Loans To Start Up A Small Business – Starting a new business is a daunting task that often leaves new business owners looking for additional help.

By the time you’re done reading, you’ll have a better understanding of which small business startup loans you may be eligible for and how to apply.

Contents

- 1 Loans To Start Up A Small Business

- 2 Ultimate Business Loan Guide For Small And Medium Enterprises — Solomoto

- 3 Common Small Business Loans

- 4 Us Small Business Lending Holding Up Despite Higher Cost Of Credit, International

- 5 Personal Loans Concept Icon. Startup Launch. Small Business Development Financial Support Abstract Idea Thin Line Illustration. Vector Isolated Outline Color Drawing. Editable Stroke 4841752 Vector Art At Vecteezy

- 6 Small Business Loan Application Examples

Loans To Start Up A Small Business

While some say to avoid debt at all costs, others argue that borrowing is essential to any business strategy.

How To Write A Startup Business Plan

And it’s true, depending on your industry and business needs, a loan can be a great way to set yourself apart.

Understanding the pros and cons is important to determining if a loan can be a useful tool in your business building journey.

To help you, an accountant can guide you through the process so you can make an informed decision.

Our team of accountants will ensure you have everything you need for the best chance of a successful loan application.

Ultimate Business Loan Guide For Small And Medium Enterprises — Solomoto

Getting a startup loan for a small business can be difficult, as lenders prefer to lend to businesses with a more established track record.

But do not despair! There are still many financing options to help you start and grow your business.

When applying for a new business loan for less than 12 months, more than the usual financial documents and proof of income are required to qualify.

Depending on the lender and the type of loan, they may require additional information from you, such as

How To Apply For Your First Business Loan

The best way to finance a startup depends on the unique circumstances of the business, such as industry, size, growth potential and risk profile.

Basically, there is no clear answer, as the best financing option for one business may be different for another.

Why? Because startups often look for financial history, proven business models, and reputable lenders when reviewing loan applications.

But it is not impossible! Many lenders understand the unique needs and challenges startups face and offer loan products and programs that help startups get financing.

Study Finds Small Business Loans Key To Startup Success

Some lenders specialize in providing loans to businesses with bad credit, but they often come with higher interest rates and fees to compensate for the increased risk.

Another option is to get equity financing from angel investors or venture capitalists, which are not dependent on credit history.

Getting a loan to start a small business can be difficult, but the effort is worth it when the process is successful.

Understanding these requirements and making thorough preparations to meet them will increase your chances of getting the loan you want.

How To Apply For A Small Business Loan?

At, we can provide you with financial services to get a loan for your small business.

Our team of experienced professionals will help simplify the loan application process, meaning less stress and time away from your business.

In addition to getting a loan, you need a strategic financial plan for the future so that your business can continue and grow.

Our expert accountants can manage this with our dedicated wealth building strategies and business analytics services.

Small Business Loans Expected To Start Friday, Mnuchin Says

Alternatively, call us on +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW. Don’t worry, we are here to be your guiding compass. In this short article, you will get a comprehensive idea of how to get a loan and manage finances for your small (dream) business.

Getting adequate financing is an important factor in the success of any business. Adequate funding is needed for product development, marketing, hiring and implementing your innovation where navigating the right type of debt and managing finances is critical. We will deal with how business loans work and how you can manage the finances to repay these loans to keep your business running smoothly.

Using personal savings or assets will allow you to have full control and adapt to changes quickly without external pressure.

Modern loans have faster approvals, and better access to loan products based on business needs, this is how banks provide loans to businesses after the integration of AI.

Common Small Business Loans

Investors are people who provide funding to a new business in exchange for shares or convertible bonds. In addition to funding, these investors provide expert connections, guidance and insight into market trends.

SBL acts as a financial lifeline usually provided by banks, providing borrowers with access to credit history (excellent), and business plans. Once approved, the loan is available to grow your business.

A term loan is an amount of money that has a fixed interest rate and is secured. It must be paid within a certain period of time. They cater to various corporate needs. Your business must have a strong credit score to apply for this.

