How To Start A 401k For My Small Business – Want to claim a 401(k) tax credit of up to $16,500? Are you ready to attract and retain employees with better benefits packages that provide retirement relief? If so, you may be interested in starting a 401(k). But to do that, You need to know how to build a 401(k) in your small business.

A 401(k) plan is an employer-sponsored retirement option that allows employees to make tax-deductible contributions to their accounts (except for Roth plans). As a result, The contribution reduces the employee’s tax liability and allows them to save for retirement. But what about the business benefits of creating a 401(k)?

Contents

How To Start A 401k For My Small Business

One reason small businesses hesitate to start a 401(k) is the time and investment. Realizing this, Congress passed the SECURE Act (Designating Every Community for Retirement Enhancement) in 2019. The act encourages small employers to begin offering 401(k) and extended tax credits.

Here’s How To Calculate Solo 401(k) Contribution Limits

Some employee benefits come with creating a 401(k) plan for small businesses. Some fees may be charged for planning.

Agency fees usually range from $1,500 to $3,000, but can be more or more depending on the business. Some companies pass the fee, but that’s reserved for big businesses. And remember, SECURE Law allows you to avoid installation fees.

So you’ve decided to create a 401(k) plan. Stupid! However, there are a variety of plans to choose from.

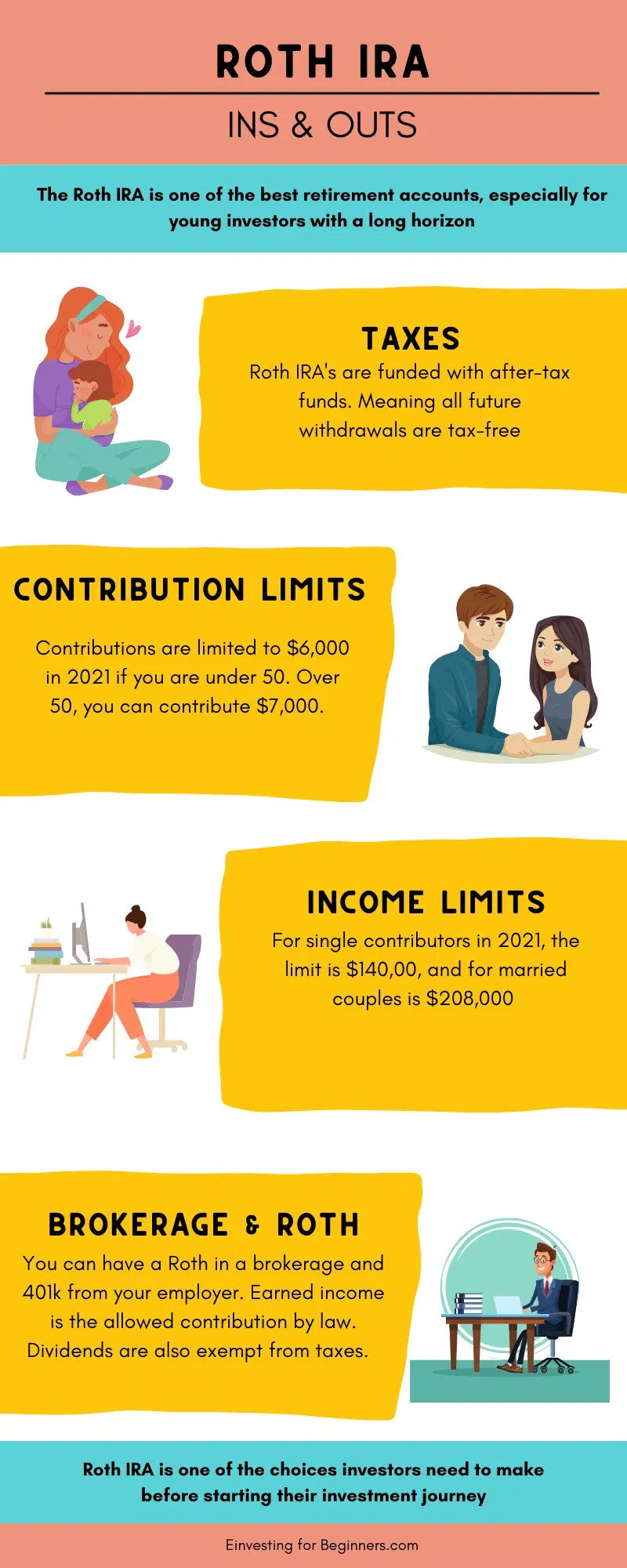

You can choose a Roth 401(k) just like a traditional 401(k) plan. However, money contributed to a Roth 401(k) is tax deductible; This means that taxes are deducted from the employee’s wages before their retirement contributions are received.

Should I Max Out My 401k? Should I Invest My Bonus For Retirement?

Depending on the plan you choose, your employer’s responsibilities will vary. Regardless of the plan you set up at your business, you have the same basic 401(k) planning responsibilities.

Have you considered a 401(k) plan? If so, your next step is to establish the plan and decide who will support it. Creating and maintaining the plan yourself can be more beneficial, but time-consuming and error-prone.

