How To Start 401k For Small Business – This website uses cookies and other technologies to support website functionality, analytics, preferences, marketing and to improve your experience and the services we provide. Our privacy policy provides more information about our use of cookies and technology. You consent to our use of cookies and other technologies when you continue to use our website.

There are many retirement options available, and it can be confusing to know which plan makes the most sense for you and your business. Offering your employees a 401(k) plan is great because it shows your employees that you are invested in them, and it can increase employee engagement in the long run. Below you will learn more about how to set up a 401(k), the different 401(k) plans you can choose from, and the pros and cons of each.

Contents

How To Start 401k For Small Business

The best 401(k) for small business will depend on the type of small business you have. Every plan is different and small business owners must decide which plan best suits their needs. The plans covered in this guide are the traditional 401(k) plan, the individual 401(k) plan, the simple 401(k) plan, and the safe harbor 401(k) plan.

K Retirement Plans For Small Business

Although each plan has different features, all 401(k) plans allow participants to take salary deductions to add to their 401(k) account.

Traditional 401(k) plans are employer-sponsored that give employees a variety of investment options. With the traditional 401(k) plan, the employer must decide whether to match an employee’s contribution, give each employee a percentage of income (a nondiscretionary contribution) or do both. A traditional 401(k) plan comes with some associated administrative costs and testing requirements.

If flexibility is what you want, this is the plan for you. Traditional 401(k) plans allow the small business owner to change the amount of employee contributions each year. For example, if business is slow one year, the small business owner may choose to reduce employee contributions to compensate.

Because traditional 401(k) plans are subject to strict means testing, they are often more expensive due to increased administrative costs. Failure to keep the plan compliant puts the 401(k) at risk of losing its tax-qualified status.

Year End Small Business Tax Benefits Of Sponsoring A 401(k) Plan

The individual 401(k) plans, also known as individual or self-employed, are similar to the traditional 401(k) plan. However, this plan is designed exclusively for sole proprietors or partners who do not have common law employees.

As a small business owner, the benefits are many – individual 401(k) plans allow you to save for retirement as both an employer and an employee. This allows you to contribute more to your retirement savings than would be possible with another plan.

If you plan to hire employees and grow your company, you need to switch to another 401(k) plan. An additional disadvantage includes responsibility for paperwork, which must be filed by the plan administrator.

Unlike the traditional 401(k) plan, eligibility depends on whether your business has fewer than 100 employees who received at least $5,000 in compensation in the previous year. According to Investopedia, the Simple 401(k) plan is a combination of a Simple IRA and a traditional 401(k) plan because it offers features found in both plans.

Who Are The Best Small Business 401(k) Providers?

The simple 401(k) plan is easy to manage and implement. Unlike the traditional 401(k) plan, you won’t have to perform an overwhelming and non-discriminatory means test that cuts out a lot of paperwork and costs.

If you’re planning to save aggressively for your retirement, the Simple 401(k) can throw a wrench in your plans—the amount that can be contributed is lower than the traditional 401(k). In addition to a lower contribution amount, the employee is entitled to all of the money in their Simple 401(k) plan immediately – this is called immediate vesting.

Like the simple 401(k) plan, a safe harbor 401(k) plan is not means tested. The 401(k) safe harbor plan enables employees to contribute a percentage of their salary with each paycheck in addition to employer contributions. According to the US it. Department of Labor, employer contributions are 100 percent vested.

As long as certain conditions are met, this plan does not require the same testing requirements as a traditional 401(k). This eases complex administrative requirements and costs for the business owner.

K Business Financing

The contributions made to a safe harbor 401(k) plan can be higher than other 401(k) plans. While this may not be a major concern for businesses with a steady stream of income, it may not be the right choice for a new business.

Saving for retirement is important and a 401(k) gives small business owners a way to retire. In addition to helping small business owners save for retirement, 401(k) plans are important for employees as well. 401(k) plans are second only to health benefits, according to a recent Harris Interactive survey. As a small business, it is vital to stay competitive by providing incentives that will attract quality employees.

While 401(k) plans allow you to contribute pre-tax dollars to your retirement account, if you haven’t chosen the Roth 401(k) option, they also allow you to qualify for tax breaks. If you are a small business owner starting a 401(k) for the first time, you may qualify for a $500 tax credit for each of the first three years of your plan.

Will you set the plan yourself or will you consult a consultant or a relevant financial institution, such as a bank or insurance company?

