Best Way To Start Credit – Good credit is essential to getting a loan, renting an apartment or finding a job. But if you have bad credit, it can be hard to know where to start. Here are some tips on how to build your credit fast:

1. **Open a credit card and use it responsibly.** This is one of the most important things you can do to build your credit. When using a credit card, be sure to pay your bill on time and in full each month. This will show lenders that you are a reliable borrower.

Contents

Best Way To Start Credit

2. **Get a secured credit card if you have bad credit.** If you have bad credit, you may not be approved for a traditional credit card. At this point, you may want to consider getting a secured credit card. A secured credit card requires a deposit, but it can help you build your credit history and improve your credit score.

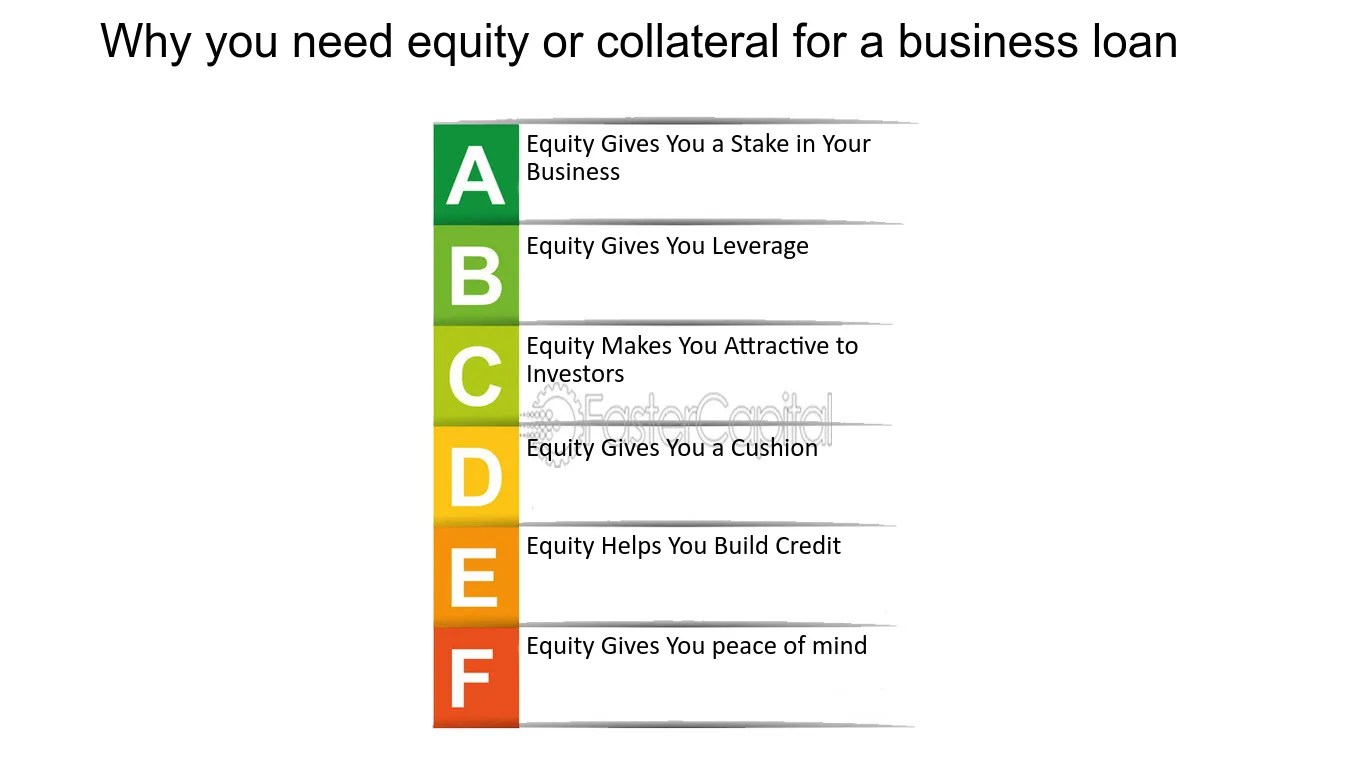

Tips For Building Credit [infographic]

3. **Pay Off Debt** The less debt you have, the better your credit score. If you have a lot of debt, focus on paying it off as soon as possible.

4. **Ask for a copy of your credit report and dispute any errors.** Make sure the information on your credit report is correct. If you notice any errors, check with the credit reference agencies.

5. **Get a copy of your credit score and track your progress.** This will help you see how your credit score is improving over time.

Building credit takes time and effort, but it pays off in the long run. By following these tips, you can improve your credit score and qualify for better interest rates on loans and credit cards in the future.

Get Your Free Score And More

* **Try to get a credit card with lower interest rates.** This will help you save money on interest over time.

* **Don’t max out your credit cards.** Your credit utilization ratio is how much you owe compared to the total amount of debt you have. Try to keep your loan utilization ratio below 30%.

* **Don’t apply for too many new credit cards in a short period of time.** This can hurt your credit score.

* ** Keep your credit report up-to-date.** This will help detect any errors or fraudulent activity early. If you’re new to the world of credit, building credit can be difficult—especially since it usually has to be done if you already have a credit account. You may feel stuck if lenders turn you down because of insufficient credit history or poor credit.

