How To Make Your Own Investment Portfolio – The debate usually centers on how many stocks an investor should own, how diversified their holdings should be across sectors, and what types of companies to target, such as high dividend stocks or growth stocks.

While there is no perfect answer, here are general guidelines we like to follow when building a dividend portfolio:

Contents

- 1 How To Make Your Own Investment Portfolio

- 2 Financial Portfolio: What It Is, And How To Create And Manage One

- 3 Investment Proposal Template To Make Your Own [including A Quick Guide]

- 4 Dividend Portfolio: What Is & How To Create Your Dividend Portfolio

How To Make Your Own Investment Portfolio

Before we analyze each guideline and review an example of a dividend stock portfolio, let’s begin with a basic understanding of why owning a diversified portfolio of companies is important.

Best Ways To Invest $1000 Right Now

Why should investors build a dividend portfolio instead of investing in one or two companies they like best?

On the one hand, investing involves a lot of randomness and luck. The world is constantly changing in unpredictable ways, so even the “best” investment professionals are wrong about half the time.

If we invest all our money in one company, even one with seemingly “low” risk, we will get a return.

Most investors don’t have the stomach for this level of volatility, especially since so many unexpected events can happen to put your capital at risk of permanent loss.

Financial Portfolio: What It Is, And How To Create And Manage One

On the other side of the spectrum, suppose you bought shares of every stock in the market. For every company in your portfolio that received bad news, you likely have many companies that unexpectedly received good news.

In other words, you will no longer rely on individual stocks to increase your investment returns and dividend income. Diversified across several different companies, your portfolio can withstand several unexpected storms.

As long as America survives, your portfolio has virtually no chance of experiencing a permanent capital loss – the market has historically appreciated over a long period of time and will continue to do so.

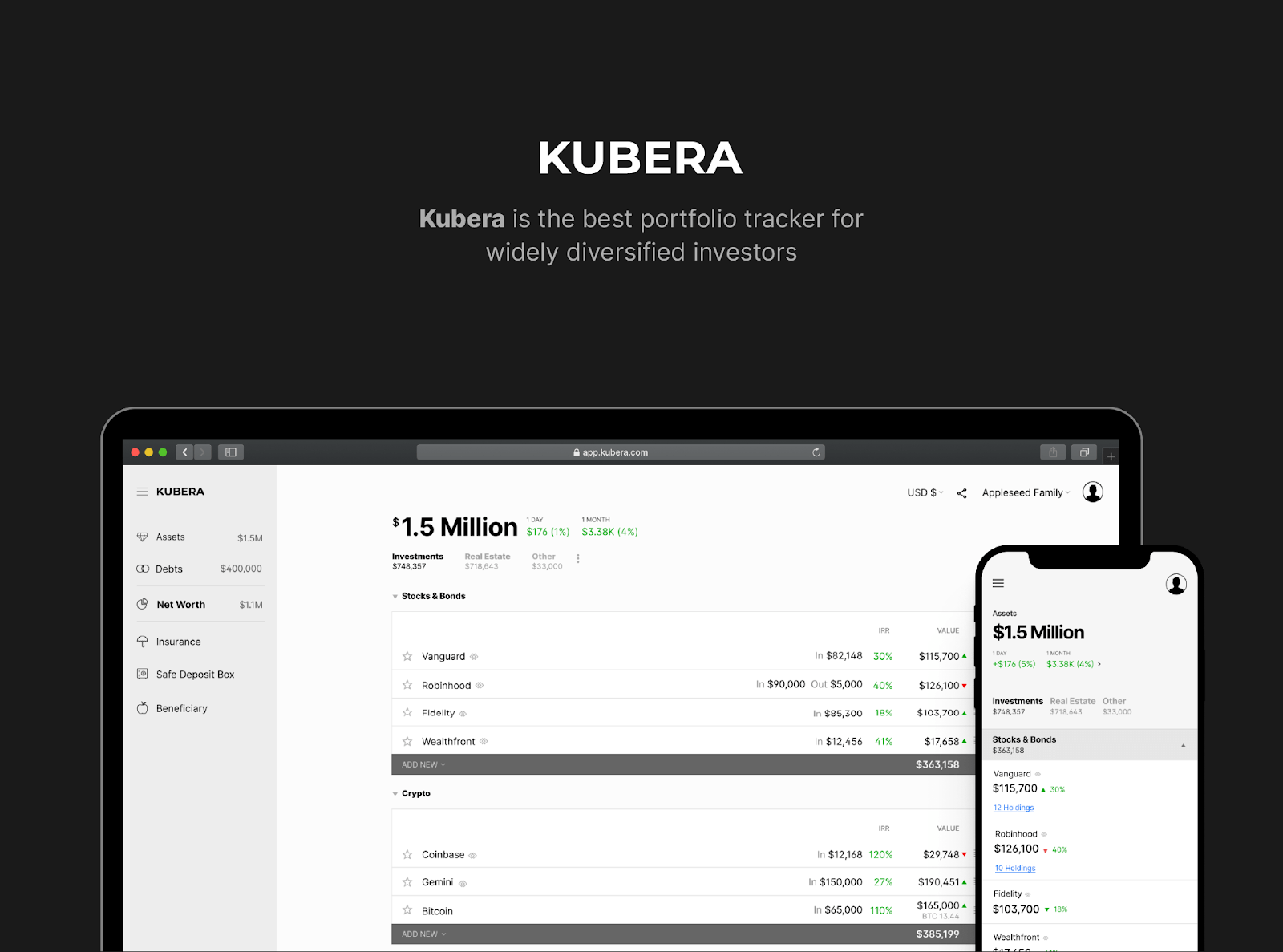

Of course, it’s not practical for an individual investor to buy shares of every company in the market without using exchange-traded funds (ETFs), but you can understand the advantages of owning more than a few shares.

