How To Start 401k Plan – If you don’t have strong legal or financial understanding, setting up a Solo 401k plan can be a challenge. Our team has put together a few graphics to help you get started.

The first part of the process involves documenting your Solo 401k plan. Our team will create the plan documents needed to set up a Solo 401k plan.

Contents

- 1 How To Start 401k Plan

- 1.0.1 Self Directed Solo 401k Eligibility Checklist

- 1.0.2 Small Business Owners Guide To 401k

- 1.0.3 What To Know About 401(k)s — The Investment Vehicles That Can Help You To Save For Retirement

- 1.0.4 Why Saving In A 401(k) Plan May Be Tough For Frequent Job Switchers

- 1.0.5 Is It Too Late To Start A 401(k) At 55? — Interactive Wealth Advisors Blog

- 1.0.6 When And Why To Start A 401(k) Plan

- 1.1 Simple 401(k): A Guide To Get Started

- 2 Not All Solo 401(k) Plans Are The Same

How To Start 401k Plan

You will be the plan administrator and trustee of your plan/trust. A Solo 401k trust is established to hold the plan assets. Also, it eliminates the need for a mentor.

Self Directed Solo 401k Eligibility Checklist

Once your plan is set up, the next step is to transfer money from your existing retirement accounts to the newly created Solo 401k plan.

The process to initiate the transfer depends on the plan type and holder. To help you manage the transfer, we offer general instructions for initiating a transfer through our customer portal. In most cases, the custodian issues an advance cheque, which is then sent to your registered address.

After you’ve made a qualified transfer, it’s time to open a non-custodial bank account for your Solo 401k plan. Your rolling checks will go into this account.

When setting up a solo 401k plan, make sure you choose a financial institution that matches your goal characteristics, with low initiation or processing fees, low maintenance costs, and quick money transfers. Do it.

Small Business Owners Guide To 401k

Once the money is in your bank account, you are ready to invest. A Self-Directed Solo 401k account offers multiple places to put your money, including both traditional and non-traditional assets.

Prakash Pandey As the Brand Identity Manager, Prakash keeps a close eye on the company’s marketing trends and initiatives. This creates an online presence for Sense Financial that is in line with the company’s core principles, which is to help our clients take full control of their financial lives. His role includes building brand awareness and ensuring consistency of our brand online.

Self-Directed IRA Valuations: Why does my Self-Directed IRA custodian request a valuation update each year? How to Start Investing in Real Estate with Your Retirement Funds A 401(k) plan is a retirement savings plan offered by many American employers that has tax advantages for the saver. It is named after a section of the US Internal Revenue Code (IRC).