Unlocking Growth: The 401(k) Small Biz Guide

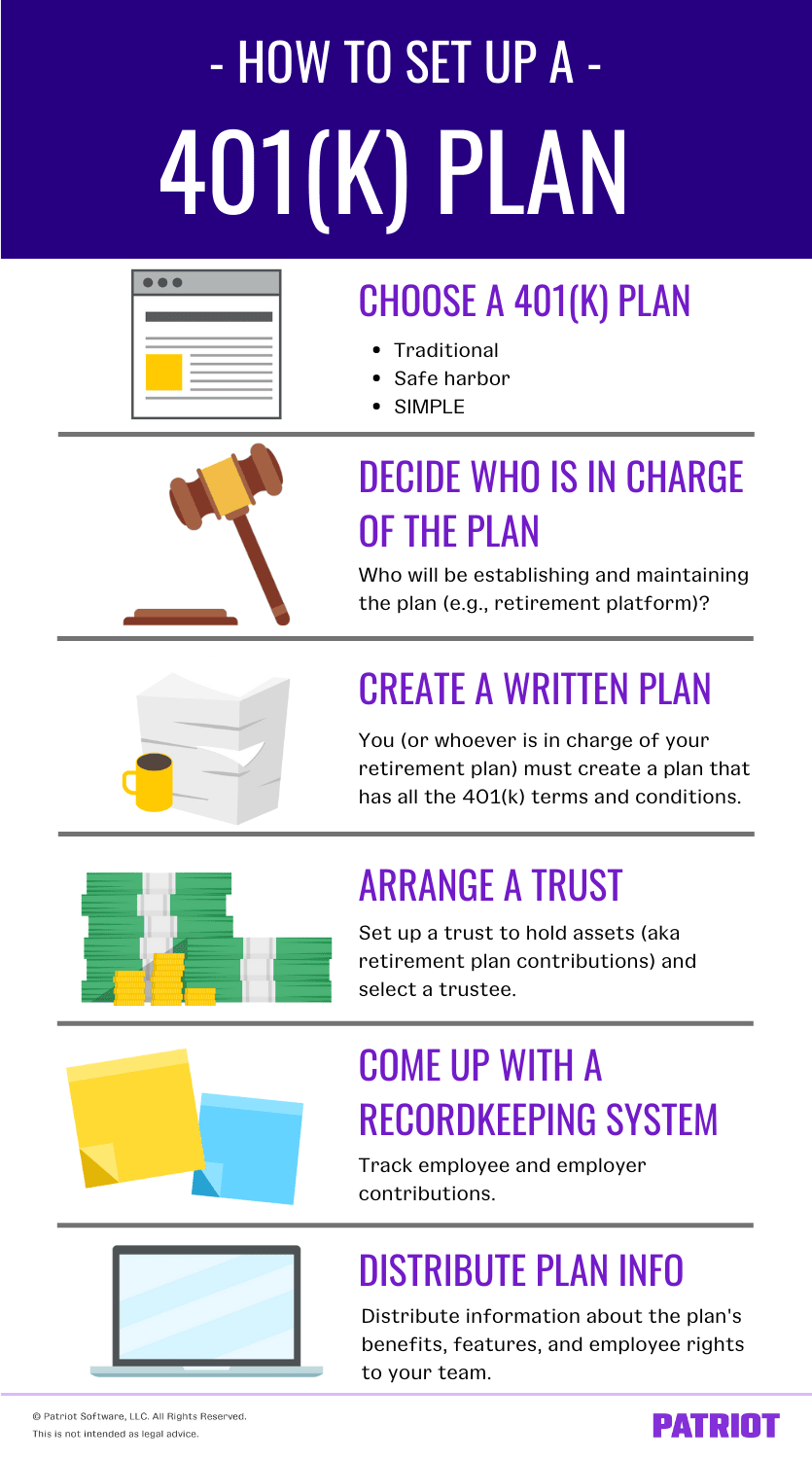

Once you have done this, and know what plan you want to move forward with, there are some basic steps you need to take. You will need to:

Setting up a small business 401(k) doesn’t have to be an intimidating venture for small business owners. When you work with an accountant or in some cases, an online payroll service can help you find the 401(k) plan you need.

This website contains articles for informational and educational value. is not responsible for information contained in any of these materials. Any views expressed in the materials are not necessarily the opinion or endorsement of. The information in these materials should not be considered legal or accounting advice, and should not be a substitute for legal, accounting and other professional advice where the facts and circumstances require it. If you require or require legal or accounting advice, other professional assistance you need, you should always consult with your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs. A key aspect of effective small business management is establishing a retirement plan that is appropriate for your organization. Assessing the retirement plan for proper fit is an area in which we often advise our small business owner clients. As many of our clients grow their businesses, we’ve helped them replace their existing company retirement plans with a 401(k) plan. In general, 401(k) plans can provide more options and flexibility than other types of retirement plans. Here, we will examine some of the key features of 401(k) plans and the benefits they can have on a personal level and in various aspects of running your business.

Business owners often face challenges in attracting and hiring top talent. Naturally, they want the most qualified candidates to staff their organizations, but highly experienced or specialized professionals are usually more likely to accept jobs in larger organizations with more generous benefit packages. A 401(k) plan can provide the advantage in hiring since many job seekers consider 401(k)s to be more healthy than other types of retirement plans and in fact, 401(k)s are more and more recognized. In addition, 401(k)s can help you retain critical talent through certain plan features, such as the gradual vesting of company contributions.

The Solo 401k Benefits

Another benefit of 401(k) plans is that they can provide a great opportunity to save for your own retirement as a business owner—sometimes much more than other types of retirement plans like a SEP or Simple IRA. It is important to note that a 401(k) is a type of defined contribution plan. In 2022, the IRS has set the maximum contribution for defined contribution plans at $61,000 and $67,500 for people age 50 and older. In order to maximize contributions up to the annual defined contribution limits, it is generally important that a 401(k) plan include a profit-sharing component. As a business owner, you will contribute to your 401(k) account as an employee and as an employer through a combination of 401(k) salary deferrals, company matching contributions, and company profit sharing contributions, as explained below:

401(k) salary deferral (employee contribution) – up to $20,500 in 2022 ($6,500 additional contribution for participants age 50 and older for a total of $27,000 in 2022)

401(k) Matching Contributions (Employer Contributions) – Company matching contributions can be based on a set dollar amount or a specific matching formula, but a common type of company contribution is the safe harbor contribution. In general, a safe harbor contribution can be a match of up to 4% of salary based on each employee’s salary deferral or a nondiscretionary contribution of 3% of employees’ salaries regardless of whether the employee contributes.

How to start my own 401k, how to use 401k to start a business, use 401k to start a business, how to start your own 401k, 401k loan to start a business, start a 401k for my business, how to start a 401k for small business, cashing out 401k to start a business, how to start a 401k for my small business, how can i use my 401k to start a business, how to open 401k for small business, roll over 401k to start business