Investment Proposal Template To Make Your Own [including A Quick Guide]

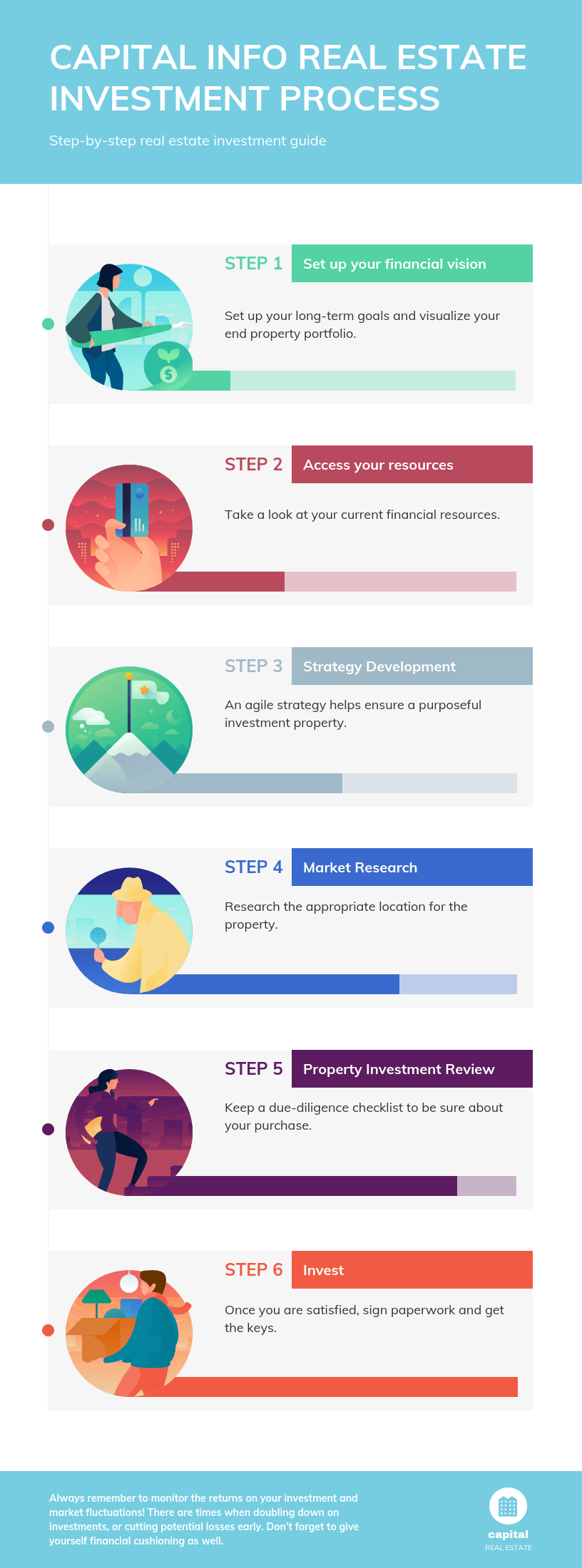

Properly constructed portfolios help us find the right balance of risk diversification and bring us closer to our goals. Building a dividend portfolio starts with understanding the key risk factors that affect portfolio returns and volatility, starting with how many stocks to own.

Many top investment professionals manage concentrated portfolios. For example, Apple owns more than 40% of Berkshire Hathaway’s total stock portfolio (see Warren Buffett’s dividend stocks here).

Believing in Warren Buffett’s statement that “diversification is a hedge against ignorance,” they confidently invest behind their top ideas.

But as individual outside investors, we don’t have Warren Buffett’s resources, connections and insight to responsibly manage a concentrated portfolio.

Investment Portfolio: What It Is And How To Build A Good One

For this reason, we like to spread our bets over a fair mix of different stocks to avoid shooting ourselves in the foot with a concentrated bet that goes bad.

The fewer stocks you hold, the more likely a portfolio will deviate from market returns. So how many dividend-paying stocks should you own to maximize the benefits of diversification? Over the past 50 years, many academic studies have attempted to answer this question.

“Individual stock ownership increases annual volatility by approximately 30% more than a perfectly diversified portfolio…Thus, an investor in individual stocks will experience annualized returns that are typically 35% above or below the market – over several years. Close to the market And several years ahead of the market.