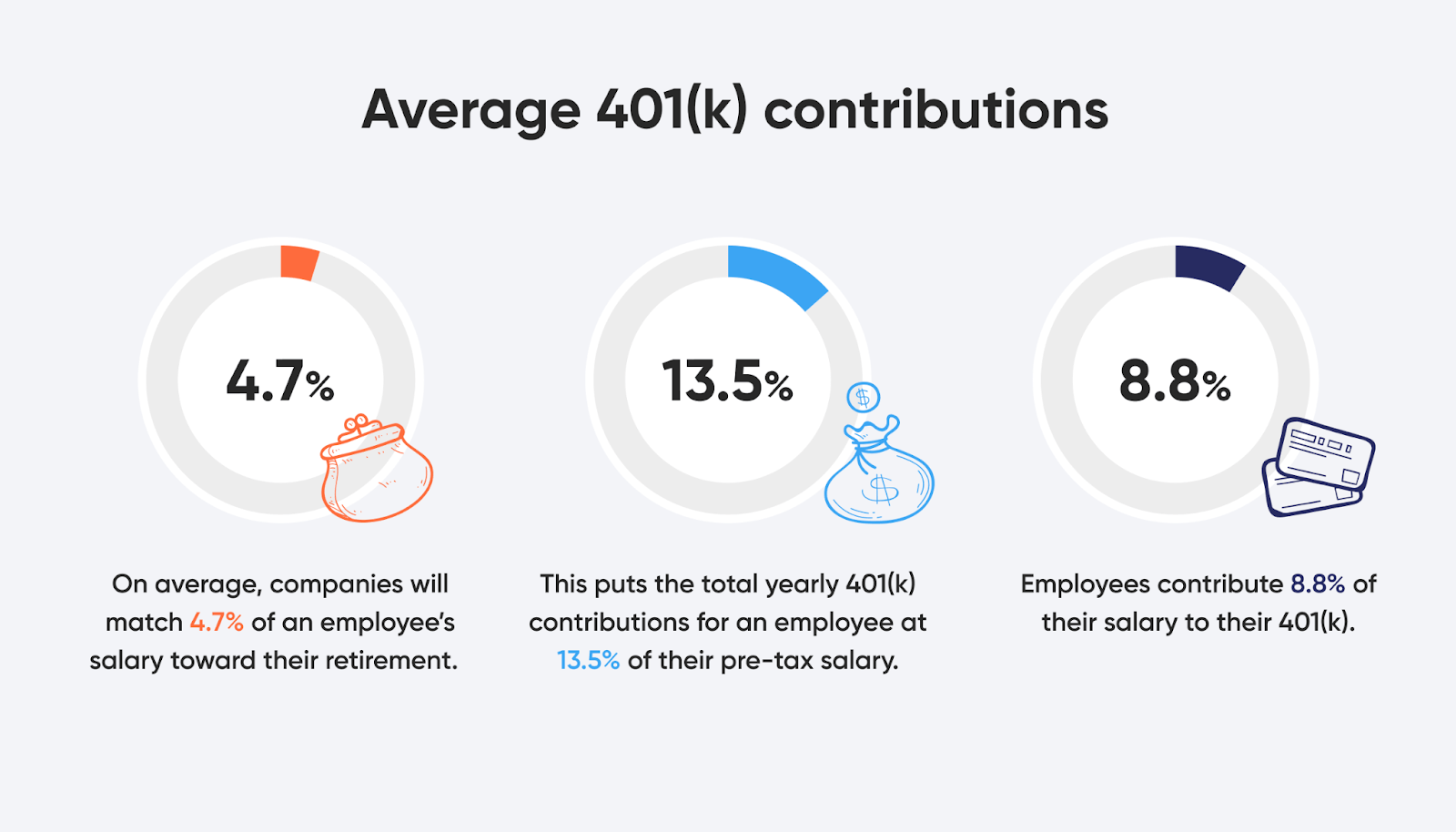

An employee who signs up for a 401(k) agrees to have a percentage of each paycheck paid directly into a savings account. The employer may match some or all of this contribution. The employee has to choose from a number of investment options, usually mutual funds.

What To Know About 401(k)s — The Investment Vehicles That Can Help You To Save For Retirement

The 401(k) plan was designed by the United States Congress to encourage Americans to save for retirement. The benefits they offer include tax savings.

With a traditional 401(k), employee contributions are deducted from gross income. This means the money comes out of your paycheck before income taxes are taken out. As a result, your taxable income is reduced by the total contribution amount for the year and can be reported as a tax deduction for that tax year. There is no tax on the money contributed or the investment income until you withdraw the money, usually at retirement.

With a Roth 401(k), contributions are taken from your after-tax income. This means the contribution comes from your paycheck after income tax is deducted. As a result, there is no tax deduction in the year of donation. When you withdraw money in retirement, however, you don’t have to pay extra tax on your contributions or investment income.

Note: Although contributions to a Roth 401(k) are made with after-tax amounts, generally, if withdrawals are made before age 59 1/2, this can trigger tax consequences. Always check with an accountant, or qualified financial advisor, before withdrawing money from a Roth or traditional 401(k).

Why Saving In A 401(k) Plan May Be Tough For Frequent Job Switchers

However, not all employers offer a Roth account option. If a Roth is offered, you can choose between a traditional and a Roth 401(k). Or you can contribute to both up to the annual contribution limit.

A 401(k) is a defined contribution plan. Both the employee and the employer can contribute to the account up to dollar limits set by the Internal Revenue Service (IRS).

A defined contribution plan is an alternative to a traditional pension, called a defined benefit plan. With a pension, the employer is obliged to pay the employee a certain amount for his life during retirement.

