Can You Roll Over 401k To Roth Ira – Wondering how to transfer from your IRA to your 401(k) plan? You opened a regular IRA and contributed to it, saved the money, waited a few months, and now you’re ready to convert to a Roth IRA. Before making this conversion to Roth, you need to first move the IRA tax from an IRA to a 401(k) or similar plan. This includes IRAs such as SEP IRAs or rollover IRAs. Although rollovers are rare, there are times when it makes sense to roll over from an IRA to a 401(k). In this blog, we explain the reasons for and against an IRA for switching to a 401(k) and how you can do it.

An IRA to 401(k) rollover is when you move money from a pre-tax IRA to a 401(k) plan. Also called “inversion.” Once vested, the funds in the 401(k) plan are invested according to the plan’s selection criteria.

Contents

Can You Roll Over 401k To Roth Ira

Rollover is the tax term used to move money from one retirement account to another. The most common rollover is rolling over a 401(k) to an IRA. Attrition usually occurs when you leave your job and can no longer participate in the company’s plan. Transferring money to another account, from an IRA to a 401(k), is known as a rollover.

How To Roll Over A 401(k)?

Yes, you can roll an IRA into a 401(k). However, some 401(k) plans do not allow this type of transfer. If they allow this transfer, direct transfer is the easiest way to do it. This allows you to roll money directly from your IRA into your 401(k).

The first step is to check if your employer’s 401(k) plan accepts IRA rollovers. Every organization is different and you may not be able to switch from an IRA to a 401(k). If they do allow it, you want to make sure you get it right if possible to avoid incurring a 10% penalty.

Step 2: Open a 401(k) account If you don’t already have a 401(k) account with your employer, you should open one.

Step 3: Contact your IRA provider and request a distribution The next step is to request a distribution from your IRA. There will be forms to fill out. Normally, you enter “Direct rollover” as the deployment reason. They then mail a check or make an electronic transfer to the 401(k) trustee. This ensures that you never receive the money and therefore are not liable for any taxes. This deal is tax and penalty free.

Inheritance 401(k): A Guide To Inheriting A 401(k)

Step 4: Follow up to make sure the conversion from IRA to 401(k) is complete. Make sure money is deposited into your 401(k) plan.

An important thing to remember is to only roll pre-tax IRA funds into a 401(k). Under current law, you cannot rollover Roth IRA assets to a Roth 401(k) or Roth 403b. Rebel

