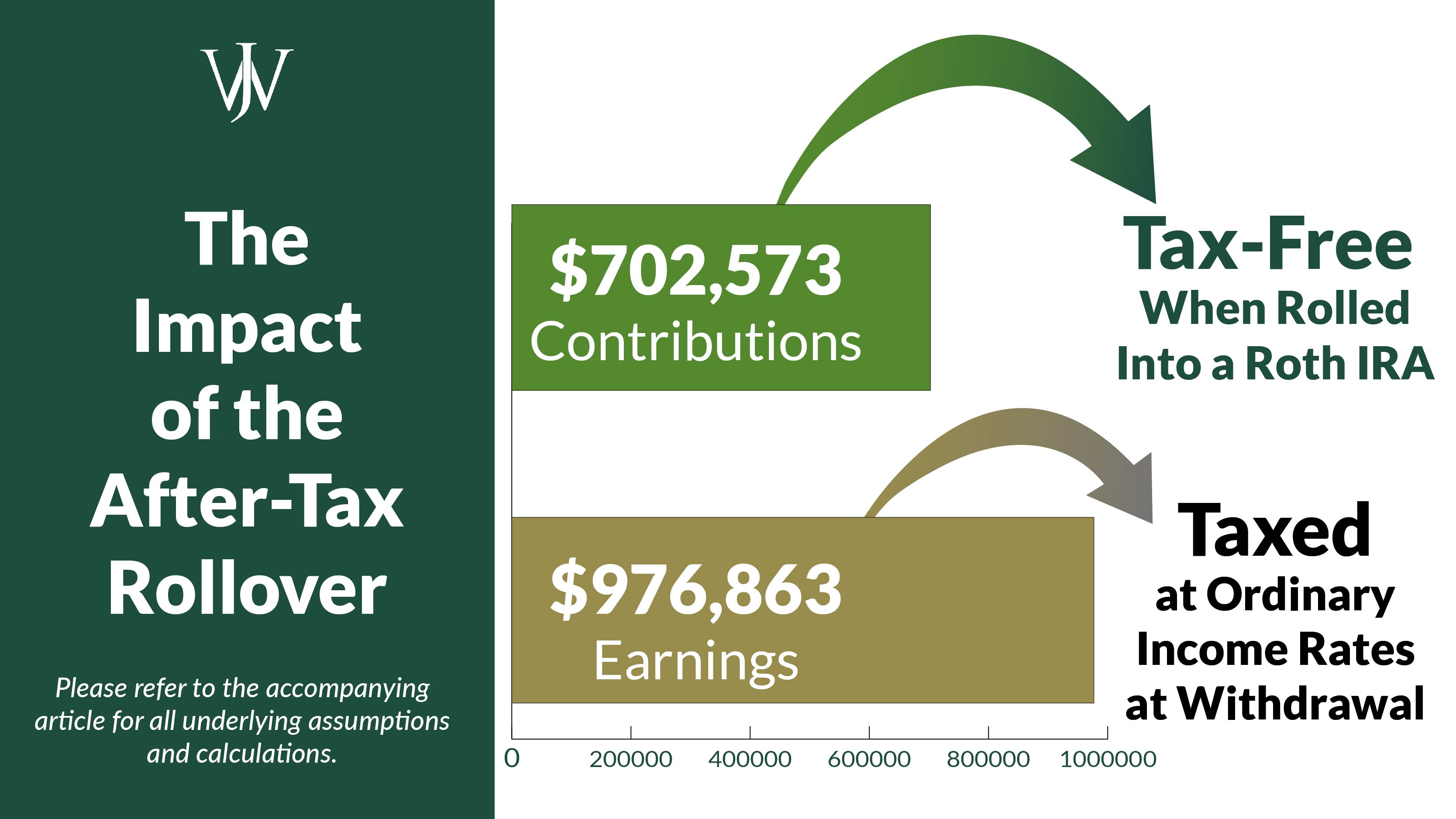

How To Roll My 401k Into A Roth Ira – What is a 401(k) rollover? A 401(k) rollover refers to moving your money from an employer-sponsored retirement plan, such as a 401(k) into an IRA or individual retirement account. You may want to transfer your retirement savings to a new account if you are nearing retirement or changing jobs. Can you convert your 401(k) to a Roth IRA? You can convert your 401(k) to a Roth IRA. You should go to your old 401(k) provider and request that your account balance be transferred to a Roth IRA. Most providers can handle this request without any problems. Rules for Converting a 401(k) to a Roth IRA When converting a 401(k) to a Roth IRA, the process is the same as transferring your 401(k) funds to a traditional IRA. However, most 401(k)s are taxed differently than Roth IRAs, so paying taxes on the converted amounts is an extra step. So the rules for converting your 401(k) to a Roth IRA are as follows: Rule #1: Make sure you are allowed to convert your 401(k) to a Roth IRA. It’s important to check if you can roll over your 401(k) directly into a Roth IRA, as some companies only allow former employees to roll over. However, some allow current employees to roll some of their savings into an IRA. Rule #2: Determine how much you want to convert. You can choose the amount you want to change. You can change the entire value of your plan or only a part of it if your plan allows it. If you can’t convert a portion and don’t want to convert all of your savings to a Roth IRA, converting your savings to a Roth IRA and another portion to a traditional IRA can work. Convert Your 401(k) into a Roth IRA Pros and Cons There are many pros and cons to converting your 401(k) into a Roth IRA. The benefits of rolling your 401(k) into a Roth IRA: You can roll your 401(k) contributions and income into a Roth IRA for free. Tax-free growth is possible for each contribution and other income. You don’t take RMDs or required minimum distributions. You may have more investment options than were available in your previous employer’s 401(k). Your Roth IRA may offer other services, such as guidance and investment tools. Many retirement accounts can be combined into a Roth IRA to simplify management. The problems of converting your 401(k) into a Roth IRA: Unlike a 401(k), you can’t borrow from a Roth IRA. All legacy 401(k) assets are subject to rollover taxes to a Roth IRA at the time of rollover. At some companies, holding your Roth IRA may have an annual fee or other fees to pay or exceed you and your 401(k) plans, which may result in higher investment costs, fees and expenses. . Some 401(k) investments may not be provided in a Roth IRA. Generally, your IRA assets are only protected if your creditors go bankrupt. There may be adverse tax consequences in the turnover of the company’s assets. Tips for Converting Your 401(k) into a Roth IRA Here are some tips to consider when converting your 401(k) into a Roth IRA. You expect taxes to increase in the future and you’ll pay upfront taxes on the money you convert from a Roth IRA application in after-tax dollars. However, you won’t pay taxes on your distributions, so make sure your withdrawals are tax-free. You want to start taking withdrawals when you’re ready, not a minute before the Roth IRA forces you to start taking retirement at age 70. So, you can accumulate Roth IRA money until you’re ready to use it. You expect to earn more in the future.Rolling your money into a Roth IRA is a good idea if you plan to earn more or earn a lot of money. You want to increase your tax diversification To diversify your future tax exposure, having two types of IRAs, such as traditional IRAs and Roth IRAs, is a safe idea if you are unsure. how your taxes and income will look. How to Convert Your 401(k) to an IRA Converting your 401(k) to an IRA is not as difficult as it may seem. Select the financial institution you want to transfer your savings to, such as a bank, online investment platform, or brokerage. Once you’ve chosen the agency, contact your former employer’s 401(k) administrator and request that your savings be transferred directly to your new IRA account. So, in creating a book, there are two types that you can choose. Direct Transfers Direct transfers occur when your money is transferred from one account to another electronically. Indirect