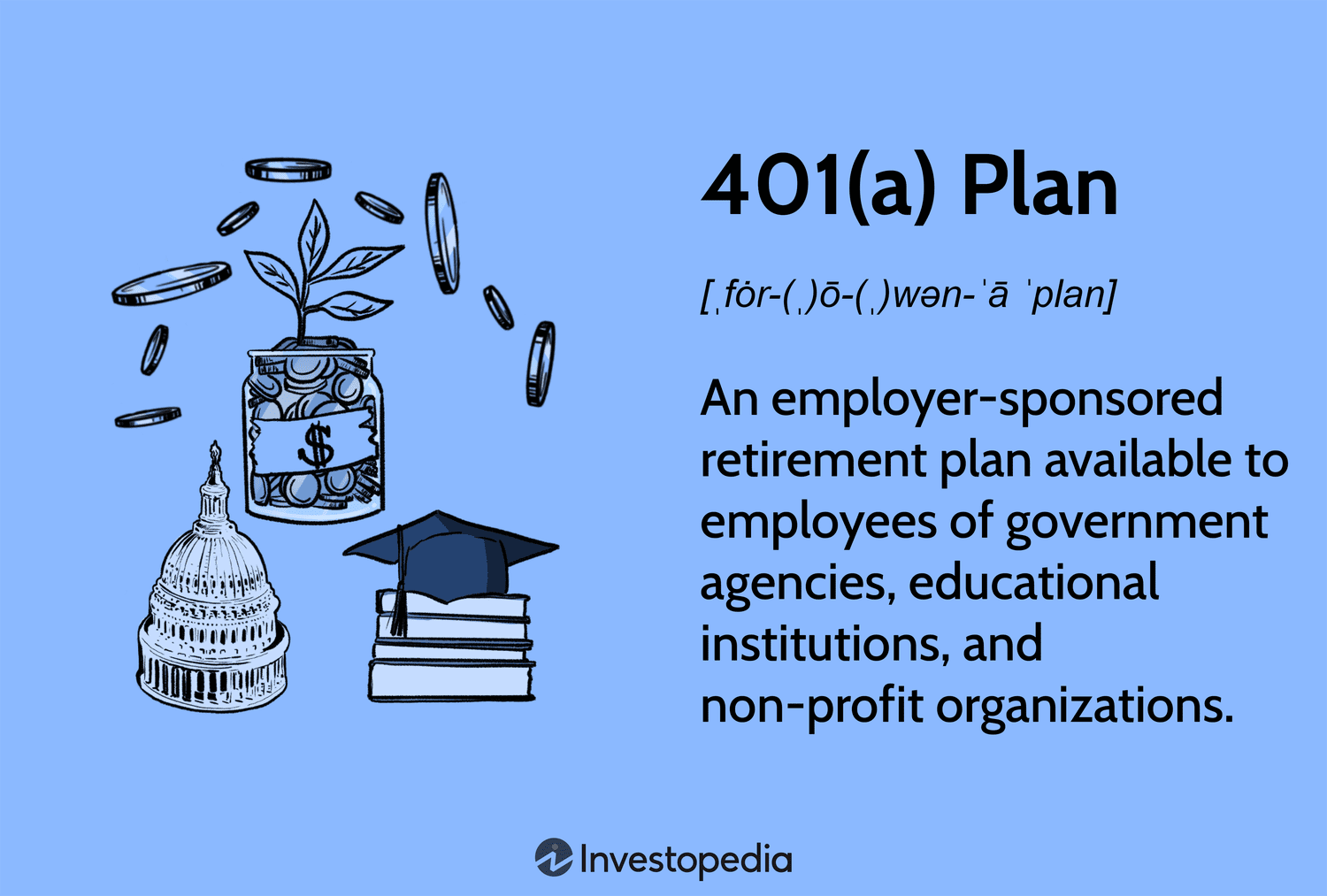

How To Use Your 401k To Start A Small Business – A 401(k) plan is a retirement savings plan offered by many companies in the United States that has tax advantages for savers. Its name is taken from a section of the United States Internal Revenue Code (IRC).

Employees who enroll in a 401(k) agree to have a percentage of each paycheck paid directly into an investment account. Employers can match some or all of those contributions. Employees can choose from a variety of investment options, usually mutual funds.

Contents

How To Use Your 401k To Start A Small Business

The 401(k) plan was designed by the United States Congress to encourage Americans to save for retirement. Among the benefits they bring are tax savings.

Can You Have A 401(k) And An Ira?

With a traditional 401(k), employee contributions are deducted from gross income. This means that the money comes from your salary before income tax is deducted. As a result, your taxable income is reduced by the total amount of contributions for that year and can be reported as a tax deduction for that tax year. There are no taxes due on contributions or investment earnings until you withdraw the money, usually in retirement.

