How To Start A Practice – Many mental health professionals dream of one day owning their own private practice, but have no idea where to start, or what steps they should take to prepare for that step.

Today’s post will give you ten critical strategies to help you build your practice from the inside out based on an interview with Tamara G. Suttle, M.Ed., LPC of Private Practice. in the field, but also a clinical supervisor and private practice trainer.

Contents

- 1 How To Start A Practice

- 2 How To Start A Meditation Practice + Free Printable

- 3 Steps For Starting Your Dream Therapy Private Practice

How To Start A Practice

Set up your private practice like a pro, Tamara has provided us with guidance on several topics to read from to build your clinical and business knowledge if you are going to interview questions for your practice. Do a group interview. She also shared her top 10 tips for professionals looking to start their own practice.

Starting An Oral Surgery Practice

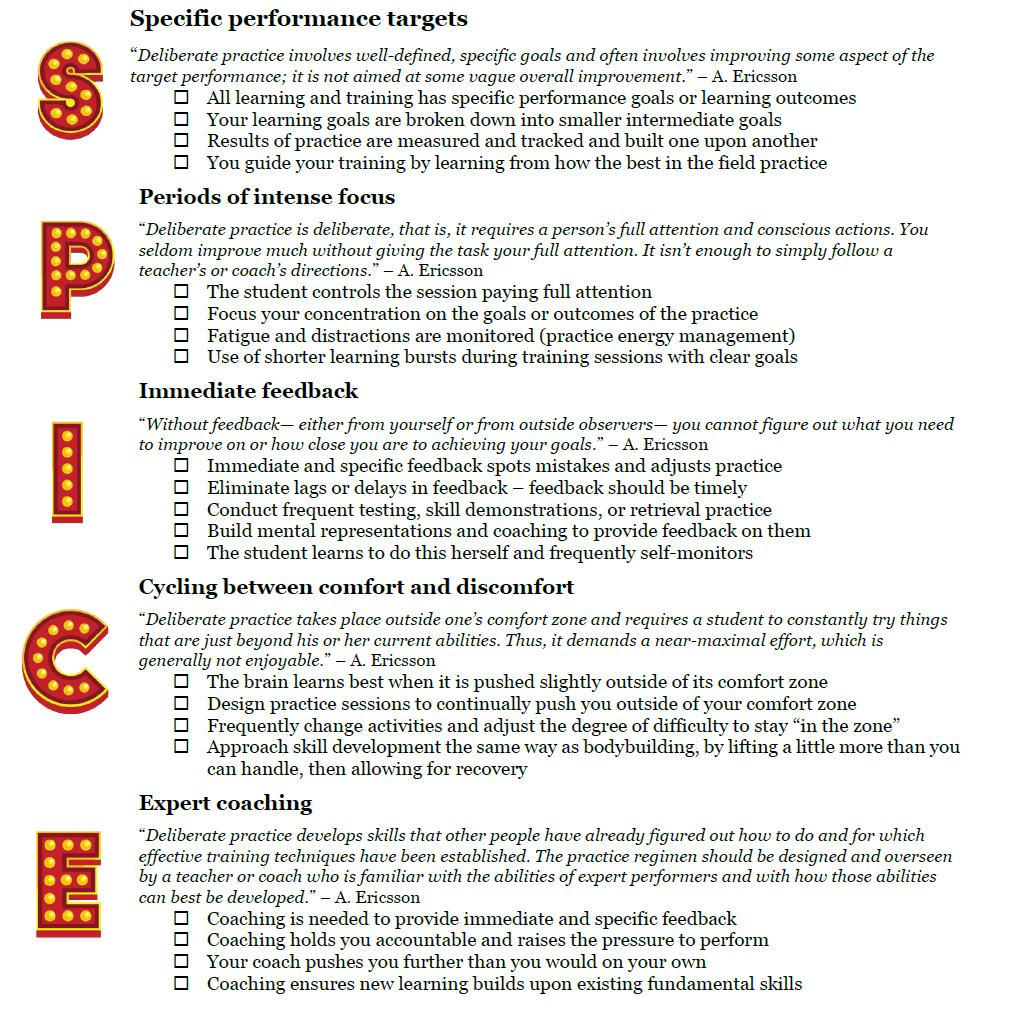

Below is an infographic that highlights these key points! Last but not least, you should check out Tamara’s answer following this chart related to setting up your practice in a foreign country!

Tamara’s 10 tips for starting a private practice Added a special question for Tamara (from a social work career reader):

Tamara, what advice would you give to a mental health professional who wants to set up a private practice in a foreign country where psychotherapy is seen as unnecessary and the patient or client will turn to a native doctor or therapist for help?

If so, remember that even then, you still retain all the skills and abilities you had before. You may be asked to use them differently. You may be able to do remote counseling from your home country with people here in the United States.

