How To Start Your 401k – Want to claim 401(k) tax credits of up to $16,500? Ready to attract and retain employees with a better benefits package so they can save for retirement? If so, you may want to start a 401(k). But to do that, you need to know how to set up a 401(k) in your small business.

A 401(k) plan is an employer-sponsored retirement option that allows employees to contribute pre-tax money (including a Roth plan) to their account. As a result, the contribution reduces the employee’s tax liability and allows them to save for retirement. But what about the business benefits of creating a 401(k)?

Contents

How To Start Your 401k

One reason small businesses hesitate to start a 401(k) is the time and cost involved. Recognizing this, Congress passed the SECURE (Setting Every Community Up for Retirement Enhancement) Act in 2019. The law encourages small employers to begin offering 401(k) with tax credits. increase.

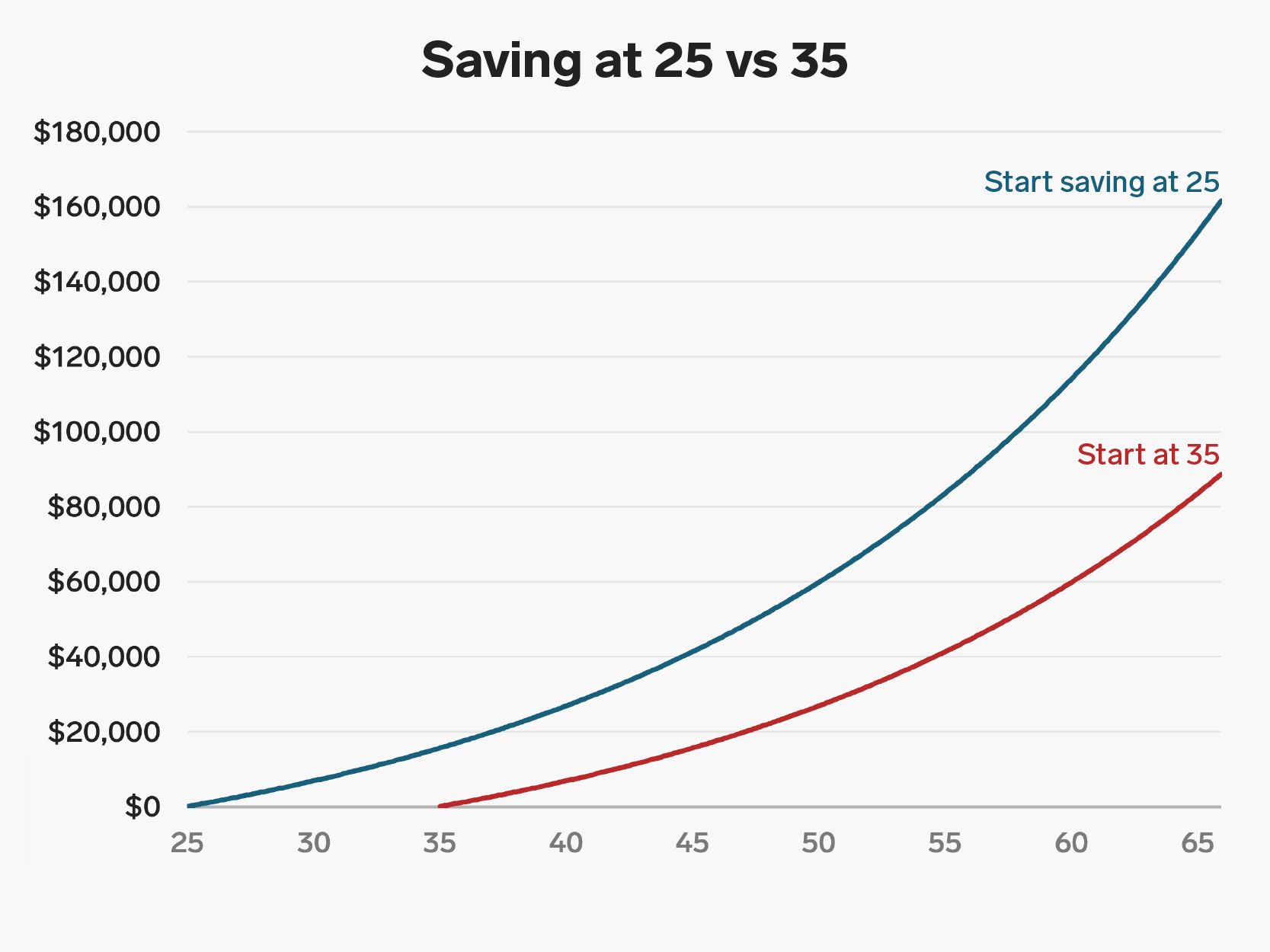

How Much Should You Contribute To Your 401(k)? — Missfunctional Money

Some work responsibilities include creating a 401(k) plan for a small business. You may have to pay some fees for setting up the program.

Establishment fees typically range from $1,500 to $3,000, but can be more or less depending on the business. Some companies may have the fee waived, but this is reserved for large companies. And remember, thanks to the SECURE Act, you can deduct reasonable installation costs.

So, you’ve decided to set up a 401(k) plan. Good! However, there are a variety of programs that you can choose from.

You can contribute to a Roth 401(k), just like a traditional 401(k) plan. However, funds contributed to a Roth 401(k) are after-tax, meaning you take taxes out of the employee’s paycheck before taking out their contributions. rest.

K: What Is It? How Does The Retirement Plan Work? (2023)

Your employer’s rights will vary depending on the plan you choose. You have the same 401(k) planning rights regardless of the plan established at your company.

Are you starting a 401(k) plan? If so, the next step is to decide who will create and maintain that plan. Of course, it’s better to organize the plan and take care of it yourself, but it’s more time-consuming and error-prone.

To save time and help avoid 401(k) related mistakes, contact a business or financial institution (bank, mutual fund, or insurance company).

