How To Start A Career In Banking – The banking industry remains one of the most competitive, competitive and rewarding industries in the world. It provides a unique opportunity to learn about other careers and businesses, the best options for career advancement, and unparalleled exit options.

Although some roles are lost due to previous roles, other opportunities continue to arise. FinTech and technology are increasingly disrupting finance, with hundreds of billions of dollars at risk. Banks need someone to manage all of this. If you’re a tech-savvy finance guy/gal, this is one of the best career associations out there today.

Contents

How To Start A Career In Banking

Everyone has certain expectations of their work. Some people would give anything for work-life balance, some love learning opportunities, and others just love to travel. But at the end of the day, all businesses have one thing in common

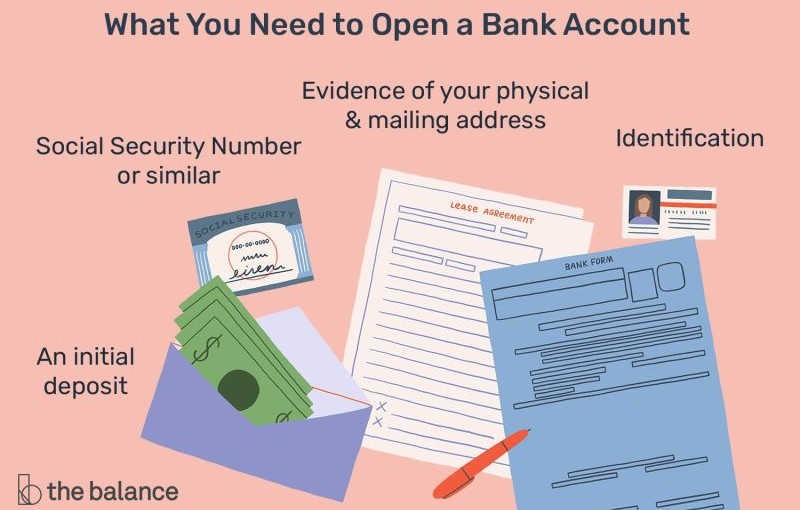

How To Open A Bank Account And What You Need To Do

When it comes to compensation, banking has earned a decent reputation for better pay than many other workplaces. Analysts with 0-3 years of experience earn between $80,000 and $200,000. This depends on factors such as the department they work in, the size and location of the bank. If you have an MBA, you can increase these numbers by around 50% with just your starting salary.

Sales & Trading, M&A, Corporate Banking, Capital Markets roles will give you the best bang for your buck in the first 3-4 years of your career. But from there, it depends on how much money you bring to the boss. This is where the roles with the highest income potential (such as trading, private equity, venture capital and hedge funds) really start to shine.

These are some of the highest-paying jobs in banking, but that doesn’t mean retail banking and support roles don’t pay well. These are well above the average for other industries, especially if you are highly skilled.

In every job. Banking is not much different in this regard. You will learn your business, learn how to sell, learn about different products and services and how they work. Same old stuff.

Career Paths In Banking (plus Tips For Choosing)

But that’s where most of the similarities between banking and other jobs lie. Because in banking, you need to have knowledge not only of your own business, but also of your clients. Do you have a customer looking to lend billions of dollars in the telecommunications industry? Customers, competitors, threats to their business, growth prospects, etc. Best to learn everything you need to know here. When a bank’s billions of dollars are at stake, make sure you know more than anyone else on the planet (sometimes including the client).

Over time, bankers learn a lot about the various industries they cover. Of course, management consultants do too, but their expertise is usually limited to a specific industry. As a banker, you can move from telecommunications to automobiles and even e-commerce in your career.

There are many different ways to get into the banking industry. In our article on the best degrees for banking, we take a look at just a few of the many academic courses that can help you start your banking career.

I have seen MBAs in bankers, engineers, economists, physicists, lawyers, even doctors and fighter pilots. It’s just a fun and competitive industry that appeals to a wide demographic.

Is Investment Banking A Good Career Path?

There are also plenty of opportunities for unusual rides. I’ve seen call center customer service representatives and even door-to-door salespeople achieve great success in the banking industry. It’s rarer and rarer these days, but I suggest you already know what it is to be successful.