In recent decades, 401(k) plans have become more common, and traditional pensions have become rarer as employers shift the responsibility and risk of retirement savings to their employees.

Is It Too Late To Start A 401(k) At 55? — Interactive Wealth Advisors Blog

Employees are also responsible for selecting specific investments in their 401(k) accounts from the selections offered by their employer. These contributions typically include a combination of stock and bond mutual funds and debt funds designed to reduce the risk of investment loss as the employee approaches retirement.

These may include guaranteed investment contracts (GICs) issued by insurance companies and sometimes the employer’s own stock.

The maximum amount that an employee or employer can contribute to a 401(k) plan is periodically adjusted for inflation, a metric that measures rising prices in the economy.

For 2022, the annual employee contribution limit for employees under age 50 was $20,500. However, those 50 and older can make a catch-up contribution of $6,500.

When And Why To Start A 401(k) Plan

For 2023, the annual employee contribution limit for employees under age 50 is $22,500 per year. If you’re age 50 or older, you can make an additional $7,500 in catch-up contributions.

If your employer also contributes or you choose to make additional tax-free, non-deductible contributions to your traditional 401(k) account, the total amount of employee and employer contributions for the year is:

For example, an employer may match 50 cents for every dollar an employee contributes, up to a certain percentage of salary.

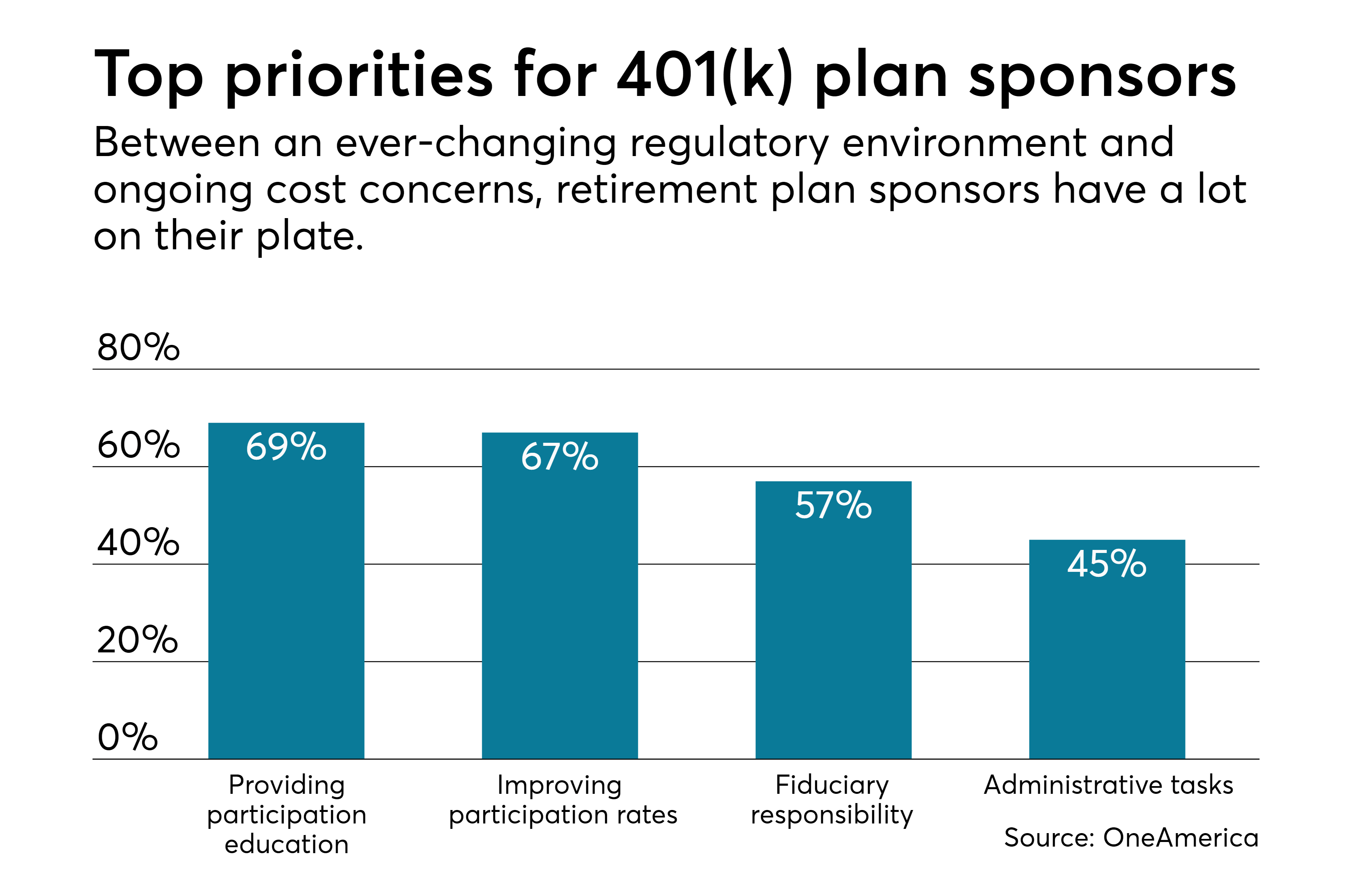

Financial advisors often recommend that employees contribute at least enough money to their 401(k) plans to receive the full employer match.

Simple 401(k): A Guide To Get Started

If their employer offers both types of 401(k) plans, an employee can split their contributions by putting some money into a traditional 401(k) and some into a Roth 401(k).

However, their total contributions to both types of accounts cannot exceed a single account limit (such as $20,500 for those under 50 in 2022 or $22,500 in 2023).

Employer contributions can be made to a traditional 401(k) and Roth 401(k) account. Withdrawals from the former are subject to tax, but qualifying withdrawals from the latter are tax-free.

Your contributions to your 401(k) account are matched by your choice from the choices offered by your employer. As mentioned above, these options typically include a mix of stock and bond funds and a debt fund designed to reduce the risk of investment losses as you approach retirement. .