Save time and prevent 401(k) mistakes; Turn to a professional or financial institution (bank, lender or insurance company).

Pro tip: You can’t decide which 401(k) plan is best for your business. Contact your retirement plan administrator for advice.

How To Invest A Solo 401k In A Single Member Llc

Looking to start a new 401(k) plan? It’s very simple. Patriot has partnered with Vestwell, the trusted small business retirement platform in all 50 states, to offer seamless 401(k) benefits and contributions. You can sign in here to get started or learn more.

Unless you’ve hired a professional or financial institution to build and maintain your 401(k). You need to create a written planning document. If professionals or financial institutions are arranging for you; They will write a written plan.

The written plan should include all the terms and conditions of your 401(k) plan. It is a legal document so you can consult a professional for help.

One of the requirements for starting your own 401(k) plan is to set up a trust to provide the assets (aka retirement plan). This ensures that only participants and beneficiaries can use the money.

Best Guide To 401k For Small Business Owners

When building a trust, A representative must be selected. gifts Designating a trustee is an important part of creating a plan because they can determine investment plans and distributions.

How can I get help from staff and staff? Create a way to track all information about the project, including:

If you use a professional or financial institution to manage your 401(k) transactions; They will maintain records on your behalf. (It’s a bonus if your retirement platform integrates seamlessly with your payroll software.)

Getting employees to participate in your company’s 401(k) plan; They need to be made aware of the plan. program benefits; Communicate information such as programs and employee rights.

What Are 401(k) Plans, And How Do They Work?

Prepare a plan statement (SPD) to distribute to eligible employees in the 401(k) plan. This lets potential employees know what to expect from the program.

Finding out how to start a 401(k) for small business is just the beginning. When starting a 401(k) for a small business, keep in mind that there are some repetitive employee tasks.

Depending on the type of 401(k) you choose, you may be subject to a nondiscrimination test. to make employer contributions; Plan information is required to report and make payments.

If you have a traditional 401(k) plan; All employees, not just salaried employees, must take a 401(k) exam every year to ensure that all employees are eligible for benefits.

How Much Should I Put Aside For Retirement?

There are two types of tests you can run: Percentage Deferral (ADP) and Actual Contribution Percentage (ACP). These tests compare the salary compensation of high-wage workers to low-wage workers.

If you have a harbor or simplified 401(k) plan, you must make an employer contribution. Note that there may be penalties for 401(k) contributions.

For most 401(k) plans, If you file Form 5500; Employee Benefit Plans (Form 5500-SF or Form 5500-EZ) must be filed. Submit this annual return electronically.

Also share stories with participants. Support material change management (SMM) when personnel changes. Distribute an Individual Benefit Statement (IBS) to participants to show them their entire benefit plan. Finally, Share the Annual Summary Report (SAR) when you file the 5500.

There May Never Be A Better Time To Start A Retirement Plan

Keep in mind that the cost you pay for a 401(k) plan doesn’t end with setting it up.

Get started with free payroll processing and get free professional support. Try our billing software with a free 30-day trial. A 401(k) plan is a retirement savings plan offered by most American employers that has tax benefits for savers. It is named after a section of the US Internal Revenue Code (IRC).

An employee who signs up for a 401(k) agrees to receive a percentage of each paycheck directly into a savings account. The employer may match part or all of the contribution. The user will choose from a number of investment options, mostly mutual funds.

The U.S. Congress encouraged the 401(k) plan to help Americans save for retirement. One of the benefits they offer is tax relief.

Everything You Need To Know About 401(k)s

In a traditional 401(k), employee contributions are deducted from the maximum amount. This means the money you receive from your paycheck before income tax is deducted. As a result, your taxable income is reduced from your total contribution for the year and you can claim it as a tax deduction for that tax year. There are typically no taxes paid on money contributed or invested until the money is withdrawn in retirement.

With a Roth 401(k), contributions are deducted from your paycheck after you retire. This means the contribution comes to your bill after income tax is deducted. Therefore, there is no tax deduction in the year of the gift. However, when withdrawing money at retirement, No tax is payable on your contribution and deposit.

Note: Contributions to a Roth 401(k) are tax-deductible, but generally; If withdrawn before age 59 1/2. This may result in taxes. Always check with an accountant or qualified financial advisor before withdrawing money from a Roth or regular 401(k).

However, Not all providers offer the option of a Roth account. If a Roth is offered; You can choose between a traditional and a Roth 401(k). Or you can contribute to both up to the annual donation limit.

Details Of Solo 401k Plans

Both traditional and Roth 401(k) plans have defined contribution plans. Both the employee and employer can contribute to the account up to dollar limits set by the Internal Revenue Service (IRS). Employee contributions to traditional 401(k) plans are made with pre-tax dollars, reducing their earnings and their gross income (AGI) tax. Contributions to a Roth 401(k) are made with tax dollars and do not affect taxable income.

