How To Start Your Own Stock Brokerage Firm – If you’re on a Galaxy Fold, consider turning on your phone or viewing it in full screen mode to maximize your experience.

Advertiser Disclosure Many of the offers that appear on this website are from companies that The Motley Fool receives compensation from. This compensation may affect how and where products appear on this website (including, for example, the order in which they appear), but our reviews and ratings do not influence compensation. We do not include every company or every offer available on the market.

Contents

How To Start Your Own Stock Brokerage Firm

Many or all of the products here are from our partners who compensate us. That’s how we make money. But the integrity of our editors ensures that compensation does not influence our expert opinions. Terms may apply to offers listed on this page.

Search Broker Reports From 1,000+ Sources In Seconds

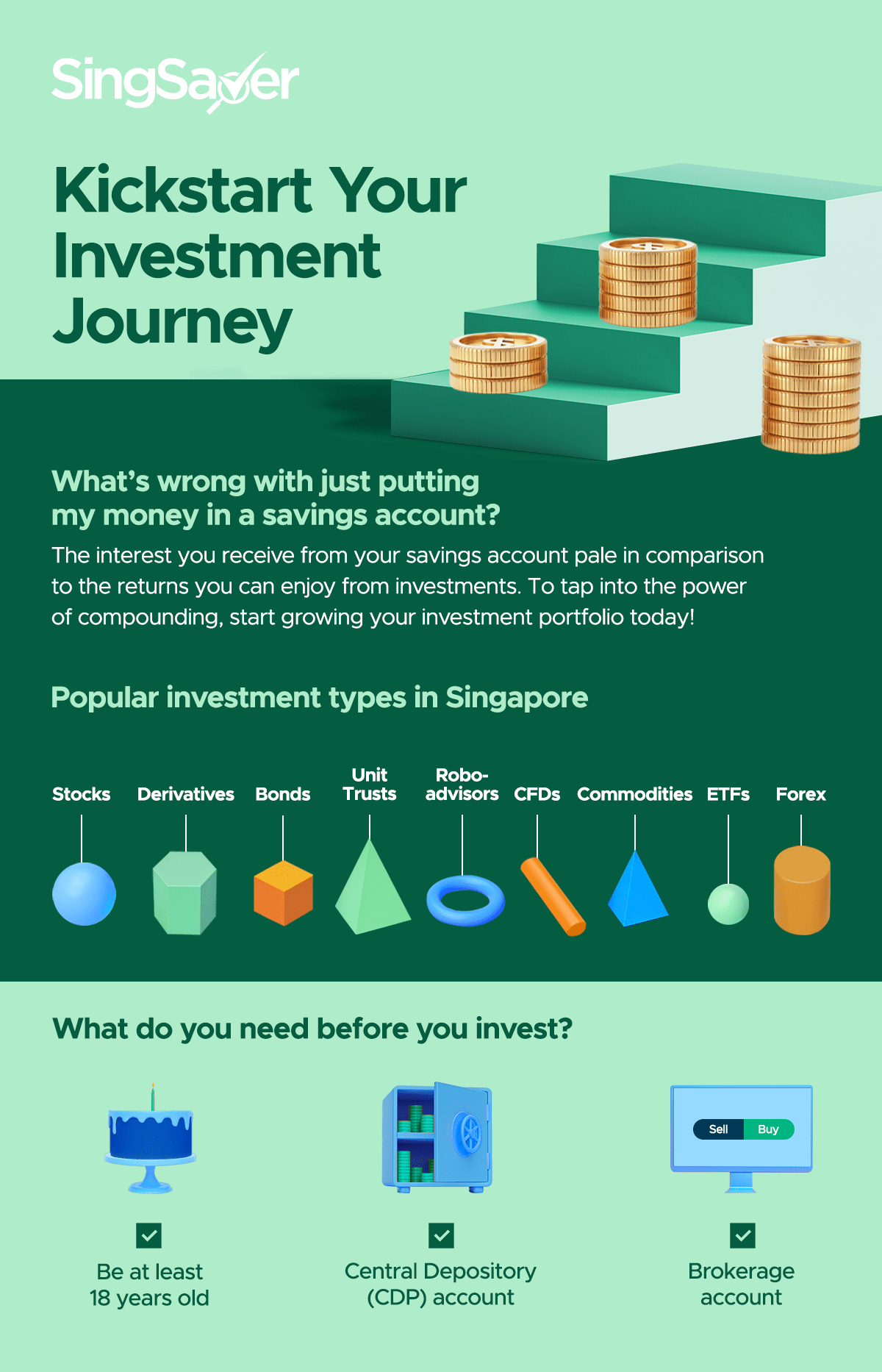

If you want to buy stocks or other investments, you need a brokerage account. But many still don’t know what a brokerage account is, let alone how to open one or what to look for in a broker. Here, you will learn everything you need to know about brokers so that you can find the right one for your investment needs.

A brokerage account is a financial account that allows you to buy and sell stocks, bonds, mutual funds, currencies, futures, options, and other types of investments. Many financial institutions offer brokerage accounts to investors.

A brokerage account works like a bank account. Like a bank account, you can transfer money in and out of your brokerage account whenever you want. This is usually done through a linked bank account. Some brokers even let you deposit by check.

But there is a big difference between a bank account and a broker. Brokerage accounts allow you to make high-risk investments in things like stocks and ETFs, but bank accounts offer stable returns with less potential downside. FDIC insurance protects bank customers from bank failure, and SIPC insurance protects broker customers from broker failure. But SIPC insurance does not protect investors from losing money against normal market fluctuations or underinvestment.

Investment Brokerage Singapore Guide: Plus, Compare Commission Fees!

4.5/5 Circle the letter I in it. Our rating is based on a 5-star rating. 5 stars equal to Best. 4 stars equals Excellent. 3 stars equal to Good. 2 stars equal to Fair. 1 star equals poor. We want your money to work harder for you. And that’s why our rankings don’t lean toward offers that guarantee flexibility while cutting out-of-pocket costs. = best = good = good = fair = poor