For Startups Tips And Advice For Maximizing Retirement Savings With A Plan

How much you contribute each year, whether your company matches your contributions, your investments and their returns, and how many years you have until you retire all contribute. How fast and how much your money will grow.

As long as you don’t withdraw money from your account, you don’t have to pay taxes on investment gains, interest, or dividends until you withdraw money from the account after you retire (unless you have a Roth 401(k) ), so you don’t have to pay taxes on qualified withdrawals when you retire).

Plus, if you open a 401(k) when you’re young, it has the potential to earn you more money, thanks to the power of compounding. The advantage of pooling is that the profits from savings can be reinvested back into the account and start generating returns on its own.

Over a period of years, the accumulated earnings on your 401(k) account may exceed the contributions you make to the account. That way, as you keep adding to your 401(k), it has the potential to grow into a bigger chunk of money over time.

Making Changes Now To Your 401(k) Plan

Once the money goes into the 401(k), it’s difficult to withdraw it without paying in part because the regional factor counts the money in the 401(k).

Revere Asset Management Inc. in Dallas. “Make sure you still have enough outside savings for emergencies and expenses,” says Dan Stewart, CFA®, president of “Don’t put all your savings in your 401(k) where you can’t easily access it, if necessary.”

Earnings in a 401(k) account are tax-deferred in the case of traditional 401(k)s and tax-free in the case of Roths. When a traditional 401(k) owner takes a withdrawal, the amount (which was never taxed) is taxed as ordinary income. Roth account owners have already paid income tax on the amount they contribute to the plan and their withdrawals will not be taxed as long as they meet certain requirements.

Both traditional and Roth 401(k) owners must be at least 59½ years old — or meet other criteria set by the IRS, such as being totally and permanently disabled — to avoid the penalty. So they start giving up.

Not All Solo 401(k) Plans Are The Same

This penalty is usually an additional 10% early distribution fee on top of anything else.

How to start a 401k plan, how to use 401k to start a business, how to start 401k, how to start a 401k for my small business, 401k to start business, how to start 401k for small business, start a 401k plan, how to start your own 401k plan, how to start my own 401k, how to start a 401k for small business, how can i use my 401k to start a business, how to start your own 401k