How To Start A Nutrition Business With Stephanie Long

You may be able to apply your skills in consulting, coaching or educational games. You may be able to apprentice with the locals to gain the skills and perspectives needed to provide services at a later date. And I’m sure there are many more options out there. The deadline to sign up for fourth quarter quarterly tax estimates from Heard is November 30. Book a free consultation

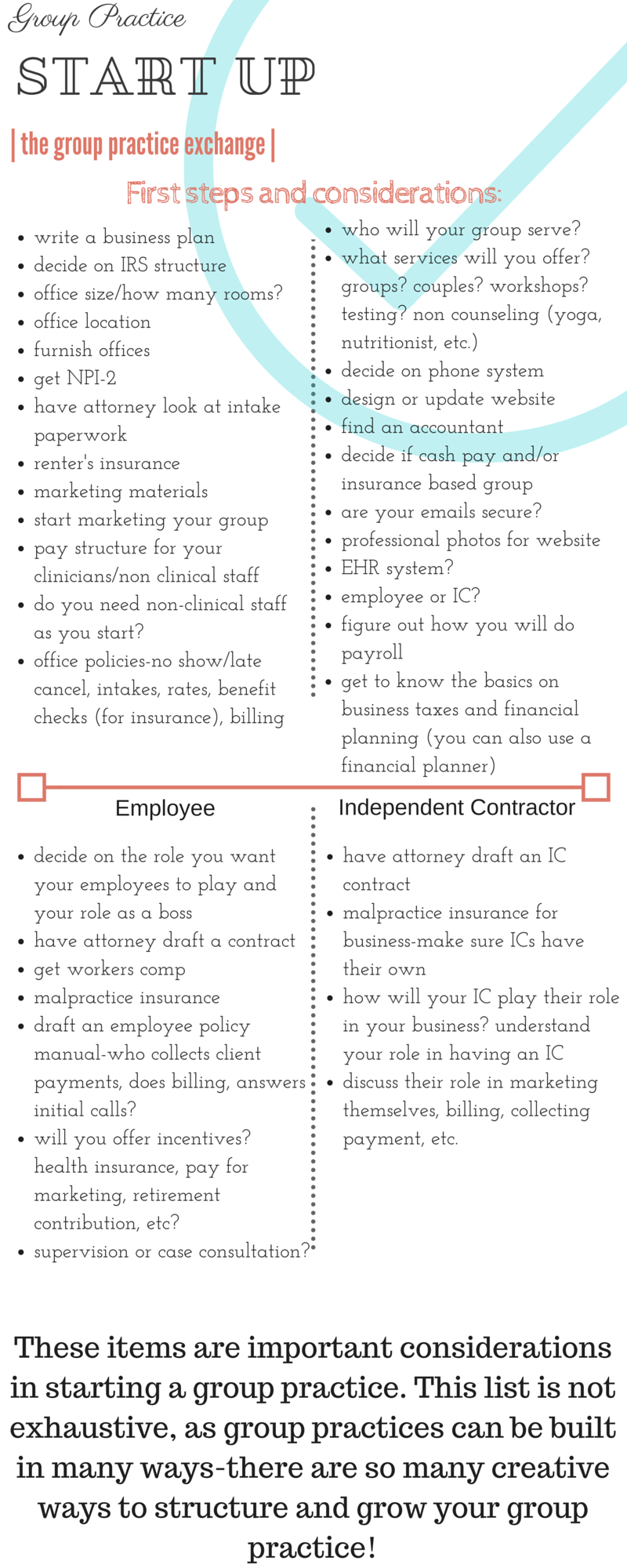

There are many moving parts to follow, from setting up a legal entity to understanding the financial aspects of your practice. Being organized from the start will keep you focused and on track for success.

This guide gives you a complete overview of what you need to do to start your own therapy practice, so you can start planning the steps you need to take.

In areas where you might want to dive deeper, you’ll find links to other articles from Heard.

How To Start A Meaningful Journaling Practice + 12 Simple Daily Journal Prompts

There’s no point getting caught up in the technical details—like business structure, accounting, and billing—if you haven’t yet decided on the basics of how your care practice will operate.

If you already figured these out, congratulations! You are about to start your new therapy practice.

However, if you are unsure about any of the above, take some time to decide before proceeding further.

When you’re just starting your practice, and you don’t have clients yet, you may not be ready to create a monthly budget.

How To Start A Law Practice With No Money In 2023?

However, you will need to know what you will need to start your practice. These are one-time and first-time expenses that are absolutely critical to running your practice.

For a full guide, see our article on how much it costs to start a therapy practice.

When you go into business for yourself and start earning non-employment income, the IRS considers you a sole proprietor by default. As a sole proprietor, your personal taxes and your business taxes are the same.