With no fees, access to trading stocks and cryptocurrency, Robinhood is a powerful, no-profit brokerage account.

SoFi has built a robust and valuable ecosystem to help manage your money in one place. SoFi Active Investing improves that ecosystem as well

4.0/5 circle the letter I in it. Our rating is based on a 5-star rating. 5 stars equal to Best. 4 stars equals Excellent. 3 stars equal to Good. 2 stars equal to Fair. 1 star equals poor. We want your money to work harder for you. And that’s why our rankings don’t lean toward offers that guarantee flexibility while cutting out-of-pocket costs. = best = good = good = fair = poor

Buying Stocks Without A Broker

To go without a minimum balance and trade without commission is the industry standard, offering no commission mutual funds makes this a wise choice for some investors.

Common stock gives investors an interest in the company. When you think about investing in the stock market, you probably think about common stocks. Common stocks are known for offering:

Most companies use common stock to raise money through equity financing. For example, companies seeking capital for the first time typically issue common stock in an initial public offering, or IPO. That makes the business a cash and stock buyer who has a stake in the business. Investors typically buy common stock to own stakes in individual companies that they believe will outperform the broader market.

A stock that requires investors to own shares in the company, but it differs from ordinary stock in a few ways:

Trading Platforms & Exchanges

Basically, preferred stocks are less risky than common stocks. If the company fails, owners of preferred stock are more likely than owners of common stock to get their money back. But preferred stock does not offer as much potential as common stock.

In many ways, preferred stocks work like bonds. Preferred stockholders often receive fixed dividends on a predictable schedule, expecting to receive the money paid for the shares at a later date. The price of preferred stocks tends to move more with the bond market than with the stock market – especially when interest rates fluctuate. Investors typically buy preferred stocks to earn fixed dividends in lower-risk stocks.

A bond is a loan that an investor makes to a company or government. Bonds do not represent ownership in the company – they represent debt that the entity must repay.

