If I Roll Over 401k To Ira – In terms of regulatory constraints, the US financial authorities are among the strictest in the world. If you are a US citizen or green card holder with a US pension fund but live abroad, you may have trouble managing your hard-earned money like a 401k because your options are limited by regulations.

There are solutions you can use to control your money and save yourself unnecessary expenses. With the right financial advice from a qualified advisor, you can enjoy the benefits of developing a solid financial plan to meet your retirement needs.

Contents

If I Roll Over 401k To Ira

In this article, we recommend that you get the most out of your 401k plan by rolling it over to an Individual Retirement Account (IRA).

Ira Transfer Vs. Rollover: What’s The Difference?

As an American living abroad, you may have experienced firsthand problems such as difficulty opening a bank account, closing brokerage accounts, and a lack of quality investment options. What’s more, some financial advisors are not trained or lack the necessary knowledge and skills to offer a range of appropriate options to US clients.

The Internal Revenue Service (IRS) and the Foreign Account Tax Compliance Act (FATCA) adversely affect the plans of Americans who work or live abroad.

An Individual Retirement Account (IRA) allows individuals to plan and save for retirement in a more tax-advantaged manner. Depending on the type of IRA (traditional or Roth), contributions may or may not be tax-deductible.

Your 401k plan is a defined contribution retirement plan that has a number of restrictions on how you can use your funds. The smaller sample of investment options available, along with the complex tax rules imposed on them, has forced many cross-border professionals to abandon their 401k plans.

How To Roll Your 401(k) Over Into An Ira

However, our team of experts can help you determine if an IRA platform is right for you.

An IRA can help you with many investment options that a 401k plan cannot offer. In this way, you will be able to create a comprehensive plan for your retirement savings.

With an IRA, you can manage your withdrawals and the taxes you pay while you decide which assets to liquidate to help you reach your goals.

Owning an IRA allows you to stay nimble if one of your funds underperforms or doesn’t perform according to your plan. With an IRA, you have the ability to be flexible and make the best choice quickly.

Left Your Job? Review Your 401(k) Rollover Options

An IRA gives you the opportunity to create the estate plan you want by allowing you to designate multiple beneficiaries should the unthinkable happen.

Many people who lack financial literacy have a hard time understanding how a 401k plan works. IRAs are simpler and standardized by the IRS.

Many types of individuals can benefit from a comprehensive program developed by fully qualified advisors with years of experience regulating the financial markets in the United States.

Our team at Holborn Assets can help US citizens living in Europe or outside the US make lump sum investments that fit their financial plans in a tax efficient manner. Our advisors have many years of experience in global financial markets and can advise you on the right investment decision so that you and your loved ones can enjoy the quality of life you deserve.

Should I Rollover My 401(k) To My New Employer?

Lump sums are mostly long-term investments and are ideal for people who want to plan ahead. As a result, these investments are more resilient to market fluctuations.

We may advise you to opt for a lump sum investment plan to avoid the PFIC (passive foreign income) tax that is burdensome for any US investor. Tax reporting will also be simplified.

If you need it, our advisors can help you choose the right investment solution that gives you access to the domestic US investment market. This means you have more freedom and more options to diversify your portfolio.

Putting money in a savings account is not the best long-term option, as inflation and low interest rates affect purchasing power. In some cases, the return on investing money in such an account may be less than inflation.

Can (and Should) You Roll An Ira Into A 401(k)?

Our experienced team tailors your investment portfolio to suit your personal circumstances and financial goals in a tax efficient manner. Contact us today to learn more and start creating the financial plan you want for you and your family.

As the European Health Insurance Card is being phased out and replaced by the Global Health Insurance Card (GHIC), there are a few things you should know.

Moving to Andalusia? Without proper planning, moving to Spain can become very complicated. Read our guide to find out what you didn’t know.

The Spanish government is preparing a dedicated digital nomad visa for expats who want to work there remotely.

Rollover Revisited: Why Sticking With A 401k May Be Better

The cost of living in Spain has increased significantly over the past year. Holborn Assets Spain can help you minimize the impact on your budget. If you change jobs frequently, you may forget about your 401(k) funds. Read these options to find out what to do with old 401(k) forms from a former employer.

When you’re changing jobs or approaching retirement, it’s important to consider what to do with your old workplace savings plan. The more often you change jobs, the more likely you are to have old 401(k) forms from your previous employer that you may have even forgotten about over time. If you suspect you’ve lost your 401(k), you can search for unclaimed pensions online. But perhaps the best way to find your old 401(k) is to contact your previous company’s HR department directly to see if they can help. If the company is sold or merged, contact the current parent company, as your old 401(k) plan may have been consolidated into the new entity’s 401(k) plan. Consider All Your Options Once you’ve found your old 401(k) plan, it’s time to think about how you can use it to meet your retirement goals. For many investors, retirement account savings, including those accumulated from previous jobs, end up making up the majority of their retirement funds, so consider all 401(k) alternatives (from retention to individual rollover) Very important retirement Account (IRA).

