How To Use 401k To Start A Business – Click HERE to learn how we can charge over $3,500 less in the first year just from our ROBS program

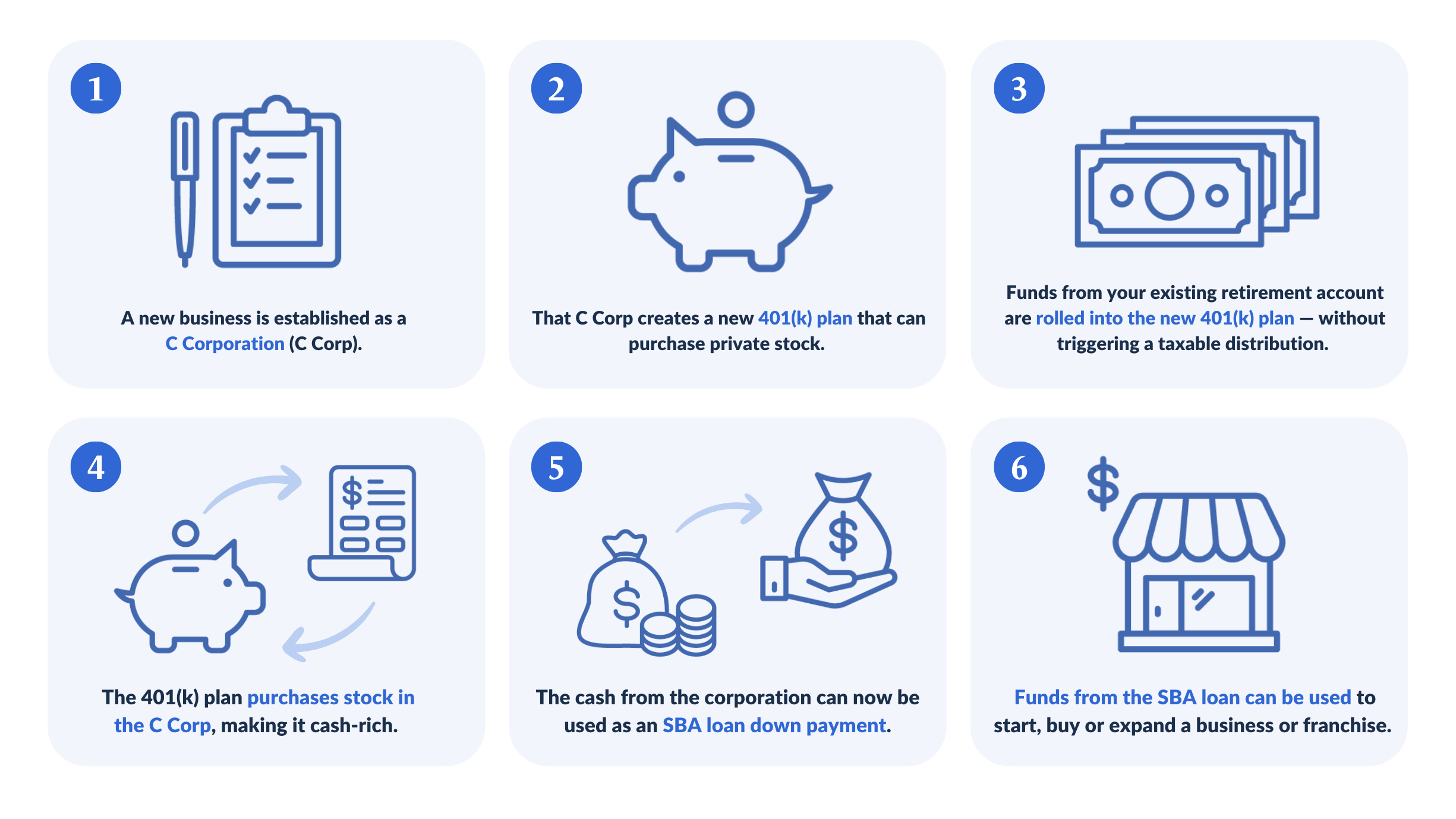

No. A 401k Business Financing Plan is what the IRS calls a “Rollover as a Business Startup.” To learn more about the stages of the ROBS event, click here.

How To Use 401k To Start A Business

What are the benefits of using a ROBS 401k plan to fund my business versus traditional small business financing options?

A Streamlined Way To Use Your 401k To Start A Business

Most aspiring or existing entrepreneurs looking for financing for their business only consider two options: borrowing funds or selling an ownership stake in their business. Another option that may be available is called a rollover as a business startup (ROBS) plan, which allows the entrepreneur to use their 401k, IRA or other retirement funds to fund the business.

I would like to use my 401k to start a business and I am considering several different businesses. What kind of business can I start with a 401k Business Financing Plan?

Almost any type. The 401k Business FinancingPlan is a very flexible financing strategy for small businesses. The type of business you can start with a 401k Business FinancingPlan is virtually limitless. As long as the business is active and not just investing or lending capital, your business should qualify for a 401k Business Financing Plan. Call us at 1.800.489.7571 and we can evaluate whether the business you want to open is a good fit.

Can I use my 401k, IRA, or other retirement funds to buy or start a business or franchise?

Is Pay Transparency Good?

We are often asked if a 401k, IRA or other retirement funds can be used to buy or start a business or franchise.