Pro Tip: Can’t decide which 401(k) plan is best for your business? Consult your retirement plan administrator for guidance.

Self Employed? A Solo 401(k) Might Be A Good Option For You

Want to start a new 401(k) plan? It was easy. Patriot has teamed up with Vestwell, a retirement plan trusted by small businesses in all 50 states, to offer a premium 401(k) combination. You can sign up here to get started and learn more.

Unless you hire a business or financial institution to set up and manage the 401(k), you must create a written plan. If a company or financial institution handles the plan for you, they will put the plan in writing.

The written plan should include the terms and conditions of your 401(k) plan. It is a legal document, so you may want to ask a professional for help.

One requirement for starting a 401(k) plan on your own is establishing a trust fund to hold the assets (also known as retirement plan contributions). This will ensure that only participants and contributors can use the funds.

How Much Does A 401(k) Cost Small Business Employers?

When setting up a trust, you must choose a trustee. Determining a trustee is an important part of creating a plan, because they must handle contributions, plan investments, and distributions.

How do you review employee and employer contributions? Find a way to track project-related information, including:

If you use a business or financial institution to manage your company’s 401(k), they will handle the recordkeeping on your behalf. (Bonus points if your vacation site integrates well with your payment plan!)

To get employees to participate in your company’s 401(k) plan, you need to inform them about the plan. Provide information such as benefits, resources and responsibilities of planning staff.

The Ultimate Roth 401(k) Guide

Prepare a summary plan definition (SPD) to provide eligible employees in the 401(k) plan. This ensures that qualified employees know what to expect from the program.

Figuring out how to start a 401(k) for a small business is just the beginning. Keep in mind that there are additional employment obligations after starting a small business 401(k).

Depending on the type of 401(k) you choose, you’ll need to complete the no-contribution test, make employee contributions, report plan information, and pay dividends.

If you have a traditional 401(k) plan, it will be subject to the annual 401(k) test to ensure that all employees benefit, not just high-paid employees.

