How To Start Your Own Cpa Practice – Perhaps you have chosen to start an accounting firm with the vision of being your own boss and achieving financial freedom.

That said, starting your own business can be a rewarding endeavor. After talking to industry experts about successfully launching their businesses, we share their tips and guidance in this article. You’ll find a helpful checklist to get you started and a real-world example of what running an accounting firm is all about.

Contents

- 1 How To Start Your Own Cpa Practice

- 2 How To Start An Accounting Firm & Run A Cpa Accounting Business 2023

- 3 Ea Vs Cpa Salary: What You Need To Know For Your Career

- 4 Cpa Vs Ca (chartered Accountant): Which Is Better For You?

- 5 Best Accounting Practice Management Software Options In 2023

- 6 Cpa Vs. Accountant: 5 Big Questions To Consider

How To Start Your Own Cpa Practice

Becoming a limited liability company (LLC) should be one of the first steps you take before opening a business for your accounting firm.

How To Find The Best C.p.a. Or Tax Accountant Near You

An LLC creates a separate legal entity for your business and provides personal asset protection. You can choose from other legal structures for your business instead of an LLC, so consider consulting with a legal expert to determine your best option.

Depending on the location of your business, you can usually form an LLC through the Secretary of State’s office. You can also contract with an LLC formation company for assistance for a nominal fee.

Research the federal, state and local laws and regulations you are subject to and apply for any necessary permits or licenses. Doing so keeps you compliant and avoids potential penalties or fines.

You should also set up a business bank account at this point. Attach it to your LLC so that your business and personal assets remain completely separate.

How To Start An Accounting Firm & Run A Cpa Accounting Business 2023

Do you want to provide tax preparation or payroll services? Do you prefer working with companies rather than individuals? Are you ready to be on call for your clients? How do you feel about the handling of their claims?

Answering questions like these will help you offer the exact services you need and who you want to serve. Consider your areas of expertise and work preferences so that you feel confident in the services you are promoting to potential clients.

Consider the amount of time it takes to complete various accounting services and the seasonality of individual projects to try to maintain a steady workload throughout the year. You can adjust your offer as you discover what works and doesn’t work for you.

Based on the services and packages you choose to offer, you must now decide how to bill your clients. Your options include a flat fee, retainer or billable hours.

Ea Vs Cpa Salary: What You Need To Know For Your Career

We cover how to price your accounting services in more detail below (and in even more detail in this article). There are many ways to do this, depending on the nature of your services and your personal preferences. Again, you can adjust your prices later to optimize your margins.

As you get closer to fully launching your business, make sure you have good systems in place to effectively manage client work and meet critical deadlines. This workflow helps you increase customer satisfaction by providing timely service and earning more referrals from existing clients.

You can use simple spreadsheets, but this method can quickly become complicated and tedious as you bring in more clients. Instead, accounting workflow management software like Jetpack Workflow can keep you and your team on track and ensure that no task slips through the cracks.

To highlight a real-life case study, we’re sharing one of our popular podcast episodes that chronicles our guest’s journey to launching her own business.

How To Start A Thriving Virtual Accounting Firm

Hannah Stricker always wanted to be her own boss after 25 years in accounting. She finally gave her notice, leaving to start an accounting firm from scratch.

Within 12 months, they banked a 6 figure income. In this podcast, she shows us how she did it.

With a background in accounting, bookkeeping and taxation, Stricker set out to own her own accounting firm.

Before venturing into entrepreneurship, she built up a healthy savings account that covered 6 months of expenses, giving her several months to see if her business plan worked before she needed another job.

Cpa Vs Ca (chartered Accountant): Which Is Better For You?

Stricker’s 20+ years of accounting experience, a willingness to put herself out there, and a drive for success allowed her to get down to business. She signed several contracts within the first 6 months of starting practice.

Through hard work and determination, they land steady clients and don’t need their savings to build their business. Diving into the deep end like Stricker did might not be for everyone, but the reward was worth the risk in her case.

Stricker found clients through networking through volunteer work. Meeting people at their church events puts them in touch with the right people. However, even if you don’t have a ready-made network as a church, there are 5 simple ways to identify and connect with new clients.

There are so many small business owners who need help setting up an accounting system. In 2021, the highest number of people ever started a business. They probably don’t have an accounting background and could use a certified public accountant to help them set up their accounting operations properly.

Alternative Career Paths For Cpas And Making The Transition

These groups exist, although these days they may be virtual gatherings. As a new accountancy business owner, you fit right in and have a pool of potential clients. It’s a win-win! Be sure to add to the discussion about the trials and tribulations of starting a small business and not always practicing your sales pitch.

Online platforms like Upwork or Fiverr are great places to build a client base. They allow you to grow a reputation for quality work, meet clients from a wide geographic area, and set your own prices.

Getting those first few sales can be challenging as the competition can be tough. However, if you have several 5-star ratings, your customer base and orders will increase.

Build a presence on Facebook and LinkedIn as well. You can run paid ads on these platforms tailored to your target market, whether they are startups, small businesses or large growing organizations.

Best Accounting Practice Management Software Options In 2023

Be careful with this approach, but could there be clients from your former firm who aren’t getting all the accounting services they need? While we never recommend stealing customers, these companies may require additional services that your previous firm does not provide.

As a bonus, they already know you and your work, which makes for a much easier selling price. However, be sure not to violate any non-compete agreements of a former employer.