The good news is that you can! While one option is to borrow from your retirement account, there is another option (often called a startup rollover) that is more flexible and offers many advantages over a loan by providing funding to start your franchise or small business. Read more >>

I called my employer and spoke with someone in HR and they said I can’t use the 401k to fund startups or any investment outside of the employer’s 401k plan mutual funds. Are they allowed to do this? Read more >>

Yes, a 401A, a type of government plan offered to employees of US or government agencies or government agencies or political subdivisions, can be converted to a ROBS 401k. Read more >>

Infographic: Creating A Benefits Package

There are two types of 457(b) plans, but only one can be rolled over to a 401k plan, such as a business finance 401k plan. The first type is a tax-free 457(b) that cannot be rolled over to a 401k (ROBS) funded company or IRA. Another type is the 457(b) status, and this type can be rolled into a ROBS 401k plan. To learn more about these types of 457(b) plans CLICK HERE.

Does my C-Corp have to be my new company or can it be a shareholder in a separate corporation? My partners don’t want to be a C-Corp. I envisioned a scenario where I could form a C-Corp and somehow make it a parent or child of the main organization.

The C corporation must own and manage the company. A C-corporation can do this through a subsidiary in which other investors invest, if the C-corporation is the majority owner of the subsidiary LLC and the other owners receive an ownership share proportional to the invested assets.

If your goal is to invest in real estate through a rollover as a business start-up transaction, you can do it by financing a C joint-stock company operating as a real estate management company. In order to qualify as a property management company, at least half of the company’s assets must be invested in managed or developed properties, and thus the company has the right to substantially participate directly in management or development activities. In addition, as part of its normal business, the unit must be directly involved in real estate management or development activities. In addition, the company must pay the expenses related to the property, and the property must not be used for personal use.

All About 401k Plan Tax Rules, Contributions, Deductions,

I plan to use my 401k to start a business. I have listed another investor who wants to use pension funds but is not involved in the day-to-day running of the business. Can he invest by starting a new business?

The ROBS 401k is not designed for someone who wants to passively invest in a company. To participate in the 401k program, a person must be employed by the company. Therefore, while an investor could not invest their retirement funds in your business through our 401k Business Financing plan, they could invest in your business through a self-directed IRA LLC. The investment can be debt (i.e. a loan to your company) or equity (i.e. the LLC buys shares in your company).

I am looking to use your 401k business financing services to purchase a business (ie the FedEx route) and would like to purchase equipment for the business from my father. Is this allowed?

Regulators believe that a “prohibited transaction” occurs when a 401k plan invests in a company where you expect the company to transact with a “disqualified person.” Family members who are disabled persons include a spouse, ancestor, lineal descendant, or any spouse of a lineal descendant (see more). As such, the company should not purchase equipment from your father (who is an ancestor) or your son (who is a descendant). Although other family members may not technically be disabled persons, in order to make a reasonable business decision for a business to purchase equipment from such other family members, it would be prudent to obtain and retain documentation to show that such a transaction was at fair market value. .

How Much Should I Put Aside For Retirement?

I have a former employer plan that I plan to use to purchase a franchise with my husband. Although we both work full-time at the new company, my husband also continues to work part-time at his current job. He has a 401k through his current employer. Is it possible to transfer his balance to a company 401k if he stays employed?

If your husband wants to transfer funds from his current employer’s plan, he should check whether the plan allows him to transfer funds while working (rolling transfer). Note that if he has funds in his current plan that were transferred from a previous employer’s plan, the plan will usually allow him to transfer those funds while he is still employed. If you would like us to review the plan, we are happy to do so. Request a summary description of the plan and send it to us by email.

While I am seriously considering using the ROBS 401k to start a business, the tax implications are my biggest concern. Unlike an S-Corp or LLC, which is funded with non-retirement assets, a C corporation would be subject to corporate income tax, so profits would be taxed twice. Is there no alternative to a C-Corp?

If you want to finance your business with recycling as a business start-up, the entity financed with your pension funds must be a C corporation. While it is certainly true that LLC/S-Corp is generally recommended by Corporate Advisors over C-Corp, the C-Corp has certain advantages (see, for example, the advantage discussed in the following article: http:// www. .legalzoom .com/incorporationguide/corporatetaxadvantage. html).

Can I Use My 401(k) To Start A Business?

Generally, these advisors recommend an LLC/S-Corp because they think that C corporations are subject to “double taxation” (where “double taxation” means a corporation that pays taxes on its income and any business profits are distributed to shareholders, capital gains tax is imposed ). While this may be generally true, it is worth noting that in our 401k Business Financing Plan (i) the double taxation effect is mitigated by the fact that all dividends paid on 401k stock are paid 401k tax-deferred; and (ii) the taxable income at the corporate level can be reduced by the reasonable salary paid to you as an employee of the corporation (as this would be an expense to the corporation). Of course, when you withdraw funds from your 401k, those funds are considered income subject to income tax (and possibly penalties) in the year of distribution. It is worth noting that the withdrawal may take place years later (e.g. when you retire) and you may be in a lower income tax bracket.

Ultimately, if you want to use your retirement funds to fund a business, the business must be organized as a C corporation. As such, perhaps a better comparison would be (i) the cost of operating your retirement funds vs. (ii) the cost of obtaining other forms of funding or the cost of withdrawing funds from your retirement account and paying applicable taxes and penalties. For example, consider the price of our plan relative to a $100,000 loan with a 7-year term and 7% interest rate. With our plan, installation fee

401k to start business, how to use your 401k to start a small business, how to use 401k to start a business, how to use your 401k to start a business, use 401k to start business, how to use 401k to start a small business, use your 401k to start a business, how to use 401k money to start a business, use 401k to start a business, how can i use my 401k to start a business, how to start 401k, how to start 401k for small business