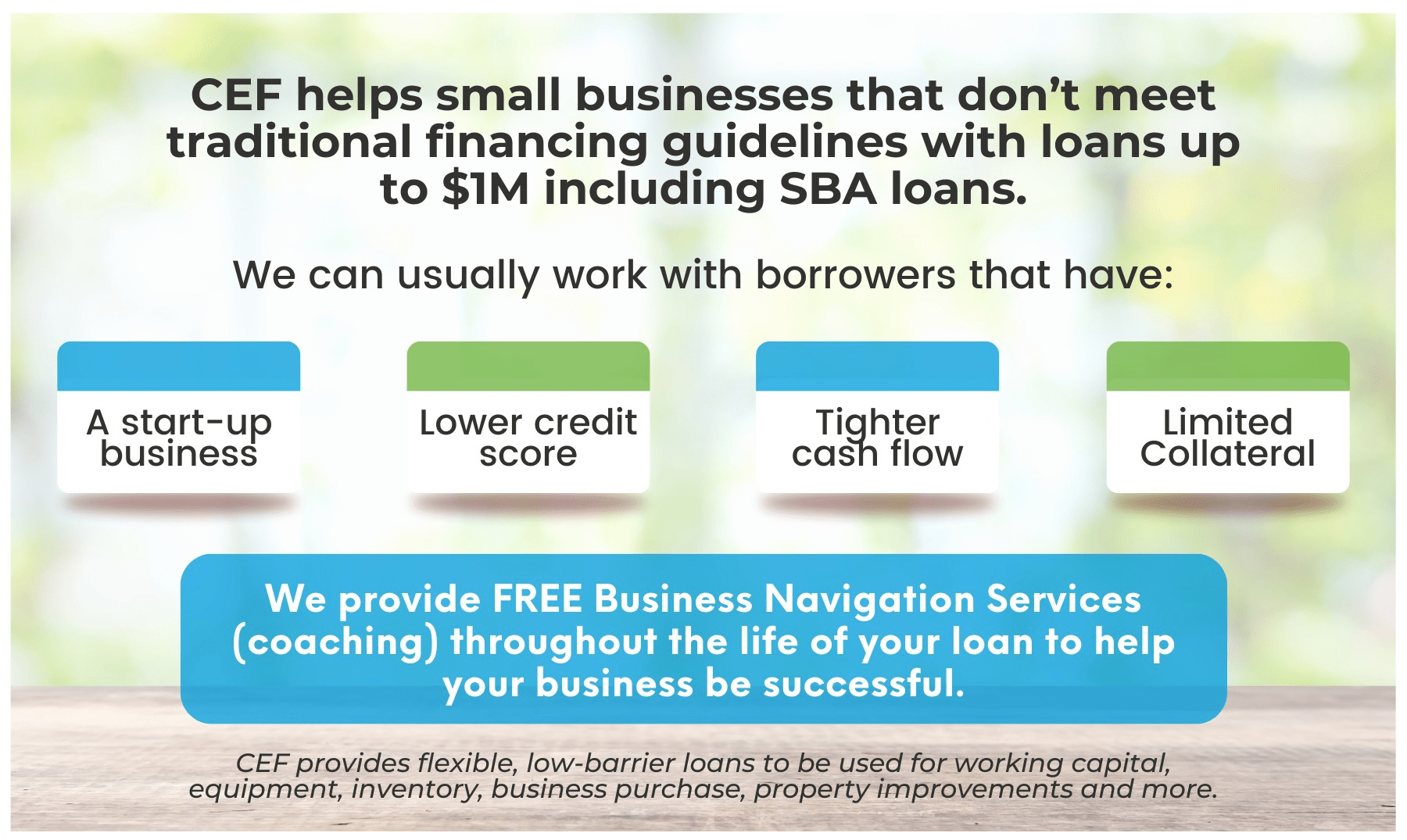

Also known as SBA loans, the government helps small businesses with affordable payments to both new and established companies. All you need is valid documents such as tax returns or valid business documents.