In exchange for receiving the investor’s money, the company or government agrees to pay a fixed interest for the duration of the loan. Upon maturity, the entity will repay the full principal amount. Investors often buy bonds to earn fixed interest.

Best Online Trading Platforms Of 2023

REIT stands for real estate investment trust. REITs collect money from shareholders to invest in various types of real estate. In some cases, REITs buy commercial or residential properties and then rent them out to collect income. Other REITs prefer to build their own buildings, or trade financial securities linked to the real estate market.

REITs are like mutual funds, except they focus only on real estate. Each REIT share represents a fractional interest in real property in the REIT’s securities. REIT managers decide which properties to buy and sell. Investors typically buy REITs to own a diversified bet on the real estate market.

Money market accounts are similar to savings accounts, but have some special features that often include check writing and higher interest rates. Certificates of deposit, or CDs for short, pay investors monthly or quarterly interest in exchange for locking in an investment for a set period of time (usually three months to five years).

Both types of accounts often offer better returns than checking or savings accounts, but they come with their own drawbacks, such as early withdrawal penalties or minimum investments.

Stock Market Terms Infographic Template

A mutual fund is an investment vehicle that allows many investors to pool their assets together, with a fund manager putting the money into stocks or other investments.

Actively managed funds have dedicated fund managers who select stocks in the hope of finding the highest return. They usually charge high fees to investors to cover research and management costs.

Index funds consistently track popular market benchmarks such as the S&P to match their performance. Compared to actively managed funds, they charge low management fees.

Owning shares in a mutual fund gives you a share of the gains in the fund’s portfolio – and any losses as well. Investors usually buy mutual funds for professional management or broad exposure to asset classes.

The Biggest Stock Brokerage Firms In The Us

Exchange-traded funds work like continuously managed mutual funds, with the main difference being that exchange-traded funds trade in major stock markets. Like mutual funds, each ETF share represents a fraction of the fund’s portfolio. Most ETFs use an index-tracking strategy to match specific market returns. But recently, actively managed ETFs have become more popular. These try to beat market indexes such as the Nasdaq and may be linked to specific categories, such as artificial intelligence companies. Investors usually buy ETFs for broad exposure to an index or category.

Master Limited Partnerships (MLPs) are publicly traded business partnerships. MLPs offer tax benefits, and you’ll often find MLPs in the energy and transportation infrastructure industries.

MLPs typically offer investors higher yields compared to bonds due to a combination of tax advantages and strong cash flow. But they are considered riskier than bonds and can be tax complicated. Investors usually buy MLPs to collect quarterly, tax-advantaged returns.

Not sure where to start? Consider opening an account with a beginner-friendly broker. You can usually do that for free. Do your research and start small – you will learn more from losing money in the market than you will from reading all the books on investing.

Prime Brokerage Services, Example, Requirements For An Account

Brokerage firms used to charge commissions for trading, but commissions have become less common recently. Many brokers now do not charge any fees for trading stocks and ETFs. However, it is wise to check the broker’s fee schedule to avoid unexpected costs.

Some types of investments charge management fees. For example, mutual funds and ETFs have annual expense ratios that cover management costs. Those fees do not need to appear on the brokerage statement; Instead, they are taken directly from the value of the fund’s shares.

Simply put, the main difference between a cash account and a margin account is that a cash account does not let you borrow money to buy more stocks. To borrow against the value of your investment, you must have a margin account.

With a cash account, you are responsible for transferring money. If you don’t have cash in your account, your broker usually won’t let you trade. Similarly, when you sell stocks, you will have to wait until the trade has agreed to withdraw your payment or use it to buy shares of another company.

What Is The Role And Importance Of Brokers In The Stock Market?

Margin account allows you to borrow from your broker. you can

How to start a forex brokerage firm, how to start your own investment firm, how to start your own cpa firm, how to start your own insurance brokerage, how to start your own brokerage firm, how to start your own firm, start your own brokerage firm, how to start your own consulting firm, start your own insurance brokerage, how to start your own law firm, how to start your own recruiting firm, start your own forex brokerage