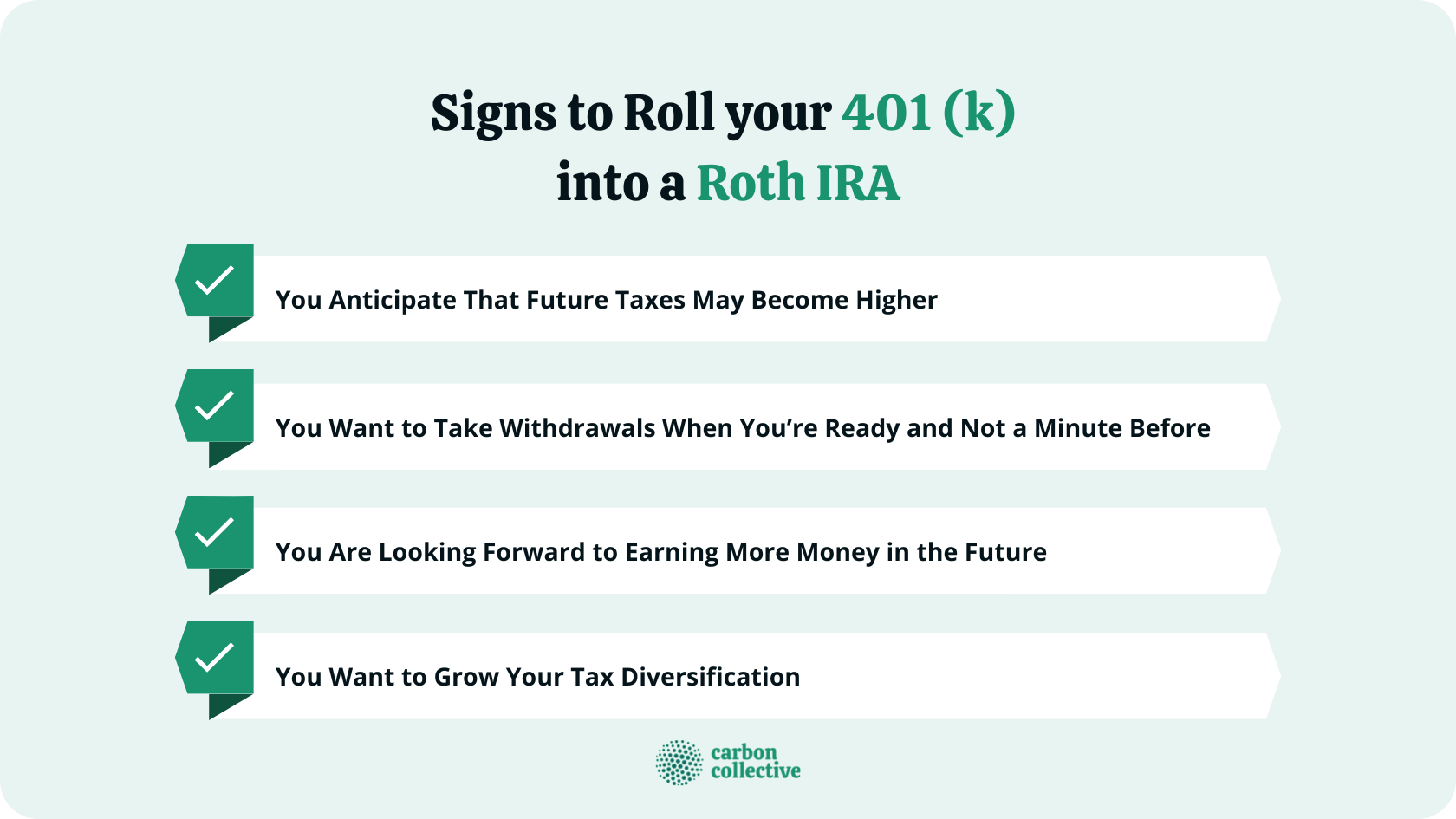

Using an IRA in a 401(k) plan can have different tax implications, so it’s important to understand them before making the switch. If you’re rolling over a traditional IRA to a traditional 401(k), the transfer is tax-free. However, if you’re rolling over a traditional IRA to a Roth 401(k) plan, you’ll also have to pay taxes on the amount of the transfer.

You must report the direct and indirect amounts on your annual tax return. You will receive a 1099-R from your IRA broker. You will have a withdrawal amount. Report this number on your 1040 tax return on the line marked “IRA distribution.” If the amount of your IRA withdrawal does not match the amount you have in your 401(k) account, you may be subject to a 10% tax penalty on the difference.

How To Guide For Mega Backdoor Roth Ira At Raytheon

If you have more than one retirement account, you can often move money between them without consequence. The most common is to roll your 401(k) into an IRA, but you can also roll a pre-tax IRA into a 401(k). The best advice is to ask the 401(k) provider if they allow you to roll over from an IRA to a 401(k) before you start the process. The different rules governing 401(k) and IRA accounts can be confusing. When considering any type of move, it’s best to work with a certified financial advisor to make sure you’re on track. ‘zero.

If you need help with your finances and want a personalized financial plan, don’t hesitate to schedule a phone call today!

Alvin Carlos, CFP®, CFA, is an investment advisor and fee-only financial planner in Washington, D.C. working with clients all over the country. He holds a master’s degree in International Relations from SAIS-Johns Hopkins. Alvin is a partner at Capital District, a financial planning firm designed to help professionals in their 30s and 40s achieve their financial goals through smart, tax-efficient investments. , retirement planning and increasing their income. Schedule a free phone call to find out how we can help improve your finances.

The District Council is an independent company that only pays for financial planning. We help professionals and entrepreneurs in their 30’s and 40’s to raise their money and increase their income. We are headquartered in Washington, D.C., and we work with people almost all over the country. Our website uses cookies to improve your visiting experience. By browsing our website you accept the use of cookies and our privacy policy.

What To Know About Rollovers From A 401(k) Plan To A Roth Ira

If you want more control over your retirement savings, better investments, and the flexibility to manage your money without the contribution limits associated with 401(k)s, a 401(k) rollover to an IRA that may qualify.

You started a new job! Let’s say in all your excitement you forget about the 401(k) you had with your previous employer.

You may contribute money directly to your retirement account from each paycheck, and your company may have a matching contribution program. But when you leave a company, you have options for continuing your 401(k). Now may be the time to consider an individual retirement account (IRA) rollover.

You can leave your old 401(k) where it is, but there may be drawbacks. Once you leave the job, you can no longer contribute to the account. Premiums may be higher for former employees of your former company, and your investments may be limited under the plan. If you have $5,000 or less in your old 401(k) account, your former employer can force you to move out of the plan and into an IRA of his choice. If you have less than $1,000, the employer can foreclose on you, causing you to pay taxes and penalties.

K) Rollover To Ira: The Rules And When It Could Make Sense

Over time, management at your previous company may change or the company itself may change ownership, making it difficult to keep your contact information handy to manage your old account.

If you’ve decided to take your previous employer’s 401(k), you have a few options. If you like the management at your new company, you can roll over the old 401(k) to the new 401(k) if your new employer allows it.

Another option is to do a 401(k) rollover to an IRA. This vehicle is useful if you have an IRA that you want to roll over the old 401(k) directly, or you can open a rollover IRA.

Directly rolling your old 401(k) into an IRA gives you flexibility in managing your money. A rollover from a 401(k) to an IRA is not a contribution, so there is no limit on the amount that can be rolled over, and the rollover will not affect the amount you can contribute. contribute to the 401(k) that year. .

How To Rollover A 401(k) To A Self Directed Ira In 2024

If you choose a traditional IRA, your money will continue to grow tax-deferred; This means you don’t pay tax on the transfer; however, you will pay taxes on the dividends when you retire. If you choose a Roth IRA, your withdrawals will be taxable unless you withdraw from a Roth 401(k).

However, there are some rules you should know to avoid tax consequences. When transferring your account, you may want to consider the direct transfer method, where you fill out a form with information about the old account and the new account you want to transfer the money to. This way the money doesn’t leave a controlled, authorized account.

If you received the money because you requested the check be mailed to you, it must be transferred within 60 days or the transfer will be considered a “payment” and may be subject to taxes. There is also a mandatory 20 percent withholding tax on vehicles, according to the Internal Revenue Service (IRS); This means you have to find the amount that is held to complete the entire drive.

When in doubt, consult a tax professional and plan administrator to learn your specific tax rules and request the appropriate forms.

Roth Conversions And Contributions: 10 Principles To Understand

And don’t forget, don’t worry if you remember

How to roll over 401k to roth ira, how to roll over 401k into roth ira, how to roll over 401k to roth ira fidelity, when to roll over 401k to roth ira, roll over 401k into roth ira, should i roll over my 401k to a roth ira, can you roll over 401k to ira, roll over my 401k to a roth ira, should you roll over 401k to roth ira, can i roll over 401k to roth ira, roll over old 401k to roth ira, roll over 401k to roth ira