Can I Roll Over My 401k To A Roth Ira – Are you wondering how to rollover from your IRA to your 401(k) plan? You’ve opened a traditional IRA and contributed, invested, waited a few months, and you’re now ready to convert it to a Roth IRA. Before you can do this Roth conversion, you need to convert pre-tax IRAs from an IRA to a 401(k) or similar plan. This includes IRAs such as a SEP IRA or a rollover IRA. Although a reverse rollover is not common, there are situations where a 401(k) to IRA rollover makes sense. In this blog we explain the reasons for and against a 401(k) rollover to an IRA and how you can do it.

An IRA to 401(k) rollover is when you transfer money from a pre-tax IRA to a 401(k) plan. This is also known as “reverse rollover”. After the rollover is complete, the funds in the 401(k) plan are then invested according to the plan’s designated investment options.

Contents

Can I Roll Over My 401k To A Roth Ira

A rollover is a tax term for transferring money from one retirement account to another. A 401(k) rollover to an IRA is the most common rollover. Rollovers usually occur when you leave your job and can no longer participate in a company plan. Transferring money from an IRA to a 401(k) is called a reverse rollover.

The Complete 401(k) Rollover To Ira Guide

Yes, you can roll an IRA into a 401(k). However, some 401(k) plans do not allow such transfers. If they allow this transfer, a direct transfer is the easiest way to go about it. This allows you to transfer money directly from your IRA to your 401(k).

The first step is to check if your employer’s 401(k) plan accepts IRA rollovers. Every institution is different and you may not be able to rollover a 401(k) to an IRA. If they allow it, if available, you’ll want to make sure you do a direct transfer to ensure you don’t incur the 10% penalty.

Step 2: Open a 401(k) Account If you don’t already have a 401(k) account with your employer, you’ll need to open one.

Step 3: Contact Your IRA Provider and Request a Distribution The next step is to request a distribution from your IRA. There are some documents to fill. In general, “direct rollover” is what you enter as a distribution argument. They then mail the check or make an electronic transfer to the 401(k) trustee. This ensures that you never receive the money personally so you are not liable for any taxes. This transaction is exclusive of tax and penalty.

The 3 Best Places To Roll Over Your 401(k) — Lendtable

Step 4: Follow up to make sure the 401(k) to IRA rollover is complete. Make sure the money is deposited into your 401(k) plan.

The important thing to remember is that you can only roll over pre-tax IRA funds into a 401(k). Under current law you cannot transfer Roth IRA assets to a Roth 401(k) or Roth 403b. Tweet it

Rolling an IRA into a 401(k) plan has several tax implications, so it’s important to understand them before making the switch. If you roll over from a traditional IRA to a traditional 401(k), the transfer is tax-free. However, if you roll over from a traditional IRA to a Roth 401(k) plan, you’ll have to pay taxes on that rollover amount.

You must report both direct and indirect rollovers on your annual tax return. You will receive a 1099-R from your IRA brokerage. It contains the amount you withdraw. Report this amount on your 1040 tax return under the “IRA distributions” label. If the amount of your IRA withdrawal and the amount you deposit in your 401(k) don’t match, you may be subject to a 10% tax penalty on the difference.

When To Roll Over A 401(k) From A Previous Job

If you have multiple retirement accounts, you can transfer money between them without consequence. The most common move is to roll your 401(k) into an IRA, but it’s possible to roll a pre-tax IRA into a 401(k). A big tip is to check with your 401(k) provider to see if they allow you to do an IRA to 401(k) rollover before starting the process. The different rules that apply to 401(k) and IRA accounts can be confusing. When considering any type of rollover, it’s best to work with a certified financial planner to make sure you’re on the right track. If you want help with your finances and are interested in having a comprehensive financial plan, feel free to schedule a discovery call today!

Alvin Carlos, CFP®, CFA is an investment advisor and fee-only financial planner based in Washington, DC, who works with clients nationwide. He holds a master’s degree in international relations from SAIS-Johns Hopkins. Alvin is a partner at District Capital, a financial planning firm that helps professionals in their 30s and 40s achieve their financial goals by investing smartly, minimizing taxes, planning for retirement and growing their money. Schedule a free discovery call to learn how we can help you maximize your taxes.

Zilla Capital is an independent, sole proprietorship financial planning firm. We help professionals and entrepreneurs in their 30s and 40s grow their finances and grow their money. We are based in Washington, DC and we work with people across the country. One of the biggest financial questions that working people like you and I face when we change jobs is whether or not I should roll over my 401(k) to an IRA.

This is a big decision, and not to be taken lightly! The answer could be hundreds of thousands of dollars in missed opportunities later down the road.

Can I Roll Over Funds From My Current Employer’s 401k To My Solo 401k?

Or worse… make the wrong move and the IRS owes you tens of thousands of dollars in taxes that you’re not willing to pay. Tell me!!!

I recently made some new changes in my life and was faced with the decision to change jobs.

I’m not shy – my 401(k) balance is crucial! 12 years of savings and tons of employee adjustments resulted in a healthy dose of 6-figures.

As I’ve emphasized before, with a large amount of capital like this, you don’t want to beat around the bush or delay this decision. Your money can be used to make you more money! That’s the beauty of shared income!

How To Rollover A 401(k) To A Self Directed Ira In 2023

So when I weighed my options and asked myself if I should roll over my 401(k) to an IRA, all the indicators came back to a green light YES!

In this post, I’ll explain why and how you can use this thought process to make your decisions if you’re ever faced with a similar opportunity to do a 401(k) to IRA rollover.