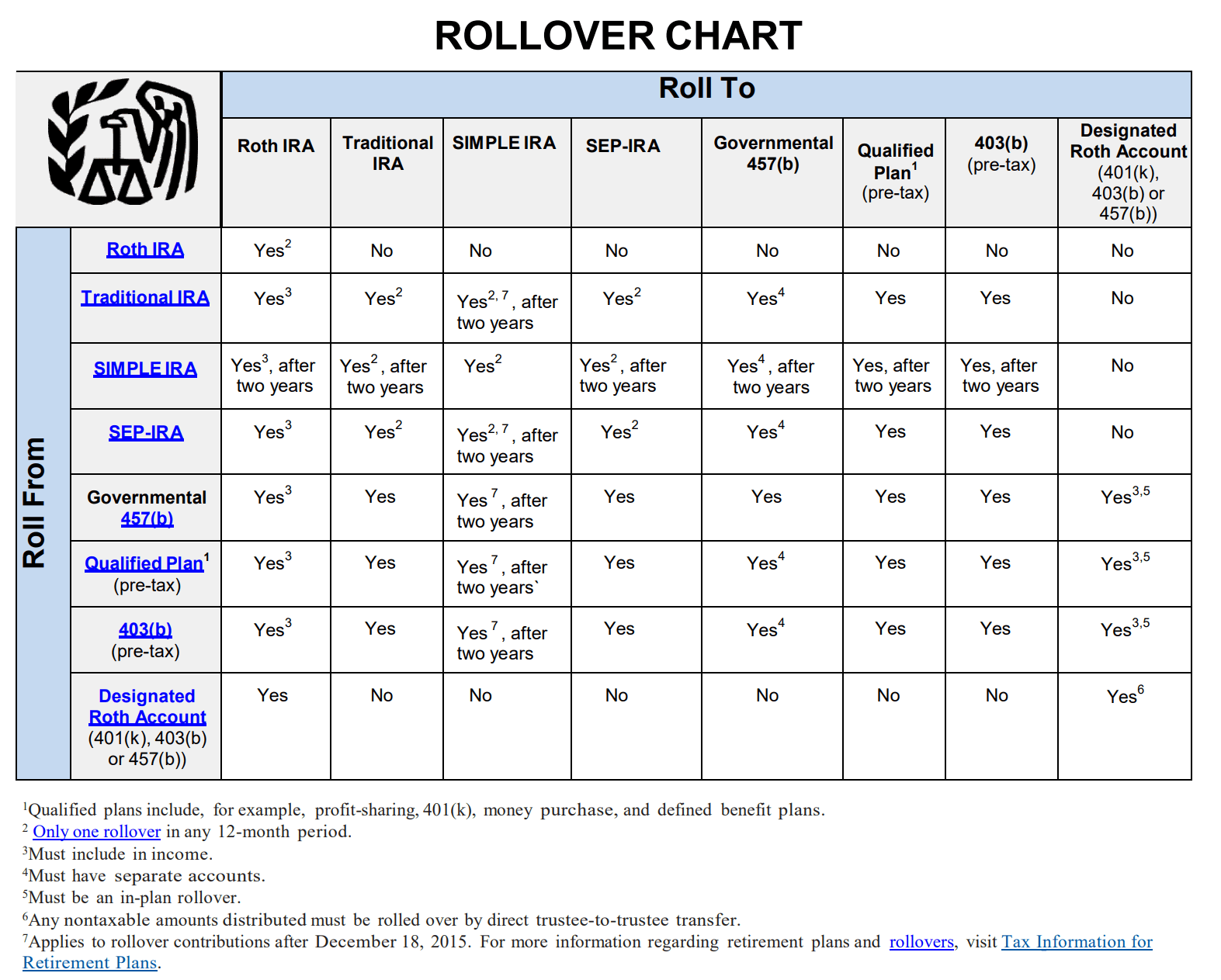

It is important to understand the impact of each option on your investment. Questions to ask yourself as you go through this process may include: What are the fees and expenses in your old 401(k) compared to what you might pay if you rolled it over to an IRA or new employer plan? Fees may include investment-related fees, sales charges, commissions, program fees, management fees or other expenses. What investment options does your new employer’s 401(k) plan offer? Are these investments right for your goals? How many options does your new employer’s plan give you to choose and manage your investments? What penalties can you face if you withdraw funds from a selected 401(k) or IRA early? Do you plan to offer services such as investor advisory and investment planning tools? Once you reach age 72 (70 1/2 for those born before July 1, 1949), the rules of your 401(k) and IRA plans may require you to take required minimum distributions (RMDs). If you’re still working at age 70 1/2, you generally don’t have to take RMDs from your current employer’s plan. Examining Your Options After researching the initial questions about what to do with your old 401(k), it’s time to examine the pros and cons of each of your options, from maintaining a retirement account to an alternative 401(k). Leave it where it is. If you leave your 401(k) with a previous employer, your money will grow tax-deferred, but you won’t be able to continue making contributions. Additionally, if you leave your employer between 55 and 59 1/2, you may be able to receive free withdrawals and have access to low-cost institutional investments. One potential downside to this plan is that it can be difficult to keep track of multiple accounts with different companies. Today, the average person changes jobs every three to five years during their career, so consider whether you want to juggle multiple 401(k) accounts at once. In addition, your former employer may pass on certain program administration or recordkeeping fees, and you may be responsible for these costs if you do so. Build this into your current employer’s plan. You may be able to convert your old account into a 401(k) account with your current employer. All earnings will continue to accumulate tax deferred until withdrawn. The plan’s investment options may include low-cost, institutional-grade products, which can mean you end up with more money in your account and fewer fees. Another benefit of joining a new plan is that if you end up needing the money before age 59 1/2 and leave your job after age 55, you may be able to withdraw from your last previous job with your employer 401(k) without penalty. Before you decide to transfer funds to a new 401(k) plan, be aware that your investment options may be limited to those in the new plan, and you may

Can i roll over 401k to traditional ira, how to roll over 401k to roth ira, can you roll over 401k to ira, how do i roll over 401k to ira, roll ira to 401k, if i roll over 401k to ira, roll over 401k to roth ira, can i roll over 401k to ira, how to roll over 401k to ira, roll over 401k to ira, how do i roll over my 401k to an ira, when can i roll over 401k to ira