With a Roth 401(k), contributions are deductible from your after-tax income. This means that the contribution comes from your salary after income tax has been deducted. Therefore, there is no tax deduction in the year of contribution. However, when you withdraw money in retirement, you don’t have to pay any additional taxes on your contributions or investment earnings.

Note: Although contributions to a Roth 401(k) are made with after-tax dollars, in general, if withdrawals are made before age 59 1/2, this can have consequences regarding taxes. Always check with a qualified accountant or financial advisor before withdrawing money from a Roth or traditional 401(k).

However, not all companies offer a Roth account option. If a Roth is offered, you can choose between a traditional Roth 401(k) and a Roth 401(k). Or you can contribute both up to the annual contribution limit.

Get Cash Back To (k)ickstart Your 401(k)

Both Traditional and Roth 401(k) plans are defined contribution plans. Both employees and employers can contribute to the account up to dollar limits set by the Internal Revenue Service (IRS). Employee contributions to a traditional 401(k) plan are made with pre-tax dollars and will reduce their taxable income and adjusted gross income (AGI). Contributions to a Roth 401(k) are made with after-tax dollars and have no additional impact on taxable income.

Defined contribution plans are an alternative to traditional pension plans, known as defined benefit plans. With a pension, an employer commits to providing a certain amount of money to an employee for life after retirement. In recent decades, 401(k) plans have become more popular and traditional retirement plans have become less common as employers shift the responsibility and risk of retirement savings to their employees.

Employees are also responsible for selecting the specific investments held in their 401(k) accounts from the options offered by their employers. These offerings typically include stock and bond mutual funds as well as target-date funds designed to reduce the risk of investment losses as employees approach retirement.

Employee account holdings may also include guaranteed investment contracts (GICs) issued by insurance companies and sometimes shares owned by the employer.

How To Withdraw From Your 401(k) Plan In Retirement

The maximum amount an employee or employer can contribute to a 401(k) plan is adjusted periodically to account for inflation, which is a measure of rising prices in the economy.

In 2022, the annual employee contribution limit is $20,500 per year for workers under age 50. However, those aged 50 and over can contribute an additional $6,500.

For 2023, the annual employee contribution limit is $22,500 per year for workers under age 50. If you are 50 or older, you can contribute an additional $7,500.

If your employer also makes contributions, or if you elect to make additional non-deductible after-tax contributions to your traditional 401(k) account, the total employee and employer contributions for the year are:

Solved When You Begin Your New Job, Your Employer Says They

For example, an employer might pay 50 cents for every dollar its employees contribute, up to a certain percentage of salary.

Financial advisors often advise employees to contribute at least enough money to their 401(k) plan to be fully employed.

If their company offers both types of 401(k) plans, employees can split their contributions, putting some money into the traditional 401(k) plan and some into the Roth 401(k).k).

However, their total contributions to both types of accounts cannot exceed the limits for a single account (e.g. $20,500 for those under 50 in 2022 or $22,500 in 2023).

