Best Small Business Start Up Loans – Whether you want to fund your startup or replenish your inventory, a lack of funds for your business can be frustrating. Fortunately, the good news is that you can get loans for small and medium enterprises (SMEs), like your business, from different lenders in Singapore.

An example of such loans is a short-term business loan, which can be used to quickly meet urgent needs.

Contents

- 1 Best Small Business Start Up Loans

- 2 Startup Funding: What It Is, How To Get Capital

- 3 Starting A Business

- 4 Best Ways To Get A Startup Small Business Loan

- 5 The Best Small Business Loans For Startup Businesses

- 6 The 7 Best Unsecured Business Loans

Best Small Business Start Up Loans

This sounds good, but short-term business loans often have higher interest rates due to their short duration. The duration of loans varies depending on the credit institution, but generally does not exceed 18 months.

Startup Funding: What It Is, How To Get Capital

So how to get a business loan in Singapore? We’ll answer, discuss the different types of SME loans, and show you how to find the best short-term business loan in Singapore.

Many lenders lend to SMEs, but choosing the best business loan and short-term lender can be difficult.

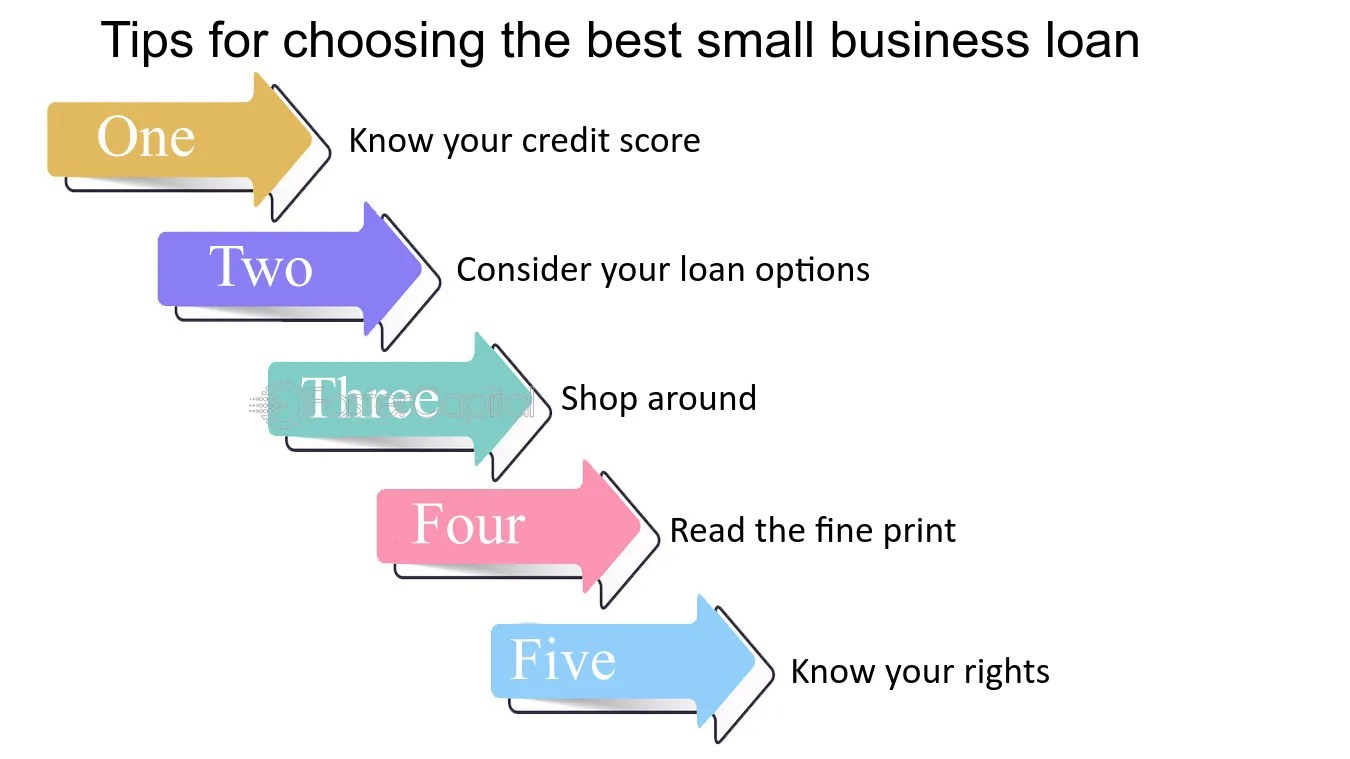

Here are factors to consider if you don’t know how to find the best short-term business loan:

SME loans are generally short-term, so the money you receive will be slightly less than with long-term loans. How much do you need and will the lender approve this amount?

Starting A Business

Check how much you can borrow and consider a lender who can approve the amount you need. Here’s a tip: borrow the exact amount you need to avoid paying high interest rates.

You need to think about how long it will take you to repay SME business loans. Repayment terms vary and depend on the loan amount you take out. Potential lenders should offer flexible loan terms to ensure you can repay without difficulty.

The size of your business determines whether you qualify for a loan. For example, startup business loans are only ideal for those who have been in entrepreneurship for at least six months.

Microloans are best suited for companies with fewer than 10 employees or with sales of less than $1 million. In contrast, SME financing is only available to SME entrepreneurs. Therefore, if you run a startup, the loan amount will not match that of an established SME.

Best Ways To Get A Startup Small Business Loan

Small business loans are generally easy to access, especially if you opt for approved lenders, who tend to process loans faster than banks.