conversions The money comes to you to give back in an indirect conversion. You only have 60 days to put the money into a new plan if you get the money instead of transferring it directly to the new account. Missing deadlines can make you liable for taxes and penalties. The bottom line is that converting your 401(k) into a Roth IRA is a great way to grow and diversify your retirement savings. This allows you to use both types of accounts. Weigh the pros and cons carefully before you make a decision. Also remember to talk to a financial advisor if you have any questions. Frequently Asked Questions 1. Can I convert my 401(k) to a Roth IRA if I’m still working? Yes, you can convert your 401(k) to a Roth IRA even if you’re still working. However, you need to make sure that your new employer’s plan allows for distribution in services. 2. What are the benefits of rolling my 401(k) into a Roth IRA? Some of the benefits of converting your 401(k) to a Roth IRA include free withdrawals in retirement, no required minimum distributions (RMDs) at age 73, and the ability to leaving your Roth IRA to beneficiaries. 3. What are the disadvantages of rolling my 401(k) into a Roth IRA? Some of the disadvantages to converting your 401(k) to a Roth IRA include paying taxes on the amount you convert and potentially losing your employer if you are still employed. 4. How much can I rollover from my 401(k) to a Roth IRA? There is no limit on how much you can rollover from your 401(k) to a Roth IRA. However, don’t forget that you have to pay taxes on the amount you convert. 5. Do I have to pay taxes on my Roth IRA withdrawals? No, you won’t pay taxes on your Roth IRA withdrawal if you’re over age 59 and a half and you’ve held the account for at least five years.

Join our next Sustainable Investing 101 website, get our favorite DIY picks, and learn how to build our portfolio.

Contents

How To Roll My 401k Into A Roth Ira

Go deeper with us and explore the potential effects of climate change on investments like your retirement savings.

How To Roll Over A 401(k) To Fidelity

Joining a new investment service can be intimidating. We are here for you. Click below to email us your questions or book a quick call.

Our team of evaluators are professionals with years of experience in the areas of personal finance and climate.

They have contributed to major financial publications such as Reuters, Axios, Ag Funder News, Bloomberg, Marketwatch, Yahoo! finance and many others.

Carbon Collective is the first online investment advisor focused 100% on solving climate change. We believe that sustainable investment is not only a great climate solution, but also a smart way to invest.

Podcast Episode 322: When Should I Rollover My 401k?

We follow ethical journalistic practices, including reporting unbiased information and citing reliable and authoritative sources. Much of our research comes from leading organizations in the climate space, such as Project Drawdown and the International Energy Agency (IEA).

Our writing and editing team is a team of experts with advanced financial institutions and writes for most of the major publications in financial media. Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters and many others.

We aim to empower readers with the most reliable and trustworthy financial information to help them make informed decisions. It’s common for financial advisors to recommend converting your 401k to an IRA when you leave a company. There are many good reasons why you should – consolidating accounts, better investments, fees and control over your finances. However, a Rollover IRA is not the way to go.

If you expect your income to exceed Roth IRA contribution limits but still want to receive tax-free growth benefits from a Roth IRA, you should consider Roth conversions later. . In short, making a non-deductible IRA contribution and then converting it to a Roth IRA gives you that

Rollover Roth 401(k) To Roth Ira

How to roll 401k into roth ira, roll traditional 401k into roth ira, can i roll over my 401k into a roth ira, can you roll 401k into roth ira, how to roll my 401k into a roth ira, how to roll a 401k into a roth ira, should i roll over my 401k into a roth ira, how to roll your 401k into a roth ira, roll my 401k into a roth ira, how do i roll my 401k into a roth ira, can i roll my 401k into a roth ira, roll 401k into roth ira