Us Small Business Lending Holding Up Despite Higher Cost Of Credit, International

Access to a predetermined amount that can be used as needed. Only the amount used is subject to interest, allowing for flexible financial management.

As promised, these tips on budgeting and cash flow management will ensure that your small business loan is a stepping stone instead of an obstacle.

Think of your business plan as a score sheet that lays out your company’s operations, goals and strategy. A well-written financial management strategy not only attracts potential investors but also meets your company’s goals, target market, investors and financial plans.

Every effective financial performance is supported by a group of knowledgeable advisors. Your financial journey will gain an extra layer of understanding and security if you get professional financial assignment help from financial experts on educational assignments. They offer advice, check your finances, and help coordinate your strategy.

Personal Loans Concept Icon. Startup Launch. Small Business Development Financial Support Abstract Idea Thin Line Illustration. Vector Isolated Outline Color Drawing. Editable Stroke 4841752 Vector Art At Vecteezy

Whether it’s a small business loan or an angel investor, financial research equips you with the knowledge of how to effectively repay business loans without breaking your bank.

Your business journey begins with an estimate of start-up costs, which requires accounting for every dollar (even a penny) needed to grow your business idea. A thorough budget gives you a transparent financial path for everything from product development to marketing and administrative expenses.

In conclusion, financing your startup through loans is at your strategic level in managing your funds. By carefully evaluating the types of small business loans and repayment plans, you can get the capital you need. Through research, sound business and financial planning, businesses can find the right balance of financial capability and move toward small business prosperity with confidence. Last month, four researchers (and business/finance professors from the University of Texas, University of California, Los Angeles and New York University) published a study titled, “How Important is Credit to Small Business Success in America?”

Studies have found that small business loans are critical to startup success. The results of this study are not surprising and they are consistent with many other market data that have been discussed for a long time. When obtained correctly and used correctly, small business financing helps businesses grow. A closer look at small business loan reviews

Bridging The Funding Gap: Boost Empowers Thousands Of Small Businesses With Their First Loans

The group reviewed applications for a five-year startup loan from Accion Texas, a lender that provides capital to startups across the country. (Startups are defined as new businesses, open 6 months or less and the majority of applications are for retail and restaurant businesses.) The study found: “Startups that receive funding have higher survival, higher revenue. They are more likely to enjoy and create more jobs. “

The study illustrates the importance of access to credit and is another reminder that borrowing capital, when done right, can be critical to business success.

Small business financing is like many other things. It is a tool that can be used wisely for large objects. It can also be misused, in which case it will not help you grow your business.

Tom Gazaway is the founder and president of LenCred. His expertise lies in helping small business owners who are in the first two years of their business properly obtain business financing that separates their personal and business credit while protecting their credit profile, protecting and Improvement too. Tom blogs at LenCred’s blog, Business Finance Lounge. Welcome to our comprehensive guide on how to remove watermarks using AI Watermark Remover. Watermarks can hinder the visual appeal and usability of images, but with advances in AI technology, removing them has become more efficient and accessible. In this blog, we will talk about how to remove watermarks from various media using an AI watermark remover, providing step-by-step instructions and guidelines on how to effectively remove watermarks from images while maintaining their quality. experience […]

Small Business Loan Application Examples

In today’s dynamic business landscape, improving workforce productivity is key to success. The evolution of technology has paved the way for sophisticated solutions, empowering organizations to streamline operations, improve productivity and increase employee engagement. Amid this digital transformation, the search for the best workforce management software has become central. In this blog, we’ll go over the ins and outs of the top workforce management software, sh […]

In today’s digital world, watermarks are a common sight on photos and videos. It is used to protect copyright or mark property. However, there are times when you need to remove this watermark for various reasons, such as restoring old family photos or cleaning photos for presentations. In 2024, we will have many AI design tools for this task.

Small business start up loans near me, best small business start up loans, loans to start up a small business, small business loans to start a business, start small business loans, start up business loans, loans for small start up business, small business start up loans and grants, government small business start up loans, small business start up loans, small start up loans, government loans to start a small business