It goes without saying that approval speed can be a deciding factor, especially if you urgently need a short-term business loan to replenish or meet incessant customer demands. After all, time is money.

Whether you are considering a bank or an approved lender, always opt for a lender that offers an online application for convenience and quick approval. Most approved lenders guarantee approvals 24 hours a day.

The last thing you want when looking for a business loan is to become a victim of illegal and malicious lenders. Unlicensed agencies, like loan sharks, will resort to threats and harassment to get your money back. Therefore, always check the legality of a lender and its compliance with government lending laws. Search the Ministry of Justice’s list of approved lenders in Singapore and ensure the lender details match those on the list.

The Best Small Business Loans For Startup Businesses

Interest rates and terms of service are key when it comes to finding the best short-term business loan.

The average interest rate for business loans in Singapore is 7-12% per year, but it can be higher if you borrow from private lenders.

Ask about additional fees, such as administrative fees and fines, and check whether the loan terms are favorable. Financing options need to be practical to avoid putting your business at risk if you have difficulty paying the loan.

Knowing the options available makes it easier to choose the small business loan that is most personalized for your facility.

The 7 Best Unsecured Business Loans

This is a government-backed financing program enabled through the Enterprise Finance Scheme (EFS-WCL). The funds are available to all SMEs, regardless of their sector of activity, although their eligibility is decided by the government.

The Singapore government has increased the loan limit from US$300,000 to US$500,000. These funds are an option for companies that have reached the WCL limit. These loans are viable for taking advantage of expansion opportunities or financing critical day-to-day operations.

An example of SME financing from WCL is the OCBC SME loan – you can get $400,000 on a five-year repayment plan.

This type of financing is aimed at young companies aged between six and 24 months. You can only opt for these programs to finance your startup or obtain capital to maintain your operations. The loan limit does not exceed $100,000.

Silent Reasons For Small Business Failure

Growing a business requires finances. For example, you might consider building new offices, retail outlets, storage spaces, or renovating (renovating) a commercial property.

You can use unpaid invoices to obtain short-term loans to protect your business. Invoice financing is a viable option if your customers owe you a significant amount in unpaid invoices. The value can represent 70 to 90% of the total billed.