Benefits Of Increasing Your Credit Limit

Whether you’re starting from scratch and trying to get a loan at age 18, or you’re about to take a big financial step like getting a mortgage or car loan and want to qualify for the best interest rates, there are easy ways to build credit fast.

Credit cards are a common way to access credit because they are easy to use and do not require a large financial commitment. However, the benefits you get depend on how you use your credit card to build credit. Because your activities add up to your credit report, spending responsibly can help build your credit, while maxing out your cards or making late payments can do more damage.

If you’ve never had a credit card before and are building credit for the first time, there are some great first credit cards you can choose from. Before applying for a card, check that your card issuer is reported to all three credit reporting agencies and compare interest rates to make sure you’re getting a card with a good annual percentage rate (APR).

If you’re new to credit or your credit has been damaged, you have four main options for building credit with a credit card.

How To Build Credit In The Uk As An Immigrant

Unlike a traditional credit card, there is a special type of credit card called a secured credit card (or credit builder card) that you can get without a credit history because the lender has essentially no risk.

When you get a secured credit card, you’ll have to pay a refundable deposit, which becomes your credit limit. Your lender keeps this security deposit if you default on your loan. Your credit score increases when your creditor reports your credit card payments to the credit bureaus and they subscribe to your payment history. 1

One of the fastest ways to build credit is to become an authorized user of a family member’s or friend’s credit card account. Since you are not applying for your own credit card, you do not need to be an adult to be an authorized user. This makes it the best approach to building credit as a teenager.

You don’t have to be an adult to build credit with a credit card. By becoming an authorized user you can take advantage of your parent’s good credit.

Understanding The Five Cs Of Credit

This process usually involves the card issuer adding the primary cardholder’s payment history to your credit report, which lengthens your credit history and improves your credit score if they are a responsible borrower.

However, it’s worth noting that being an authorized user affects your credit score in the opposite way – it will drop if the primary card user doesn’t make payments on time or uses more than the credit limit. You should make sure that your credit card company reports authorized users to the credit bureaus – only if this happens will your credit benefit.

If you are starting from scratch or have a bad credit score, it can be difficult to qualify for an unsecured credit card as many companies impose minimum credit score requirements for these credit cards. If you ask a family member or close friend to be a co-signer on your credit card application, you have many more options.

Remember that your cosigner will assume responsibility for paying off your loan if you stop making payments. For this reason, you should weigh the pros and cons and not make hasty decisions.

Best Credit Card Build Credit In Powerpoint And Google Slides Cpb

More and more companies are responding to the demand for credit cards among people with no or poor credit by using criteria other than creditworthiness to assess creditworthiness.

If you want an unsecured card but don’t want to involve anyone else by becoming an authorized user or getting a cosigner, you can qualify for one of these alternative cards with no minimum credit score requirements:

Please note that some unsecured credit cards for people with no credit require a fee and may only offer relatively low credit limits. However, these cards have the advantage of allowing you to access an unsecured line of credit without the help of someone else.

A common misconception is that you need to carry a small balance on your credit cards to build credit. It will only cost you more interest. As long as you use the card occasionally to keep it active, having a zero balance will actually help your credit, as mainstream credit scoring models reward customers with low accounts with a balance. 2 3

How To Build Good Credit With A Credit Card: Actionable Tips

It’s difficult to build credit if you have no credit history (or little credit history) because you don’t qualify for most loans and credit cards. Fortunately, there are credit building tools you can access even without a credit history.

Unlike traditional installment loans, credit builder loans don’t give you immediate access to the money you borrow and don’t require a good credit score. Instead, your lender will deposit your credit-building loan into a savings account that you won’t be able to access until you repay the full amount.

Typical loan amounts range from $300 to $1,000, and you repay the loan in installments over 6 to 24 months. 4 You can get these loans from banks or credit unions. After you pay off the loan, the lender will report the loan repayment to the credit bureaus, which will improve your credit score.

Opening a new line of credit isn’t the only way to establish credit. Many people don’t know that you can get a loan to pay regular monthly bills and rent. Sign up for a paid reporting service (like Rental Kharma, LevelCredit, or PayYourRent) or a free bill reporting service like Experian Boost.

What Is A Secured Credit Card & Does It Build Credit?

Experian Boost will give you credit towards your phone bills, utilities and streaming services like Netflix. However, this will increase your Experian credit score – your TransUnion and Equifax scores will not change.

Unfortunately, older FICO scoring models included bill payments in credit score calculations, while FICO 8 and earlier models did not include rent payments. 5 However, FICO 9 and all VantageScore models include both rent and bill payments. 6 7

Having open business transactions and active accounts on your credit report is an essential first step to building credit, and the following good credit habits should be practiced to build and maintain a good credit score:

If you have trouble keeping track of your bills, you can set up automatic payments to make sure you never forget to pay them on time. Alternatively, you can log into your bank account

Best Credit Cards To Build Credit Scores In 2023 Bright Money

Best way to start business credit, best way to start a credit score, best way to start your credit, best way to start credit score, good way to start credit, best way to start credit history, easy way to start credit, the best way to start credit, easiest way to start credit, best way to start building your credit, best way to start building credit, best way to start my credit