Best Way To Start Credit Score – You clicked on a link that was taken by post office staff from a credit union’s website. Please note that Post Office Credit Union cannot control and makes no guarantee as to the accuracy of information or the security of any site you visit. Thank you for visiting the Post Office Employees Credit Union website.

Last Friday we talked about the difference between a credit score and a credit report and what factors actually make up your score and report. We also talked about behaviors that can hurt your credit score; So this week, we’re bringing you seven ways to build good credit, including raising your credit score and improving your credit report. If you haven’t read our previous post yet, you can continue.

Contents

Best Way To Start Credit Score

Nobody’s perfect, we’ve all made mistakes that hurt our score, but there’s nothing that persistence and time can’t fix. If you’re struggling with a low credit score, read below to learn what you can do to boost your credit score. At the end of this blog, if you’ve decided to take steps to improve your credit score but are having trouble knowing where to start, call us at (504) 885-6871 and speak with our lending and certified financial advisor, Christy Adams, to help you plan your first steps. .

Ways To Improve Your Credit Score Quickly

If you’re a member and want to improve your credit score, but don’t know where to start, don’t forget you can visit one of our certified financial advisors. Since you’re reading this blog, you’ve no doubt heard about it. The importance of building credit and building a good credit score. But before we dive in, let’s talk about what a credit score is.

A credit score is a measure of a person’s track record of using and maintaining credit, including bankruptcies, foreclosures and more. Several public claims and lawsuits.

Almost anyone who plans to take out a loan—whether it’s a credit card, home mortgage, car loan, or any type of loan—needs to establish a credit score. In some cases, credit scores and/or credit history may be required to rent an apartment, purchase utilities, or enter into other contracts.

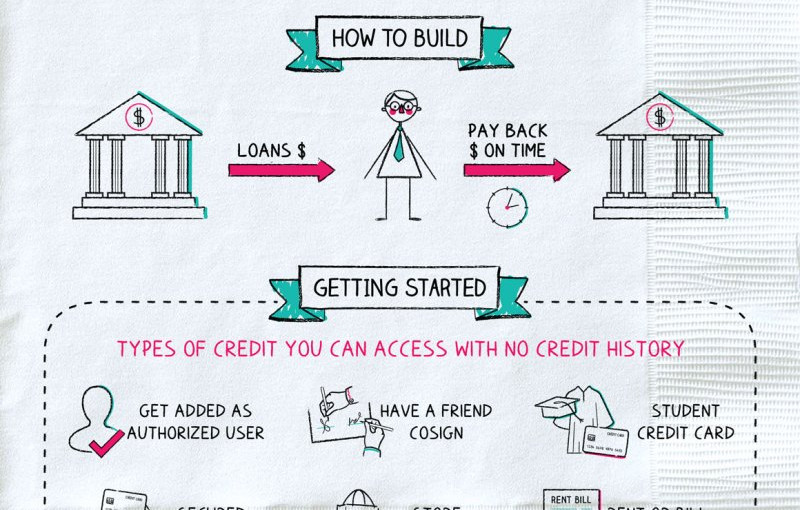

By opening a credit card, loan or other credit account, you create credit and use the account responsibly and carefully. Credit bureaus collect and report information on all users of credit accounts (including minors), thereby creating credit histories and possible credit scores. It is worth noting that these types of accounts are not available to those under the age of 18, but minors can be authorized users of someone else’s credit account with an established credit history. Here are some tips on how to build credit for beginners:

How To Build Your Credit From Scratch

If you have a credit account or loan, your score shows how well you manage the account/debt. Making payments on time can positively or negatively affect your score, along with the number of loans you apply for, the total amount owed, and other factors.

There are many resources available to help educate and advise you on not only how to get a loan, but also how to build a positive credit history that allows you to get a loan with competitive interest rates and terms. Watch our video on how to improve your credit score.