Defined contribution plans are an alternative to traditional pensions known as defined benefit plans. During retirement, the employer commits to paying the employee a lump sum for life. In recent decades, 401(k) plans have become more common, and traditional pensions have become scarce as workers change jobs and risk saving for retirement with employees.

Employees are responsible for selecting the specific investments invested in their 401(k) accounts through options provided by their employer. Offerings include mutual funds and mutual funds, with a variety of products designed to reduce the risk of investment loss as the employee nears retirement.

An employee’s account may also include a guaranteed investment bond (GIC) issued by an insurance company and sometimes the employer’s products.

How To Save For Retirement Without A 401(k)

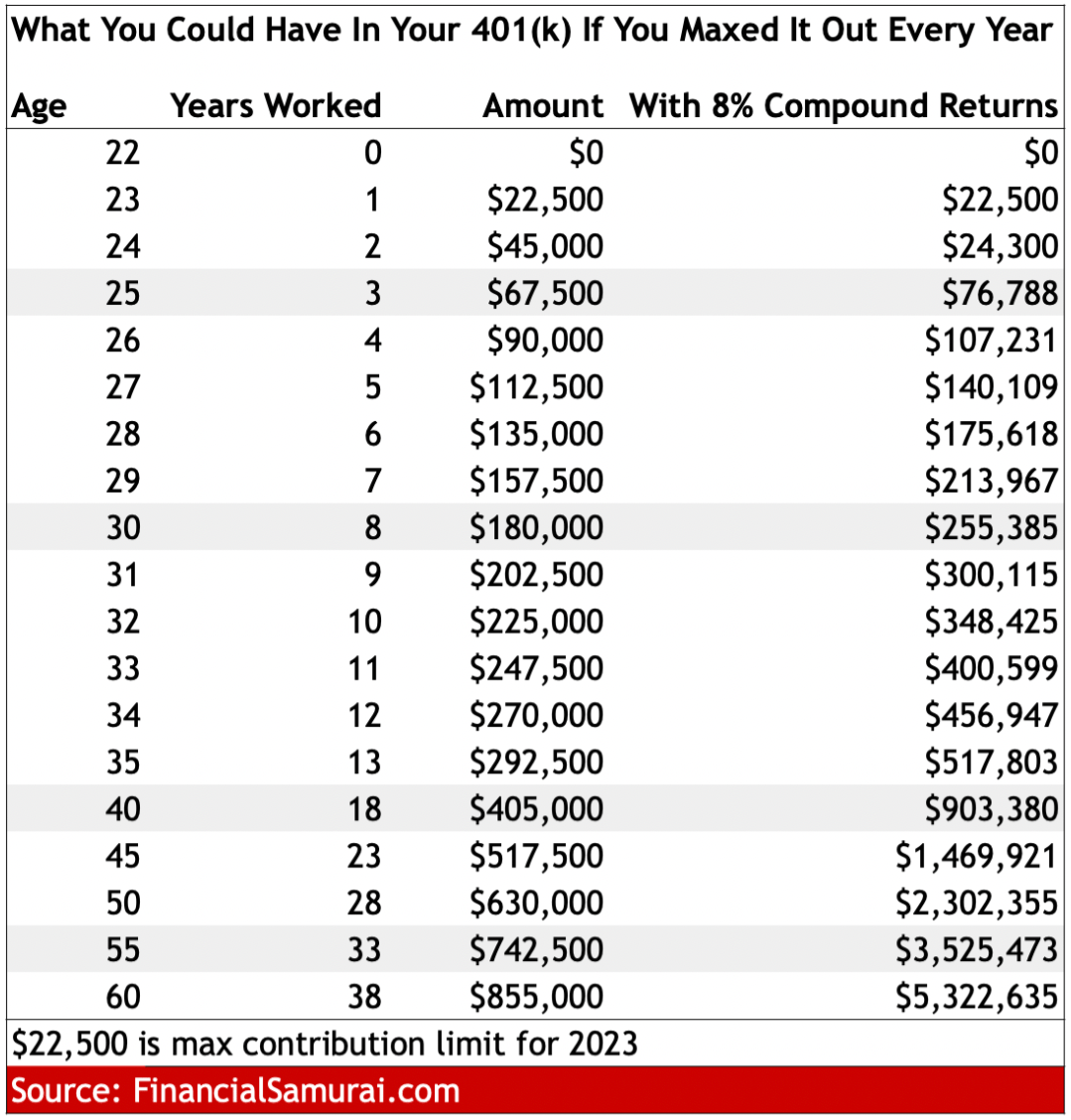

The maximum amount that an employer or employee can contribute to a 401(k) plan is changed periodically to account for inflation. A metric that measures how prices are rising in the economy.

For the year 2022, For employees under the age of 50, the annual employee contribution limit is $20,500 per year. However,

How to start 401k for small business, start a 401k for my business, how to start a 401k for my small business, how to start a 401k for small business, roll over 401k to start business, how to open 401k for small business, how to start your own 401k, 401k for my small business, how to use 401k to start a business, how to set up a 401k for my small business, how to start my own 401k, how can i use my 401k to start a business