The AAII study further stated that, as a rule, diversifiable (i.e., company-specific) risk is reduced by the following amounts relative to owning a single stock.

How Does Investing Work?

A more recent study in a 2014 paper called Stock Portfolio Diversification: How Many Stocks Are Enough? Evidence from five developed markets.’

The salient findings were that markets require a greater number of stocks to diversify risk during periods of financial crisis—correlations between stocks are often highest in this type of environment.

In the United States, researchers have concluded that the average number of stocks required is about 55 to ensure that 90% of the diversified risk is mitigated. However, during times of calamity, this figure may increase to more than 110 shares. .

In general, we believe that creating a dividend portfolio of 20 to 60 stocks provides a reasonable balance between the need for diversification, the desire to maintain low trading activity, and the limited research time to devote to maintaining a portfolio.

Where To Invest $1 Million: World Cup, Energy, Munis, Farmland

Investors with larger portfolios, a greater willingness to spend time doing research, and increased comfort with greater diversification may aim for higher valuations in our recommended holdings.

Portfolios full of more speculative stocks that face a wide range of outcomes may prefer to bet on a larger number of holdings. The next step is to figure out how much to invest in each position.

“Especially the future is difficult to predict. The late Yogi Berra, who played professional baseball and never shied away from sharing his unconventional wisdom, may explain why behind our portfolio building guidelines below.

When building a dividend portfolio from scratch, we like to balance our positions with roughly equal weights because it’s hard to know which holdings will perform best over the long term.

Stashaway Flexible Portfolios Review: Customize Your Favourite Portfolios In 4 Steps!

The stock market is quite efficient in the long run. This goes a long way to explaining why several active fund managers who spend millions of dollars each year on research have outperformed their respective benchmarks over time.

In fact, S&P found that 92 percent of all active U.S. fund managers underperformed their benchmarks over the past 20 years to 2022.

Over the years, we have come across several fund portfolio managers who have impressive long-term track records and conduct world-class research. None of them can escape the inherent uncertainty that can make investing difficult.

In fact, some of these managers shared with us that they could never predict which holdings would do best in a given decade.

What Is Income Investing?

Most of their performance is also due to a few stocks, and about 40-50% of their investment ideas ultimately fail.

We are not smarter than them. And spreading our bets evenly across our portfolio ensures we don’t outdo ourselves.

Holding more stocks can reduce risk, but investors end up with poorly diversified portfolios if they gravitate toward certain types of stocks (eg, consumer products with household names) or investment “rules” (eg, buy only stocks priced to earnings). may be ratios below 12x).

This is because stocks in similar industries are often sensitive to the same factors and move together in the market (ie they are highly correlated).

Etfs And Your Portfolio: Experts Weigh In On What Percentage To Own

If a shared factor, such as interest rates or oil prices, turns unfavorable, your portfolio can significantly underperform the market.

Choosing stocks from different sectors and industries helps to diversify this risk. When some sectors struggle, others often do well.

The chart below shows the sector breakdown of the S&P 500. You can see that one sector, IT, represents more than 15% of the total market.

Our preference is not to invest more than 25% of our portfolio in one sector and we try to own companies that overlap in their activities.

Dividend Portfolio: What Is & How To Create Your Dividend Portfolio

However, sector diversification should not be at the cost of breaking valuation principles or going outside your area of expertise.

Just because consumer staples makes up about 7% of the S&P 500 doesn’t mean you should buy stocks in the sector unless you can find one at a reasonable price.

Equally important, you should not diversify into a sector or industry outside of your comfort zone.

For example, many conservative investors are underweight the technology sector because the pace of change is so fast. Trying to predict which tech companies will still be relevant five years from now can be challenging.

How To Build Your Own Investment Portfolio

When you’re wondering if an investment is in your wheelhouse, renowned fund manager Peter Lynch has provided a helpful test:

The bottom line is that you need to be intentional with your diversification across sectors and business models, but you don’t need to play everywhere. Stick to the market areas you like and use common sense when you seek diversification.

Dividend cuts often occur during recessions when the tide goes out. Companies with too much debt, cyclical earnings, inconsistent free cash flow generation and poor dividend coverage are more likely to cut their payouts.

Investors building a monthly dividend portfolio should avoid businesses with these attributes. This means looking for companies with low leverage ratios, sustainable earnings streams, conservative payout ratios, time-tested operations and a long track record of reliable dividend payments.

Guide To Diversification

Some stock groups, such as the S&P Dividend Aristocrats, are popular because they consist of companies that have paid high dividends without interruption for decades.

But dividend streaks alone aren’t always a great indicator of safety. For example, 16 of the 60 dividend aristocrats cut or stopped their dividends in the midst of the 2007-09 financial crisis.

Our Dividend Safety Score™ can help investors avoid dividend cuts before they happen.

How to start your own investment portfolio, how to make investment portfolio, how to make your own art portfolio, make your own portfolio, how to build your investment portfolio, create your own investment portfolio, how to make your own modeling portfolio, managing your own investment portfolio, how to manage your investment portfolio, how to make your own portfolio website, how to make your own portfolio, how to create your own investment portfolio