Heather Bahe joined Bankers Trust in 2004 as a Relationship Banker in the Eastern Branch. Four years later, he moved to the Branch Management Division and held several positions before becoming the current Vice President, Consumer Credit Manager in 2014. In this role, Heather supports clients in Des Moines, Cedar Rapids and Phoenix. Providing guidance on compliance and assurance, process development, operational efficiency, systems management and data analytics. He oversees quality control functions related to regulatory requirements, internal auditing and federal testing.

Subscribe to receive the Center’s latest posts on topics that matter to you. Whether you are looking for a mortgage, taking out a loan or renting a new home, you should know how important this is. You have a good credit score. For many people, building credit starts with making timely payments on student loans or credit cards. However, you usually need to have a good credit history to qualify for a credit card or loan first. This creates a difficult “chicken and egg” scenario in which credit is required to build credit.

Tips On How To Build A Healthy Credit Score

So how do you start building credit from the ground up – or try to rebuild your credit?

Before looking at how to build credit, it’s important to understand what credit is and why it’s important.

Credit allows people to borrow money for goods or services that they promise to pay for at a later date. Lenders (i.e. lenders, merchants or service providers) lend to people based on the level of risk they pose as borrowers. This risk and, in turn, the creditworthiness of the lender is determined by your credit score and credit report.

A credit report is a history of credit management and debt settlement history. It works out what card issuers and other companies see when deciding to do business with you. Your credit report contains a historical record of how and when you paid your bills, how much you owe, and how long you’ve maintained your credit accounts.

Steps On How To Build Your Credit Score In Singapore Effectively

Lenders and other companies can use your credit report to learn more about your past credit history, which helps them make credit decisions. Credit reports are also used to calculate your credit score. There are three national credit bureaus in the United States – Equifax, Experian and TransUnion.

A credit score is a 3-digit number based on the information on your credit report that your lender uses to decide whether or not to grant you a loan. Although there are several brands of credit scores, the most commonly used is the FICO® score. FICO scores generally range from 300 to 850, with lower scores equaling a higher risk of not paying the bill as agreed in the future. Depending on the activity reported on your credit accounts, your credit score may change over time.

While other scoring models have different metrics, your FICO score is based on five categories of information gathered from your credit report. Each category represents a percentage of your FICO score. These categories include:

Once we have a better understanding of what credit is, we need to start thinking about how to build a credit history.

Personal Finance Articles & Guides

The minimum score criteria can be met by a single account or by multiple accounts on your credit file. Therefore, if you have been approved for a new loan that has been actively used and reported to the credit bureaus, you must meet the minimum score criteria within six months.

When you first decide to build credit from scratch, it can be paradoxically difficult to get a credit card or loan without a good credit history. However, there are several options that can help you get started on your credit building journey.

Credit cards make it easy and convenient to pay for goods, services, bills and more. Unlike a debit card, which takes money directly from your bank account, credit cards essentially act as a permanent loan from the credit card. When you open a new credit card account, the card sets a credit limit you can apply. Available credit is the amount of money you have left on the card when you charge it. Then, before the due date, you return the credit card for the spending.

If you have an existing relationship with a bank or credit union, they will already evaluate your business and that relationship may qualify you for a credit card. Other credit cards offer cards designed specifically for new credit builders.

Stop Borrowing Money To Improve Your Credit Score

Becoming an authorized user on a family member’s credit card account is one way to build credit from scratch. Because even if you never use a credit card, you can still enjoy the benefits of a good credit history. Its process is simple; The primary account holder needs to add your name to the credit card.

However, this method does not have a significant impact on your credit score and does not provide the benefits of being a primary account holder. To start building your credit score, you need your own credit card account. For many people, their first credit card is a secured card.

Secured credit cards are a type of credit card that requires a security deposit to open an account. This is usually the amount

Best way to check your credit score, best way to start credit, best way to monitor credit score, best way to start your credit score, best way to check credit score free, best way to monitor your credit score, best way to fix credit score fast, best way to check my credit score, best way to get credit score, best way to fix credit score, best way to start a credit score, best way to get free credit score