For example, an OCBC SME loan or an EFS-Green program can help you realize your business dream of going green and improving sustainability.

Funding is supported by the Government and provided by the Enhanced Enterprise Funding Scheme for companies specializing in large businesses. The Singapore government doubled the loan limit to $10 million.

Best Startup Business Loans Of 2024

A business loan is a good example of a revolving loan through which businesses can access the funds needed to finance needs such as purchasing inventory. The loan term is renewable annually with interest rates of 5 to 8%.

Getting a small business loan in Singapore can be helpful in many ways. You can take advantage of these financing programs to cover unexpected costs.

Start-up costs may not always fit into your budget, so supplementing them with small business loans can help with undiscovered expenses and unexpected operating costs. You can opt for these programs if you are optimistic about your business’s cash flow in the coming months.

Insufficient cash flow can affect the stability of your business. For example, making daily or weekly payments for replenishment purposes can be difficult if your business is still in the early stages of growth.

Sba Startup Loan: What To Know Before Applying

Additionally, purchasing inventory or other discounted products within your specialization may not be budgeted for. This is why most business owners turn to SME loans to cover inventory costs.

Emergencies affect large companies, much less small businesses; and when they do, insufficient funds could jeopardize any progress. Fortunately, SME business loans are an ideal source of financing for dealing with unexpected financial scenarios.

Running a small business can be difficult without funds. With sufficient liquidity, paying suppliers, temporary workers and other short-term expenses would become a problem.

Small business loans are easily available in Singapore. But researching and comparing different loans is essential to finding the ideal lender. The first thing to do is determine why you need the loan.

Small Business Grants: 21 Options To Apply For Free Funds For Your Business

For example, microcredits would be useful for making one-off purchases or covering short-term expenses. On the other hand, significant financing is beneficial for the purposes of expansion or acquiring essential assets such as real estate or production equipment.

Clarifying financing needs makes it easier to choose the ideal loan for SMEs. You can make an informed decision after comparing loan rates, validity period, additional fees and loan terms.