Before we dive into why an IRA rollover is a good idea, let’s review exactly what your options are for your 401(k) when you leave your job.

About a week after my last day at work, I received a letter explaining that I had the following options:

Rollover 401k To Roth Ira: 4 Steps

Note that if you’re under 59-1/2 you don’t want to take option 4 unless you’ve fallen on really, really, really hard times financially. (And even then, there are better choices you can make.)

Why is this a bad choice? You’re emptying your retirement nest egg, but you’ll have to pay taxes and a 10% penalty on the balance you withdraw. Think about it: For every $100,000, you probably have a 25% tax ($25,000) and a 10% penalty ($10,000). It wipes out all your income!

Believe it or not, 25% have taken this route, reports the Trans-American Center for Retirement Studies.

As I said, I choose option 3 (rolling my 401(k) into an IRA with a private institution) to keep in the old plan or transfer to my new company 401(k) plan for several good reasons.

Rolling Over A 401(k) To A Roth Ira: Should You Convert To A Roth?

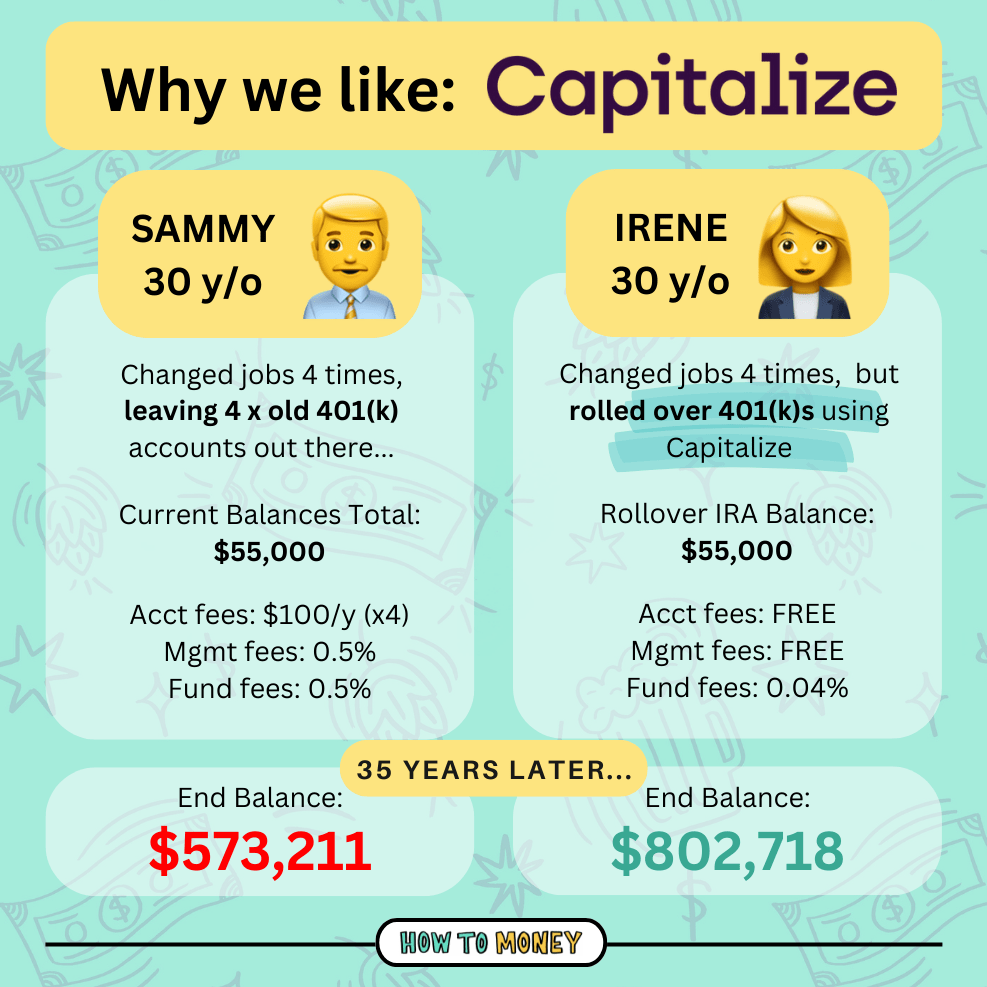

Most people know that when you choose your funds for your 401(k), they are not free. With owning them comes annual costs. Usually these costs are expressed as a percentage called the “adverse ratio”. For example, an expense ratio of 0.5% means that each year you pay $500 for every $10,000 invested in this fund. These charges are paid to the mutual fund company that runs the fund and they pay to the fund manager, intra-fund transactions etc.

Well, in case you didn’t know, the fun doesn’t end there. There’s a whole second group of more obscure costs you pay when you have a 401(k) called “administrative expenses.” This is a whole separate set of expenses like running the 401(k) fund, bookkeeping, etc. According to Bankrate, these administrative fees sometimes range from 0.36 percent to 1.71 percent.

As you can imagine, once you’re in the six-figure balance, these cumulative “surcharges” of 1 and 2% can really start to add up. It seriously drains you of money that should be going

Roll over 401k to roth ira, can you roll over a 401k to a roth ira, can i roll over my 401k to a roth ira, how to roll over 401k to roth ira, can i roll over 401k to roth ira, can i roll over 401k into roth ira, can you roll over a 401k into a roth ira, how to roll over 401k to roth ira fidelity, should i roll over my 401k to a roth ira, can i roll over my 401k into a roth ira, should i roll over my 401k into a roth ira, should you roll over 401k to roth ira