapore.

Contents

How To Get A Small Business Start Up Loan

SG Startup Founders provides first-time entrepreneurs with mentorship and a seed capital grant of up to $30,000 in a joint matching arrangement. What this means is that the scheme matches $3 for every $1 raised by the entrepreneur up to $30,000. Therefore, to receive the maximum grant value of $30,000, the entrepreneur himself must raise and deliver $10,000 to the business.

How To Qualify For A Small Business Loan

Please note that AMP can take up to 50% equity in your startup. You should therefore contact AMP for more details about their equity terms.

Also under Startup SG, Startup SG Tech is targeted at technology start-ups and offers successful applicants early-stage funding to commercialize proprietary technologies. Technology startups can apply for either a proof-of-concept (POC) grant of up to $250,000 or a proof-of-value (POV) grant of up to $500,000, depending on the stage of development of the technology or concept. theirs.

A POC project is a project that is still in the conceptual stage and the technical/scientific viability of your concept has yet to be tested. On the other hand, a POV Project is a project where you already have a technically/scientifically viable concept and want to develop a working prototype.

Again, if you are offered a grant, remember that the grant will have an equity component where Enterprise Singapore will have the right to exercise share subscription. To maintain financial discipline, you are also required to increase your paid-up capital by 10% and 20% for POC and POV grants respectively.

How To Start A Business

Visit the Startup SG Tech page for more information on the grant and the application process.

The Enterprise Development Grant (EDG) is a program managed by Enterprise Singapore. The grant aims to support projects that help start-ups (and Singapore businesses in general) strengthen their business foundations, pursue innovation and improve productivity, and expand into overseas markets.

EDG covers up to 30% – 70% of eligible project costs, depending on whether your business is a Small Medium Enterprise (SME) and whether your costs are related to software and equipment.

You can visit Enterprise Singapore as well as the IMDA website for more information about the grant.

Ways To Support A Small Business

The Productivity Solutions Grant (PSG) supports companies interested in using IT solutions and tools to improve their existing business processes and improve productivity. PSG covers up to 70% of investment costs in long-term government-approved technology solutions, such as customer relationship management solutions and human resource management systems.

VFG grants are available to new and existing social enterprises that need funding to start or expand their operations. It is offered by the Center for Social Enterprise Singapore (raisE) and supported by the Ministry of Social and Family Development. Interested applicants can apply for grants of up to $300,000.

Your social enterprise must address local social gaps/needs in one or more of the outcome areas provided to qualify. Some of these areas include providing employment opportunities, or bridging social gaps in the areas of mental health and care. A full list of outcome areas can be found on the raiSE Singapore website along with a link to apply for a grant.

For businesses registered in Singapore in the tourism sector, the BIF aims to encourage innovation and the use of technology, as well as the redesign of business models and processes to improve productivity and competitiveness. BIF is provided by the Singapore Tourism Board.

Small Business Start Up Kit, The: A Step By Step Legal Guide: Pakroo J.d., Peri: 9781413327236: Amazon.com: Books

Depending on the size of your business, the level of support provided by BIF will vary. Successful Small and Medium Enterprise (SME) applicants will receive funding support of up to 70% of the eligibility cost, which includes:

The proposed project will be evaluated on how it improves the productivity and competitiveness of tourism companies. More information is available on the Singapore Tourism Board website.

P-Max is an initiative by Tenaga Kerja SG that aims to match SME hires with professionals, managers, executives and technicians (PMETs) seeking employment. PMETs who are looking for a job will be reviewed and then placed in the right position in the SME recruitment by the P-Max Program Manager. Alternatively, SMEs can send newly hired PMETs to the P-Max programme.

Newly hired PMETs will attend a 2/3 day workshop, while supervisors from SMEs will attend a 1 day workshop. The P-Max Program Manager will then follow the newly trained SMEs and PMETs for a period of 6 months to monitor their performance and help ensure the implementation of the practices learned at the Workshop.

Reasons You Should Build A Small Business , Not A Startup

If your company successfully completes the 6-month follow-up and retains your new employment, you will be eligible for a one-time grant of $5,000.

To apply, you should contact the relevant program manager or submit your interest at this link.

More information about P-Max, as well as a list and contact details of program managers, can be found on the Workforce SG website (click on the “How to Apply?” tab).

Most of the startup grants discussed above require that you have incorporated your company before you can start applying for them. If you haven’t already done so, you may want to consider hiring a corporate services firm to incorporate your company on your behalf. It is not easy to create a new business and often, there are many legal formalities at the initial stage that require proper attention and compliance.

Small Business Statistics To Keep An Eye On In 2023

Corporate services firms provide business support services to companies, including company incorporation. It can help you with business registration as well as filing important documents to meet the legal requirements to incorporate a company.

Most importantly, a corporate services firm can help you manage your deadlines and compliance needs. With a dedicated corporate services firm that handles such legal requirements, you can better direct your resources in the real direction of starting and realizing your goals.

