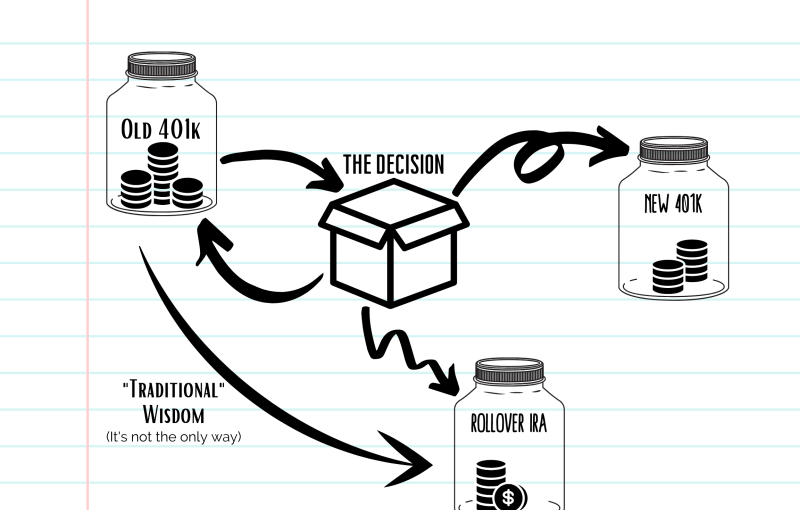

Roll Over 401k To Roth Ira – It’s common for financial advisors to recommend rolling your 401k into an IRA when you leave the company. There are many reasons why you should: account consolidation, better investments, costs, and more control over your accounts to name a few. However, that doesn’t mean a Rollover IRA is always the way to go.

If you expect your income to exceed the Roth IRA contribution limit but still want to benefit from the tax-free growth of a Roth IRA, you’ll want to consider a backdoor Roth conversion. In short, you make a non-deductible IRA contribution and then convert it to a Roth IRA, giving you access to a Roth IRA even if you pay too much to fund it directly. If that sounds like exploiting a loophole, it’s not. The Congressional Report on the Tax Cuts and Jobs Act of 2017 greenlights this set of actions in the text on page 289: “Although individuals with AGI above certain limits cannot contribute directly to a Roth IRA, individuals can contribute to a traditional IRA and convert a traditional IRA to a Roth IRA.”

Contents

Roll Over 401k To Roth Ira

Does it have to do with not rolling the 401k into an IRA? The IRA consolidation rules, which treat all of your non-Roth IRAs as one when distributions are made. That would be fine except for the fact that you are not allowed to specify the amount to withdraw (pre-tax vs. post-tax). Instead, distributions are made proportionally to the pre-tax and after-tax dollars in all of your non-Roth IRAs. What this means for a Roth conversion is that even if you have a completely separate IRA with only non-deductible contributions, if you have pre-tax money in other IRAs, your Roth conversion will be partially taxable.

How The Spending Bill’s New Retirement Rules Will Affect Roth Iras And 401(k)s

Let’s say you have a $54,000 IRA that you rolled over from a former employer (all money before taxes) and you want to make a non-deductible contribution of $6,000 this year and convert it to a Roth. The total non-Roth IRA balance is $60,000, and $54,000 (or 90%) of that is tax-free. 90% of your $6,000 Roth conversion, even if your pre-tax and after-tax money is in separate accounts, is taxable, and only the remaining 10% is tax-free. It’s especially painful when you remember that both your $6,000 contribution and 90% of the $6,000 conversion were taxed this year. In the long run it all ends up being a single tax, but it sure looks like a double tax now.

You can keep your existing 401k account, consolidate it with your new company’s 401k plan, or take a tax-deductible distribution. These options may or may not be available or available to you; For example, your new business may not accept rollovers in its plans, or if you don’t qualify for qualified distributions, you’ll be subject to an additional 10% tax penalty when making a tax withdrawal. Claire Boyte-White What Happens to Your 401(k) After You Leave Your Job at Investopedia is a solid foundation for figuring out what to do with your old 401k.

In general, I rely on summarizing and I don’t leave a trail of accounts behind. So unless there is a specific reason why your old 401k account is preferred, I would try to combine it with your new 401k. This makes both accounts the same, and you leave the old plan behind completely. It all depends on your specific situation, of course. Your new company’s 401k plan might be crap and you just want to contribute enough to get your company match. Maybe you don’t have a new 401k plan or you’re starting your own business. Those may be reasons to leave your old 401k account intact.