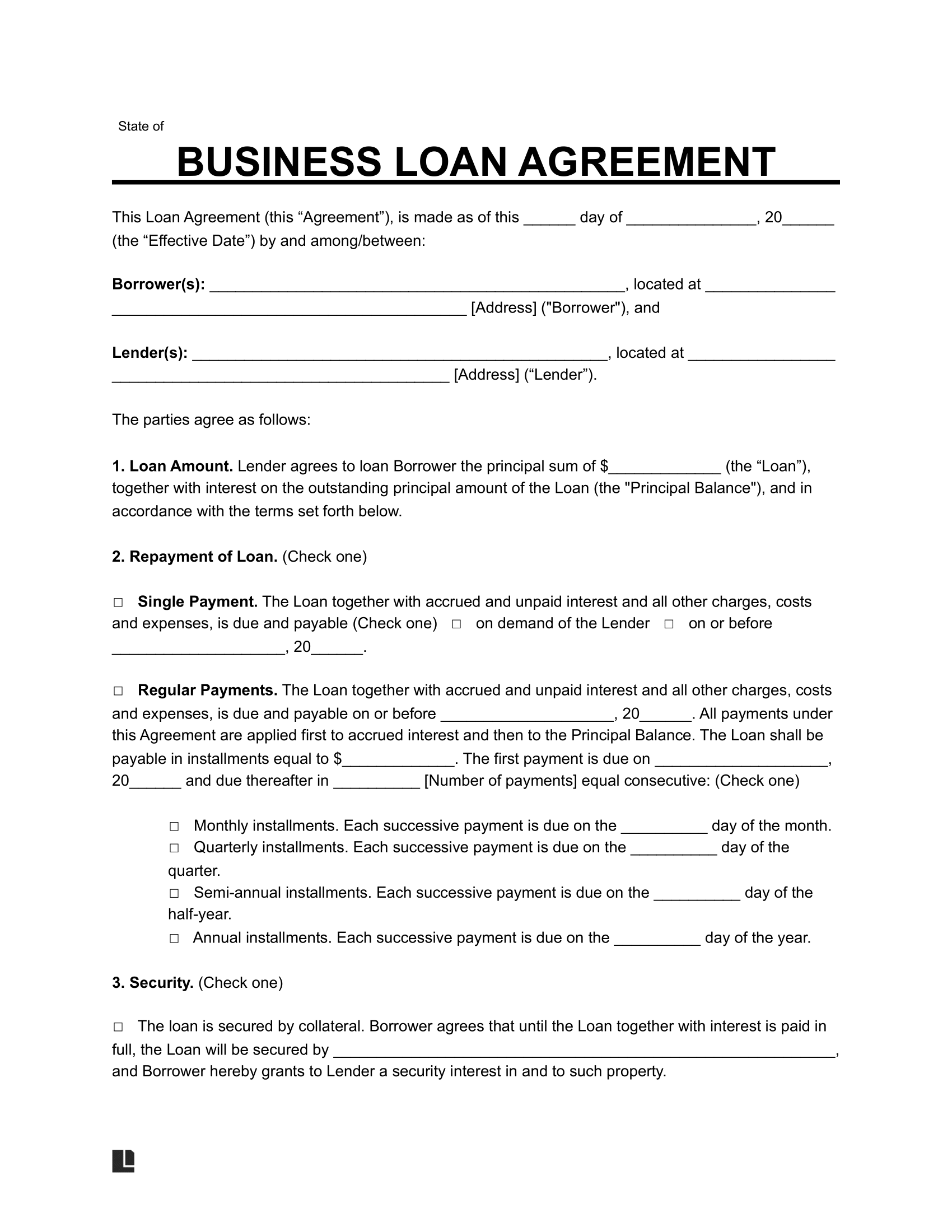

If you’re wondering how to find the best short-term business loan, the best small business loans should have the lowest rate, realistic loan terms, affordable rates, and flexible tenure. Make sure you’re comfortable with the loan terms before signing on the dotted line.

Once you know how to find the best short-term business loan, it’s time to look for financing. Depending on your business needs, your choices include:

The Best Small Business Startup Loans For Women Entrepreneurs

Traditional financial institutions like banks are one option, but they can be helpful if you have a history with the provider. Examples of banks offering SME loans in Singapore include United Overseas Bank, OCBC Bank, DBS Bank, HSBC, Standard Chartered Bank and Citibank.

You can get quick disbursements from finance companies if you want working capital loans. The maximum loan amount is $100,000 and interest rates start at 1%, excluding processing fees (5-7%), with a loan term of 12 months.

If your startup is about to manage its daily costs, you can opt for a line of credit if your startup is at least six months old. Monthly interest rates vary between 1 and 3.9%.

Many approved lenders in Singapore offer unsecured small business loans as long as your business has been in operation for at least six months.

Business Ideas For High Profit With Low Investment In India

Horison Credit is one of the viable options in this category. Signing up takes less than five minutes and up to 24 hours to receive funds.

The government has made it possible for entrepreneurs to benefit from startup loans in Singapore. It will bear 50% of the risk of default on SME loans.

The government decides the eligibility criteria, while banks set the interest rates on loans. Some of the eligibility requirements are:

Even if you meet these criteria, there is no guarantee that you will be approved for government-backed loans.

Best Ways For Getting Funding To Start A Small Business

Companies often get stuck when they least expect it. However, short-term business loans are a relief even when you are on the verge of bankruptcy.

Never let your business and hard work go down the drain when you can save it with timely SME loans from lenders like Horison Credit.

Contact us for more information,

Small business start up loans, start up business loans, best loans for business start up, best start up loans, start small business loans, best business start up loans, start up loans for small business, small start up loans, small business start up loans and grants, small business start up loans bad credit, government small business start up loans, loans to start up a small business