Roll Over 401k To Start Business – If you’re thinking about funding a startup or franchise, you may be ready for the big gamble of turning your 401(k) into an equity investment for a business: the potential lose your retirement account completely. But are you willing?

The method described above, called a Rollover as a Business Startup (ROBS), puts money into the business from your 401(k) account. Part of the Employee Income Security Act of 1974 (ERISA), ROBS has been popular for years.

Contents

- 1 Roll Over 401k To Start Business

Roll Over 401k To Start Business

The potential for profit is enticing, which is why many entrepreneurs are willing to put all their chips on the table. Unfortunately, few realize how difficult it is to recover these chips if they are mishandled.

How To Roll Over A 401(k)

A poorly managed ROBS is full of tax traps. Also, the simple act of starting a ROBS can attract unwanted attention – this type of financial investment is immediately suspect in the eyes of the IRS. Then remember that what you are betting on is retirement.

This retirement accident brought a long time business client of mine to my door looking for help pulling out his ROBS. After struggling with the problems of the ROBS system (which is often underestimated), the fact that their entire financial future depends on new business in an unstable economy was too much.

If you’re feeling the ROBS heat and want to take a break, remember our door is always open. We will talk you through the problems and get you where you want to go. If you’re not sure, give us a call and we’ll put you in touch with one of the clients we’ve helped get out of this ERISA nightmare. They will show you the way down the cliff.

Before I sign off, I’ll give you some information about ROBS, taken from the 2009 small business guide that my clients have found useful.

Best Places To Rollover Your 401(k) In October 2023

ROBS programs are promoted by franchisees and franchisees all over the Internet and are organized by investment firms specializing in financial investments.

ROBS companies charge a fee to guide customers through the process of forming a C corporation. The new corporation starts its own 401(k) or profit sharing plan, which must give employees the option to buy shares in the company. The new business owner then transfers the money from the existing 401(k) to the newly formed corporate plan.

Only one person in the plan (for example, the owner of the new business) can direct the 401(k) account investments to purchase the employer’s stock in the new business. The funds transferred are used to buy a franchise or to finance a new business, mainly to create tax-free working capital.

ROBS may be legal, but they operate in a gray area of IRS codes and regulations. To maintain a legitimate ROBS business, the business owner must comply with several IRS regulations and avoid engaging in certain prohibited transactions. The penalties for non-compliance are staggering.

What Should You Do With Your 401(k) When You Switch Jobs? Experts Weigh In

For example, if the IRS determines that the arrangement is a prohibited business, it may trigger an estate tax. If you engage in these prohibited activities, you may face a penalty of 110 percent or more.

ROBS recommendations must be made with great care and no two cases are exactly the same. This is not something you can try with online software or any law firm that “prepares documents to your destination” as they say. You want an attorney who is well-versed in ERISA law before diving into a ROBS settlement.

It can also become expensive. Clients who have used them often need to hire a “design manager,” someone who will make sure the I’s are dotted and the T’s are crossed. This is an ongoing payment. It can also make it difficult to hire new talent. Anyone included in the payroll must be eligible for a profit sharing plan. Remember: it was funded by your money.

A memo issued by the IRS on October 1, 2008 appears to have put the brakes on the ROBS plan. The 13-page memo concludes:

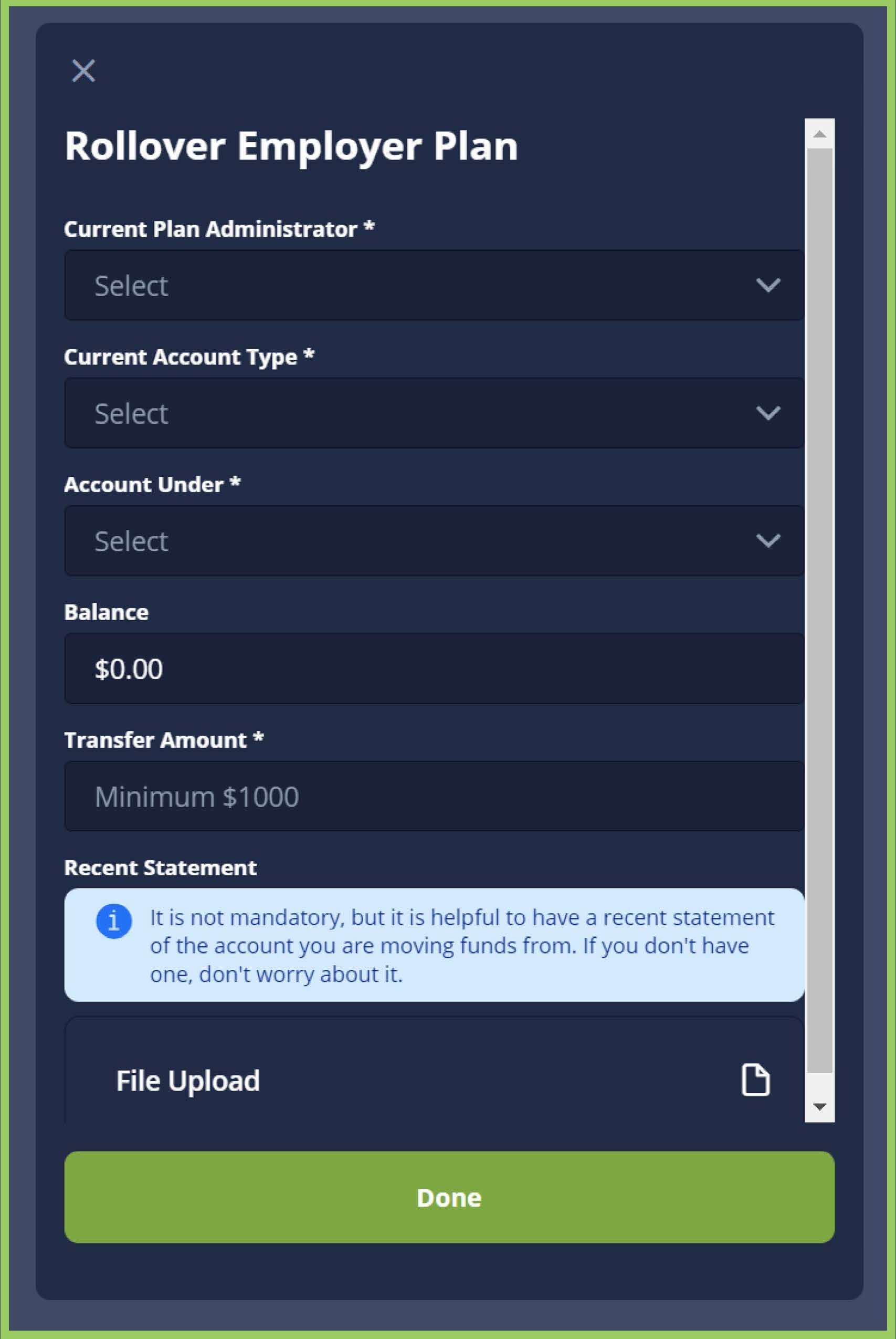

How To Rollover My Retirement Account (401k, 403b, Pension, Annuity, Etc.)

“ROBS transactions may violate the law in several ways. First, such a scheme may create a prohibited transaction between the plan and its sponsor… In addition, such a scheme may ‘ do not satisfy the requirements of its benefits, rights and features. Laws …

The IRS looks closely at each case for different things, such as making sure that companies using ROBS funds provide coverage to all of the company’s employees. If this did not happen, it would violate the laws of non-discrimination.

Another red flag is when the transfer amount is equal to the value of the company’s assets. Such figures, according to the IRS, often indicate that the intent of the transfer should only be used as business start-up capital, rather than being used as a retirement vehicle for actual employees.

ROBS advocates insist that changes made by reputable companies operate under the guidance of the IRS and will not raise agency concerns. However, ROBS is not a strategy to be taken lightly. It requires careful consideration and analysis because you are putting your retirement plan at risk. It also takes work out.

Should You Rollover Your Pension To Ira?

The Fisher Law Office is known for its expertise in estate planning, probate administration, asset protection and business development. Annapolis attorney Randall D. Fisher has been in practice for over 20 years, maintains the highest standards of peer review (AV Preeminent) by Martindale-Hubbell, and is a travel associate of long street .

This entry was posted in Business Law, Business Strategy, Retirement Planning and tagged 401(k), business, equity investments, Employee Retirement Income Security Act, retirement finance , fund starts with Retirement, IRA, IRS, Retirement, Retirement Investing, ROBS, Rollovers as a start. Bookmark the permalink. Local banks turn down 80% of aspiring small business owners for loans. Few people have enough money to start or buy a business or franchise outright. Why struggle with these obstacles when you have money to invest in yourself?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

401(k) business funds, also known as Rollovers for Business Startups (ROBS), are a way to support small businesses and franchises. ROBS allows you to withdraw money from your retirement account to start or buy a business without paying an initial withdrawal fee or tax penalty. This is not a loan – ROBS gives you access to your money so you can build the life you want without going into debt.

Robs Business Financing Strategy: The 8 Step Guide

401(k) business funds are a great option if you don’t want to go into debt, can’t get a loan, or don’t have the money to start or buy a business. Unlike other types of financing, your credit score, past experience or available collateral play no part in eligibility. Instead, the main factors are the type of retirement account (such as a 401(k) or IRA) and how much money you have in it (at least $50,000).

ROBS is also a tool for building your retirement assets. While using ROBS means you’re withdrawing money from your retirement accounts, it also means giving money back. While you work for your company and are paid a salary, you will also contribute a percentage of that salary to the 401.(k), just as you would if you were an employee of any company. This means that your retirement assets will continue to grow as you build your business.

In 1974, Congress enacted the Employee Retirement Income Security Act (ERISA) to shift the burden of retirement benefits from employer to employer. ERISA, combined with certain sections of the Internal Revenue Code, makes it legal to access your eligible retirement accounts without an early withdrawal fee (if you’re under 59 1/2) or tax penalty.

401(k) business investment funds (also known as Rollovers for Business Startups or ROBS) allow you to tap into your retirement account and use that money to start or buy a business or franchise. To get your money without making an early exit payment or tax penalty, the ROBS structure must first be created. The structure has many moving parts, and each of them must meet specific requirements according to the IRS.

How To Use Your 401(k) Funds To Start A Business

Although the ROBS structure can be complicated, the result is your ability to buy or start a business without going into debt or pledging your home. For a more detailed explanation of the ROBS structure, see our Complete Guide to Trading 401(k) Funds.

Rollovers for Business Startups (ROBS) have been around for decades, since 1974. They were made possible when Congress wanted to give American workers another option to grow their retirement assets.

Yes! ROBS is not limited to private companies. Because a franchise is a small business, you can use many types of financing (including ROBS and SBA loans) to finance your franchise just as you would any other business.

ROBS is not a tax break. In 1974, Congress passed the Employee Retirement Income Securities Act (ERISA), which applies in conjunction with certain sections of the

The 6 Best Robs Providers Of 2023

How to roll over a 401k, how to roll over 401k, roll over 401k to ira, roll over 401k, if i roll over 401k to ira, fidelity 401k roll over, best way to roll over 401k, can i roll over 401k to ira, roll over 401k to roth ira, how to roll over 401k to ira, roll over old 401k, roll over 401k to new employer