If you’re reading this because you want to do a backdoor Roth conversion, but you’ve already rolled your 401k into an IRA, have a SEP or SIMPLE IRA (these still count for the aggregation rule), or have made a tax-free IRA. IRA contribution. , all is not lost. If your current company’s 401k allows rollovers, you can eliminate your pre-tax IRAs by rolling them into your 401k. You open the door for a backdoor Roth conversion but take away the IRA benefits of flexibility and control.

Can I Rollover My Roth Solo 401k To A Roth Ira?

Remember, this is just one of the reasons why rolling your 401k into a Rollover IRA might not be the right move. There are still good reasons to have a Rollover IRA, and other factors in your life can complicate the decision. Just because you want to take advantage of a backdoor Roth conversion doesn’t mean Rollover IRAs are off the table. You should evaluate your situation as a whole before deciding on any part of it.

Need some clarity on your situation? Email me or schedule a time to talk. I want to see how I can help. Wondering how to roll over your IRA to your 401(k) plan? You’ve opened and contributed to a traditional IRA, invested it, waited several months, and now you’re ready to convert to a Roth IRA. Before doing a Roth conversion, you must move pre-tax IRAs out of the IRA into a 401(k) or similar plan. This includes IRAs such as a SEP IRA or a rollover IRA. While reverse rollovers may not be common, there are times when an IRA to 401(k) rollover makes sense. In this blog, we’ll explain the pros and cons of IRA to 401(k) rollover and how you can go about it.

An IRA to 401(k) rollover is when you move funds from a pre-tax IRA to a 401(k) plan. It’s called “reverse displacement.” Once the rollover is complete, the 401(k) plan funds are invested according to the plan’s investment options.

A rollover is a tax term for moving money from one retirement account to another. The most common rollover is a 401(k) rollover to an IRA. A promotion usually occurs when you leave your job and can no longer participate in the company plan. Moving money the other way, from an IRA to a 401(k) is known as a rollover.

How To Do An Adp 401k Rollover

Yes, you can convert an IRA into a 401(k). However, some 401(k) plans do not allow this type of rollover. If they allow this transfer, then direct transfer is the easiest way to do it. This allows you to transfer money directly from your IRA to your 401(k).

The first step is to check if your employer’s 401(k) plan accepts IRA rollovers. Every organization is different, and you may not be able to do an IRA with a 401(k) rollover. If they allow it, you’ll want to make sure you do a direct transfer, if applicable, to make sure you don’t get hit with the 10% penalty.

Step 2: Open a 401(k) Account If you don’t already have a 401(k) account with your employer, you’ll need to open one.

Step 3: Contact Your IRA Provider and Request a Distribution The next step is to request a distribution from your IRA. There will be some documents to add. Generally, “direct rollover” is what is entered as the reason for the distribution. They will then send a check or make an electronic transfer to the 401(k) custodian. This ensures that you never receive the money personally so you will not be liable for any taxes. This transaction is free of taxes and penalties.

Rollover 401(k) To Roth Ira

Step 4: Follow up to make sure the IRA to 401(k) rollover is complete. Make sure the money is deposited into your 401(k) plan.

An important point to remember is that you can rollover pre-tax IRA funds into a 401(k). Under current law, you cannot rollover Roth IRA assets to a Roth 401(k) or Roth 403b. to tweet

Rolling an IRA into a 401(k) plan can have several tax implications, so it’s important to understand them before making the switch. If you are rolling over a traditional IRA to a 401(k), then the rollover is tax-free. However, if you’re rolling over a traditional IRA to a Roth 401(k) plan, you’ll still have to pay taxes on the amount rolled over.

You must declare direct and indirect transfers in your annual tax return. You will receive a 1099-R from your IRA broker. This will contain the amount you withdraw. Report that number on your 1040 tax return on the line labeled “IRA Distribution.” If the amount you withdraw from your IRA and the amount you deposit in your 401(k) don’t match, you may be subject to a 10% tax penalty on the difference.

Roth 401(k) To Roth Ira Rollover

If you have multiple retirement accounts, you can often move money between them without consequence. The most common move is to roll over your 401(k) to an IRA, but it is possible to roll over a pre-tax IRA to a 401(k). The biggest tip is to check with your 401(k) provider to see if they will allow you to make an IRA to 401(k) rollover before you get started.

Can you roll over 401k to roth ira without penalty, roll over 401k to roth ira tax calculator, can i roll over my 401k to a roth ira, can i roll over 401k to roth ira, can you roll over a 401k to a roth ira, how to roll over 401k to roth ira fidelity, when to roll over 401k to roth ira, can you roll over 401k to roth ira, roll over roth 401k to roth ira, how to roll over 401k to roth ira, should you roll over 401k to roth ira, should i roll over my 401k to a roth ira