Tax Change For High Income Earners’ 401(k) Catch Up Savings Hits Snag

There are two types of tests you need to do: Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP). These tests compare the salary deferrals of highly paid workers with those of underpaid workers.

You must make employer contributions if you have a Safe Harbor or SIMPLE 401(k) plan. Remember that there may be penalties for late 401(k) contributions.

For most 401(k) plans, you must file Form 5500, Employer Plan Annual Report (Form 5500-SF or Form 5500-EZ, as applicable). File this annual return electronically.

Also give presentations to participants. Provide a summary of material change (SMM) when employees make changes. And distribute a single thank you note (IBS) to show the planners all their benefits. Finally, distribute an annual summary report (SAR) when filing Form 5500 so participants know what you reported to the IRS.

Human Interest Offers Industry First 3% Cash Back For Retirement

Remember that the cost you pay for a 401(k) plan is not limited to its structure.

Get started with a free subscription plan and enjoy free technical support. Try our premium software on a 30-day free trial. A 401(k) plan is a retirement savings plan offered by American employers that offers tax benefits to the saver. Its name comes from a section of the US Internal Revenue Code (IRC).

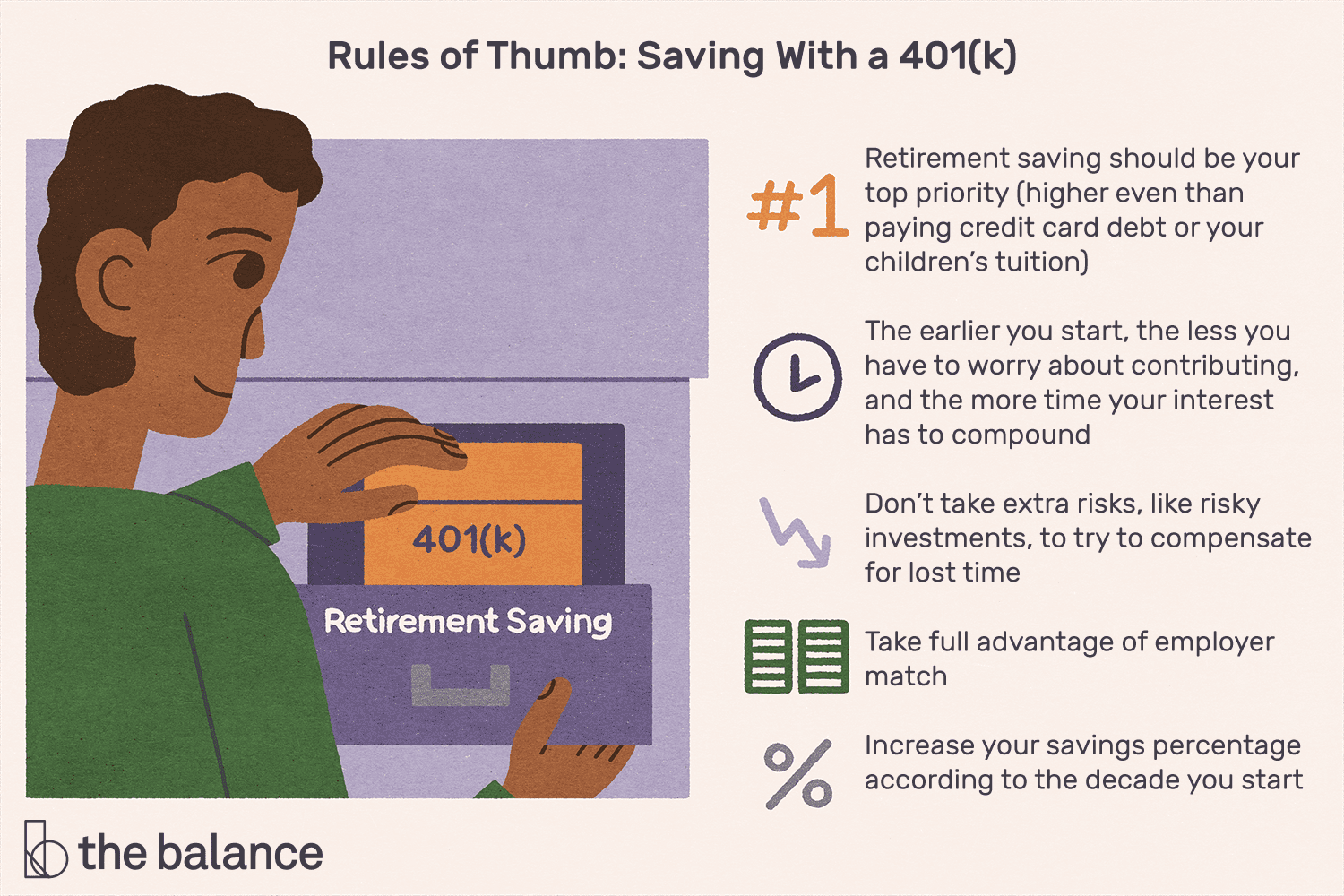

An employee who signs up for a 401(k) agrees to have a percentage of each paycheck paid directly into an investment account. The employer may compare part or all of this scholarship. The employee can choose from several investment options, usually mutual funds.

The 401(k) plan was designed by the United States to encourage Americans to save for retirement. Among the benefits they offer is tax savings.

The Self Directed Solo 401(k) From Rocket Dollar

With a traditional 401(k), employee contributions are deducted from income. This is how much money you get from your paycheck before income tax is deducted. As a result, your taxable income is reduced by the amount of contributions for the year and can be claimed as a tax credit for that tax year. There are no taxes on the money contributed or the earnings until you withdraw the money, usually during retirement.

With a Roth 401(k), contributions are deducted from your after-tax income. This means that contributions come from your paycheck after income tax has been deducted. As a result, there is no tax liability in the year of contribution. However, when you withdraw money during retirement, you don’t have to pay any additional taxes on your contributions or earnings.