On the one hand, this is good, because the ownership tax refund is relatively simple. On the other hand, it’s not so good, because you are 100% responsible for all your business obligations and legal proceedings.

How To Do Market Research Before You Start Or Grow Your Practice

That is, if you cannot pay your business debts, you are responsible for yourself. And if someone sues your clinic, they sue you.

Many solo practitioners who go into business for themselves choose to form a single-member S corporation. This business structure offers greater liability protection than a sole proprietorship, without incurring additional federal taxes.

Others choose to operate as a limited liability company (LLC). LLCs are formed on a state-by-state basis. When you file your taxes as an LLC, you can choose to have them as a variety of different entities—including an S corporation—depending on your preference and how you run your business.

Some states, such as California, may require practitioners to form professional LLCs (PLLCs). This is a business structure that is specifically intended for professionals licensed by the state. In other states, forming a PLLC is optional and not required. To find out if you live in a PLLC state, check your state secretary’s website.

How To Start A Meditation Practice + Free Printable

You should establish a legal business entity that you intend to use directly – changing it later, after establishing your business, may create additional complications. You can learn more about how to choose a business entity for your care practice from Heard’s article.

Even if you don’t intend to hire employees, you’ll need an EIN to open a business bank account and set up a legal business entity.

An EIN is like an SSN for your business. In fact, if you didn’t get an EIN, you’ll use your SSN to file taxes as a sole proprietor. The IRS uses your EIN to track your tax filings.

You can apply for an EIN for your business online, or learn more from our article on EINs for caregivers.

How To Start A Therapy Private Practice: 13 Things To Do Before Leaving Your Agency Job

Regardless of whether you plan to work with an in-network insurance provider or not, your practice needs an NPI number so that clients can file out-of-network claims with their insurance providers for so-called “overbill” reimbursement.

If you plan to do business under your own name, you don’t need a DBA. If you plan to do business under a different name — “Jane Smith Consulting,” as opposed to “Jane Smith Only” — you’ll need to apply for a DBA from your state.

The cost of registering a DBA, and the actual process of obtaining one, varies from state to state. In most cases, you can find the information you need on your secretary’s website.

As with the DBA, the process of obtaining a business license – and the cost – depends on your location. Unlike a DBA, a business license is usually not optional.

Ultimate Guide: Start A Private Practice Free Checklist

Your business permit allows you to legally operate within the boundaries of your specific municipality or city. It must be updated annually. You can expect a business license for your private practice to run you anywhere from $80 – $200.

Your foreign minister or local small business administration office should provide you with details on obtaining a business license.

In the event that a client – or someone else – sues you for damages that you may or may not have caused during your work, public liability insurance will cover the cost of the legal case, and possibly the cost of the damage.

On top of that, general liability insurance can protect you in case of photos or damages that you or your clients suffer in your office. This may cover legal claims, damages and replacement costs.

Resources To Start A Career In Private Practice And Therapy

One subset of liability insurance, malpractice insurance, only protects you in the event of claims from the consumer. General liability insurance covers negligence insurance, and covers all the events covered above.

Depending on your level of coverage, annual liability insurance premiums can range from $350 to $1,000 or more. But before you start working, you definitely need to buy this insurance.

A small business checking account is one of the most powerful tools at your disposal for organizing the finances of your private practice.

When you have a business bank account, every business transaction—every time you spend money on expenses, or receive money from paying customers—is reflected on your bank statement. You have one authoritative source of information to track how your practice is spending and making money.

How To Start A Private Practice: The Ultimate Step By Step Guide

On the other hand, when you use your personal bank account for your practice, your personal income and expenses are mixed with your business transactions. Then, once you’ve set up an accounting system to track your finances, you’ll be doing a lot of work every time you update your books, because you’ll be separating personal and business transactions, and trying to figure out which one is which. he.

Heard has partnered with BlueVine to offer online business checking accounts for caregivers. When you sign up for BlueVine, you avoid many of the business verification fees that banks typically charge. There are other benefits, too — like earning 1.5% interest on your account balance if you meet With certain minimum banking requirements Learn more about Heard and BlueVine.

You may be happy with patient notes and other paper records stored in a secure filing system (HIPAA compliant.) But, if you’re looking for a paperless solution, an EHR system is your answer.

An EHR system gives you a secure and centralized place where you can store all of your customer data. You can certainly start your practice using paper records and

Steps For Starting Your Dream Therapy Private Practice

How to start a private medical practice, how to start a psychology practice, how to start a concierge medical practice, how to start a private therapy practice, how to start a telemedicine practice, how to start a medical practice, how to start a therapy practice, how to start a dental practice, how to start a counseling practice, how to start a medical practice checklist, how to start a solo law practice, how to start a private practice