If you are interested in getting involved with a corporate services firm, you can learn more and connect with us on this page.

Once you have successfully established your company and applied for the above grants, you must consider the regulatory and compliance requirements mandated under Singapore law. Some of these requirements include having a registered office and appointing a company secretary. Your chosen corporate services firm can also provide corporate secretarial services and help you manage your grant-related needs.

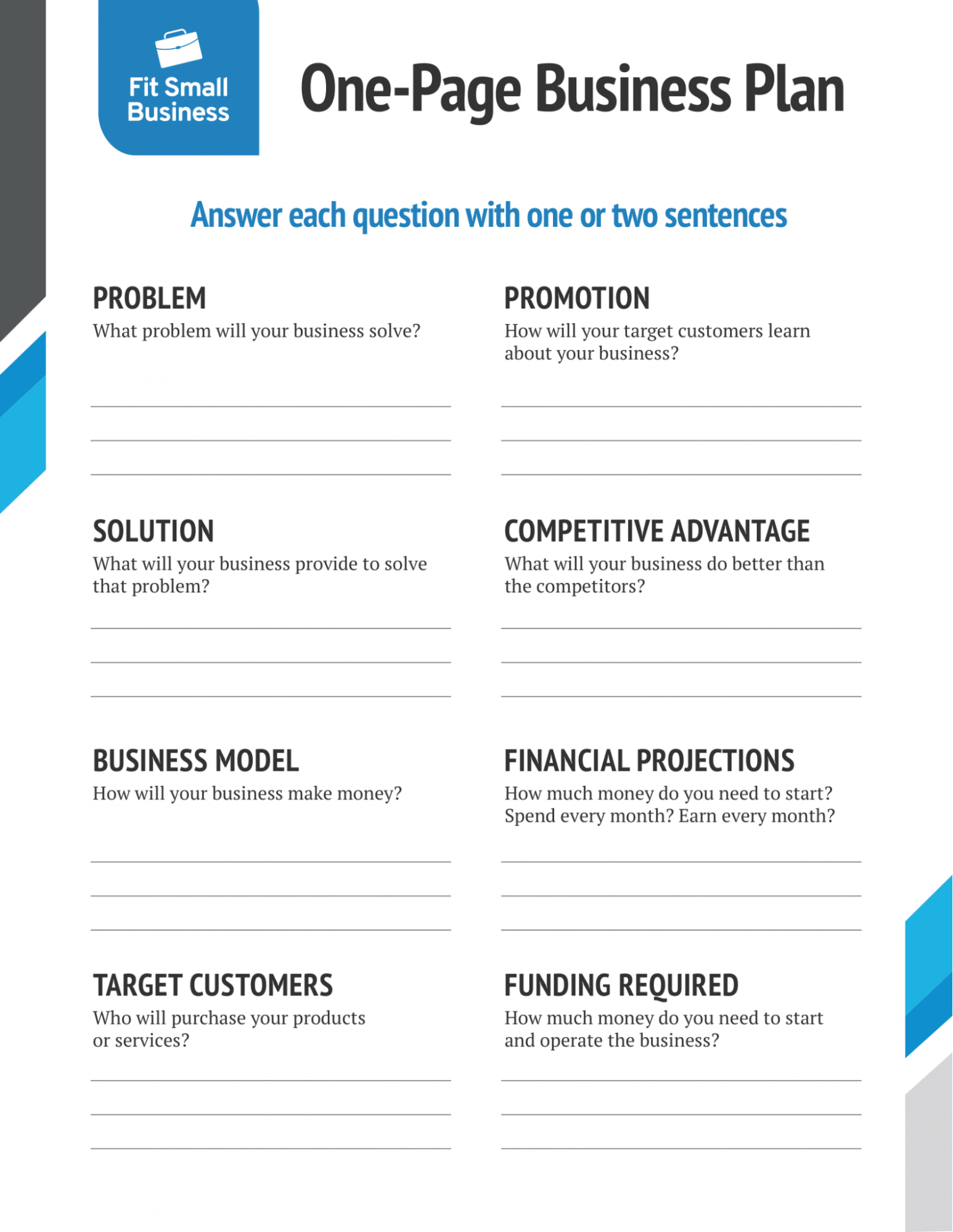

Things To Consider When Writing A Business Plan For A Start Up

Additionally, you may wish to consult a corporate attorney, either to navigate the various forms and requirements involved in incorporating a company or for legal support with specific tasks such as intellectual property protection and the review and drafting of agreements. contractual.

The information provided does not constitute legal advice. You should seek specific legal advice from an attorney before taking any legal action. Although we make every effort to ensure the accuracy of the information on this website, you rely on it at your own risk.

How to get a start up loan, get start up business loan, small business loan start up, how to get a loan to start up a business, how to get a loan to start a small business, how to start a small loan business, how to get a small business start up loan, how to get a small business loan for start up, loan to start up business, how to get start up business loan, where to get start up business loan, how to get loan to start business