Note: Although contributions to a Roth 401(k) are made with after-tax income, generally, if withdrawn before age 59½, tax consequences may begin. Always check with an accountant or qualified financial advisor before withdrawing money from a Roth or 401(k).

However, not all employers offer the option of a Roth account. If the Roth is offered, you can choose between a traditional and a Roth 401(k). Or you can contribute both up to the annual contribution limit.

Why You Need To Start Looking At Your 401k

Both traditional and Roth 401(k) plans are defined contribution plans. Both the employee and the employer can contribute to the account up to the financial limits established by the Internal Revenue Service (IRS). Employee contributions to a traditional 401(k) plan are made with pre-tax funds and will reduce your taxable income and your adjusted gross income (AGI). Contributions to a Roth 401(k) are made with after-tax earnings and are no longer subject to taxable income.

A defined contribution plan is different from a traditional pension which is known as a defined benefit plan. With a pension, the employer commits to providing a specific amount of money to the employee for survival during retirement. In recent years, 401(k) plans have become more common and traditional pensions have become less common because employers have lost the responsibility and risk of taking care of their employees.

Employees are responsible for selecting specific investments held in their 401(k) accounts from a selection provided by the employer. These awards often include various types of cash and bond funds designed to reduce the impact of investment losses when the employee starts.

Employee account balances can also include guaranteed investment contracts (GICs) issued by insurance companies and sometimes the employer’s own liability.

K) Contribution Limits Rising Next Year

The maximum amount an employer or employer can contribute to a 401(k) plan is adjusted periodically to account for inflation, which is the metric that measures inflation. price structure in an economy.

For 2022, the annual limit for workers under age 50 is $20,500.

How to start 401k for small business, roll over 401k to start business, how to start my own 401k, how to start 401k plan, how to start your own 401k plan, how to start roth 401k, how to use 401k to start a business, how to start a 401k for small business, how to start your own 401k, how to start a 401k for my small business, how to start 401k, how can i use my 401k to start a business