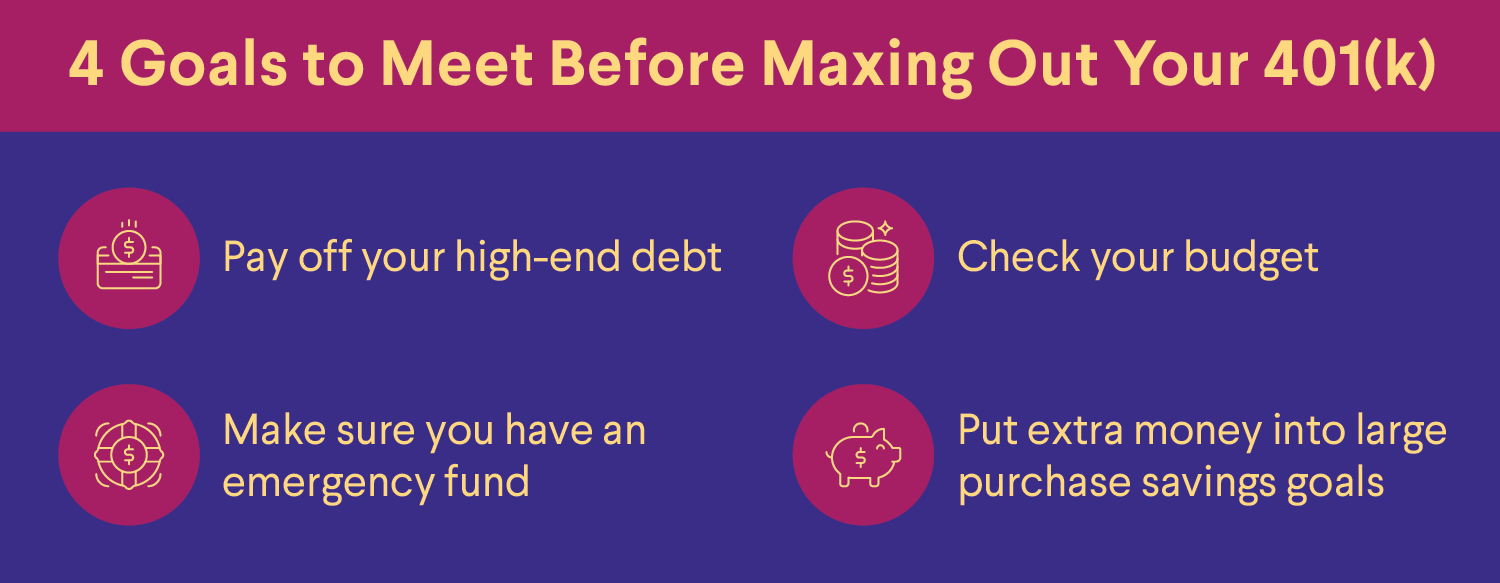

Should You Use A 401(k) To Pay Off Credit Card Debt? What Experts Say

Employer contributions can be made to both traditional 401(k) and Roth 401(k) accounts. Withdrawals from the former will be taxable, while qualified withdrawals from the latter will be tax-free.

Your contributions to a 401(k) account are invested according to the choices you make from the options your company offers. As mentioned above, these options often include stock and bond mutual funds as well as target-date funds designed to reduce the risk of investment losses as you approach retirement.

How much you contribute each year, whether your company matches your contributions, investments and profits, plus the number of years you have until retirement, all contribute to how fast and how much your money will grow.

As long as you don’t withdraw money from your account, you don’t have to pay taxes on investment gains, interest, or dividends until you withdraw money from the account after retirement (unless you have a Roth 401(k), in which case you don’t pay taxes on the withdrawals). eligible upon retirement).

Should I Close My 401(k) & Withdraw Retirement Savings?

Plus, if you open a 401(k) while you’re young, it can potentially help you earn more money thanks to the power of compound interest. The benefit of compound interest is that profits generated from savings can be reinvested into the account and start generating profits on their own.

Over some years, the gross income in your 401(k) account may actually be greater than the amount you contribute to the account. This way, as you continue to contribute to your 401(k), it has the potential to grow to a sizable amount over time.

Once the money is transferred to a 401(k) account, it is difficult to withdraw the money without paying taxes on the withdrawal amount.

“Make sure you still have enough money saved outside for emergencies and expenses you might incur before you leave,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Don’t put your entire savings in a 401(k) where you can’t easily access it, if needed.”

How To Use Your 401(k) To Start A Business

Earnings in a 401(k) account are tax-deferred in the case of traditional 401(k)s and tax-free in the case of Roths. When a traditional 401(k) owner withdraws money, that money (which was never taxed) is taxed as ordinary income. Roth account holders already pay income taxes on the money they contribute to the plan and will not be taxed on withdrawals as long as they meet certain requirements.

Traditional and Roth 401(k) owners must be at least 59½ years old—or meet other criteria set by the IRS, such as total and permanent disability—when they start withdrawing money to avoid penalties.

This penalty is usually an additional 10% early distribution tax on top of the other taxes they have to pay.

Some employers allow employees to borrow money based on their contributions to a 401(k) plan. Basically, employees borrow from themselves. If you take out a 401(k) loan and leave your job before the loan is repaid, you must pay it back all at once or face a 10% early withdrawal penalty.

The Best

Traditional 401(k) account holders are subject to required minimum distributions (RMDs) upon reaching a certain age. (Withdrawals are often called distributions in IRS parlance.)

Starting January 1, 2023, retirement account holders must begin taking RMDs from their 401(k) plans starting at age 73. The RMD amount is calculated based on your life expectancy at that time. Prior to 2020, the RMD age was 70½ years. Before 2023, the RMD age will be 72 years. The age was updated to 73 in the HR omnibus spending bill. 2617 in 2022.

When 401(k) plans were introduced in 1978, companies and their employees had only one choice: the traditional 401(k) plan. Then in 2006, Roth 401(k)s appeared. Roth is named after former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA a reality.

Although Roth 401(k)s have been slow to catch on, many companies now offer them. So the first decision employees often make is choosing between a Roth and a traditional (401(k).

Left Your 401(k) At An Old Job? Here’s How To Track It Down

As a general rule, employees who expect to be in a lower marginal tax bracket after retirement can opt for a traditional 401(k) and take advantage of the immediate tax breaks.

On the other hand, employees who want to enjoy a higher salary after retirement can choose a Roth to avoid taxes on their savings later. Also important—special

Use your 401k to start a business, roll over 401k to start business, use 401k to start a small business, how to use 401k to start a small business, how to use your 401k to start a business, how to start a 401k for small business, how to start a 401k for my small business, how to use your 401k to start a small business, how to start your own 401k, how to use 401k to start a business, how can i use my 401k to start a business, how to start 401k for small business