Are you a math buff? Is it a super seller? A rock under pressure? A legitimate genius? An economist? there

The articles listed above detail career options and pathways for each role. Here’s a general breakdown of how things work:

This means you’ll continue to develop your expertise in your industry so you’ll become more valuable over time, which is often the best option in banking. You start as an analyst (or post-MBA associate) and work your way up the chain over the years. From Associate, you progress to AVP/Vice President/Assistant Director, then Full Director, and finally General Manager and various CXO roles.

How To Start A Career In Finance (with Jobs And Salaries)

You don’t need to be in the same bank for this, just in the same vertical. In fact, the flexibility to move from one bank (and/or location) to another is actually a huge career advantage, and you can increase your salary and responsibilities through such horizontal moves.

Some personality types get bored of doing the same thing and like to switch things up every now and then. You can do this to a great extent in the banking industry as well. Some roles allow more flexibility than others, and it all depends on how transferable skills are between roles.

For example, if you have a top-notch customer experience, you will be successful in any sales role. Similarly, you can become an independent financial advisor if you choose 10-15 years of solid experience in most roles. Some bankers ended up launching their own funds or starting their own FinTech startups.

There are some of the best withdrawal options in the banking industry. Analysis, logical thinking, relationship management, business knowledge, people and time management. You will develop many basic skills such as When you spend a lot of time with your clients, you learn a lot about other industries. Here are a few options for bankers to withdraw:

The Access Bank Uk Limited On Linkedin: #graduateopportunity #theaccessbankuk #graduatejobs

This is the ultimate goal of many IB Analysts, which is why they happily spend 80 hours a week with a smile on their face. There’s good money to be made if you get your foot in the door of a popular shopping destination. Not everyone can get in, though many have experienced burnout before getting there. But for many it is the promised land!

Finance is a huge and evergreen industry and its products or information. There are hundreds of thousands of companies, large and small, that can always use expert advice. Of course, this option is not for everyone, as it is similar to starting a business alone. But I think it’s biased

This is what I want to do as well, but it’s more work than I thought. They also use programmers to create products and then present them to potential customers. Hiring also requires some degree of funding. But it’s something I’ve always noticed, and I’m sure there are people tougher than me who can make this work.

Starting a new business as a financial officer is always a good option. The real attraction of this option is that you can handle a lot of funds, which is really exciting. Budgeting, financial planning, banking connections, post-funding, etc. You set it up. Expect to buy at least some stock in the company, and if it goes up, you’ll be a millionaire! If it doesn’t work, try the next one.

Career Opportunities In Banking And Finance Sector

I’ve seen my fair share of CFOs at Fortune 500 companies where I was a former banker. It’s usually a relatively easy and relaxed way of life, and stress levels are often much lower. The money may not always be as good at the lower levels, but you’ll still end up at the higher levels. Plus, you get stock!

The traditional financial world. But the truth is they don’t. Because banks are now adopting whiplash technology and creating solutions with big budgets and expertise from tech companies.

Then there’s artificial intelligence, which represents the next era in terms of how work gets done. The bank is also one of the biggest investors in artificial intelligence and machine learning. For those willing to embrace new ideas and technologies, career opportunities in banking and finance are higher than ever.

A short, curated list of the best online courses, certificates, and degree programs to help you get started in banking and finance.

Investment Banking Recruitment: The Ultimate Guide

Gaurav started his finance career in 2009 as an intern in Siti’s corporate client group, and a few years later, he was the vice director of corporate and institutional banking at Standard Chartered Bank. By 2016 he was an independent consultant helping FinTech startups in London with product development and launch. Gaurav also assists banks with their digital banking initiatives and advises PE and VC firms on investments in the financial services and FinTech sectors. Gaurav has written on topics ranging from EU banking regulation and traditional finance to Blockchain initiatives

How to start career in cyber security, how to start a career in golf, how to start a career in filmmaking, how to start a career in banking, how to start a career in modeling, how to start a career in coding, how to start a career in it, how to start a career in music, how to start a career in insurance, how to start career in data science, how to start career in investment banking, how to start a career in hr