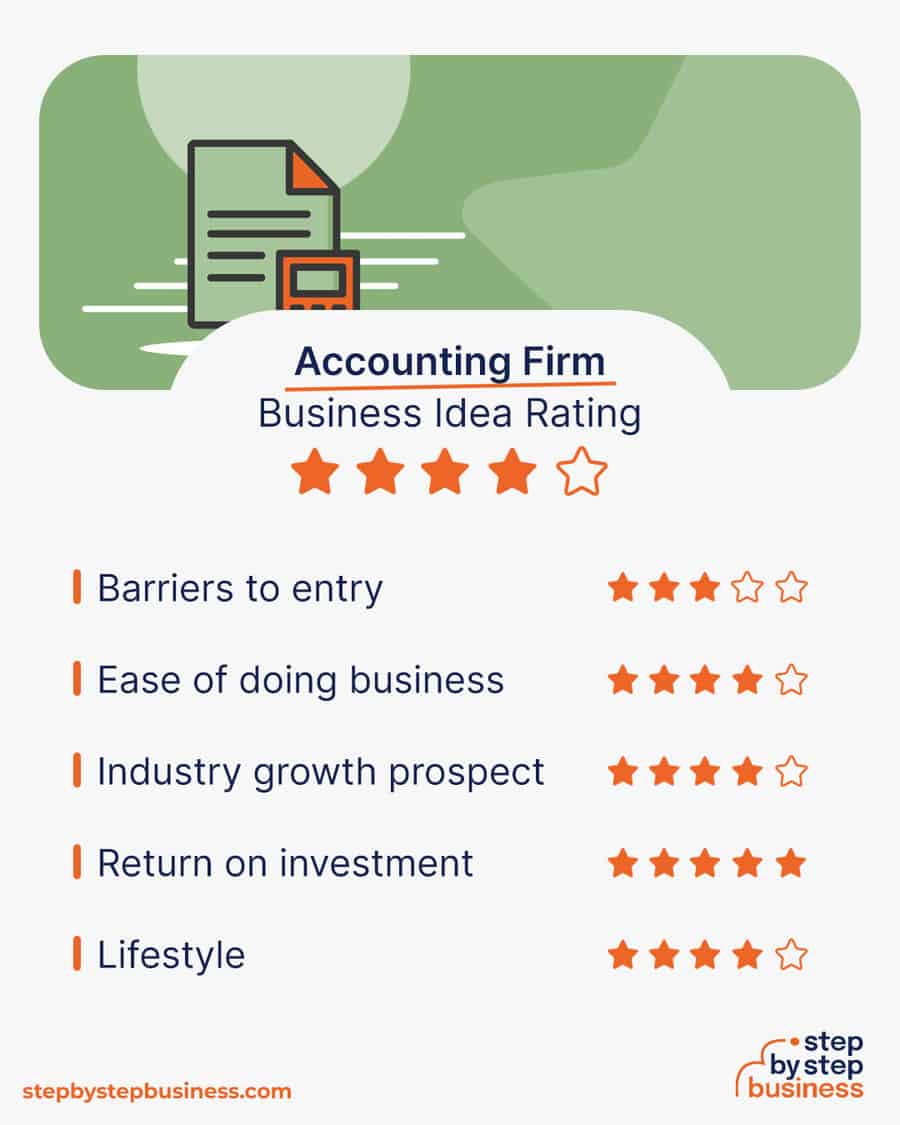

You might think the best option is to set your rates based on each client, but it’s best to start by understanding how you value your time and what you want to bill.

Stricker decided to work with clients on a reservation, but that’s not your only option. You can charge by project, by billable hour, or by retention.

Cpa Vs. Accountant: 5 Big Questions To Consider

Each of these options has positives and negatives, but each of these billing methods can work. Depending on what your clients are comfortable with, you can use more than one method.

On a flat fee project, you quote a project price to the client, and once they agree, the price is set. These projects make your cash flow projections easier and, if you don’t lose a customer, give you a good idea of where your money is coming from each month. On flat fee projects, you can skip tracking your time.

The advantage is that you take all the risk if the project runs longer than expected. To compensate for this risk, you can take into account the maximum number of hours of the project, so that the cost of the project does not fall entirely on you.

The billable hours are long the bane of lawyers who often need to bill in 6 minute increments. If you decide to bill by the hour, you need to figure out how much you want to earn each year and the number of hours you are willing to work to determine your hourly rate.

From Cpa Lifestyle Practice To Billion Dollar Ria Enterprise

If you are working with multiple clients, you may want to bill differently depending on each team member’s experience or expertise. If you bill by the hour, it is essential to keep track of the time spent on different projects in order to provide detailed bills to your clients.

Clients are charged a regular weekly, monthly or quarterly fee. Before you start your work, determine the services under custody. Like a flat fee, this billing method means accurately assessing the amount of work involved for clients.

Stricker provides all accounting, payroll and tax return services for a fixed monthly fee. Before quoting a price, she meets with each customer to determine the level of service they require and how often they expect to interact with their books.

When setting your prices, consider your profit margin. Stricker achieved an 85% profit margin on his first 6 figures of revenue.

Try It Yourself: Create Your Own Cpa Sequence

If you are not paying other staff members, the cost of providing accounting services is minimal, but you need to determine the value of your time when setting your rates.

To maximize your profit margins, make sure you operate efficiently. Even with hourly projects, clients want to see that you are billing for a reasonable number of hours.

While you may decide to create your workflow system with spreadsheets, companies like Jetpack Workflow have created free workflow templates and online accounting software systems to help you organize and streamline your CPA practice faster.

📌 Extra: Are you ready to grow your business and increase income? We took the best strategies and insights from 100+ interviews with our customers. Download our exclusive book, Your Double Entry Accounting Business for free.

Cpa Firm Partner Compensation: The Art And Science

The fastest way to

Start your own cpa firm, how to start your own therapy practice, how to start your own practice, how to start your own cpa firm, how to start your own counseling practice, how to start your own law practice, how to start your own medical practice, how to start your own private practice, how to start your own accounting practice, how to start your own dental practice, how to start your own tax practice, how to start a cpa practice